Bitcoin (BTC) cost was up to $65,800 on Wednesday, slipping back listed below essential intraday pattern lines and raising issues that recently’s drop to $60,000 might not have actually been the last bottom. Now, experts state the possibility of another drop to the annual low ($ 59,800) is increasing due to a growing liquidity space in between $66,000 and $60,000.

Secret takeaways:

-

Bitcoin has actually formed a series of lower highs after duplicated rejections near the $70,000–$ 72,000 resistance zone.

-

The relative strength index (RSI) is trending towards oversold levels as the cost trades listed below essential moving averages.

-

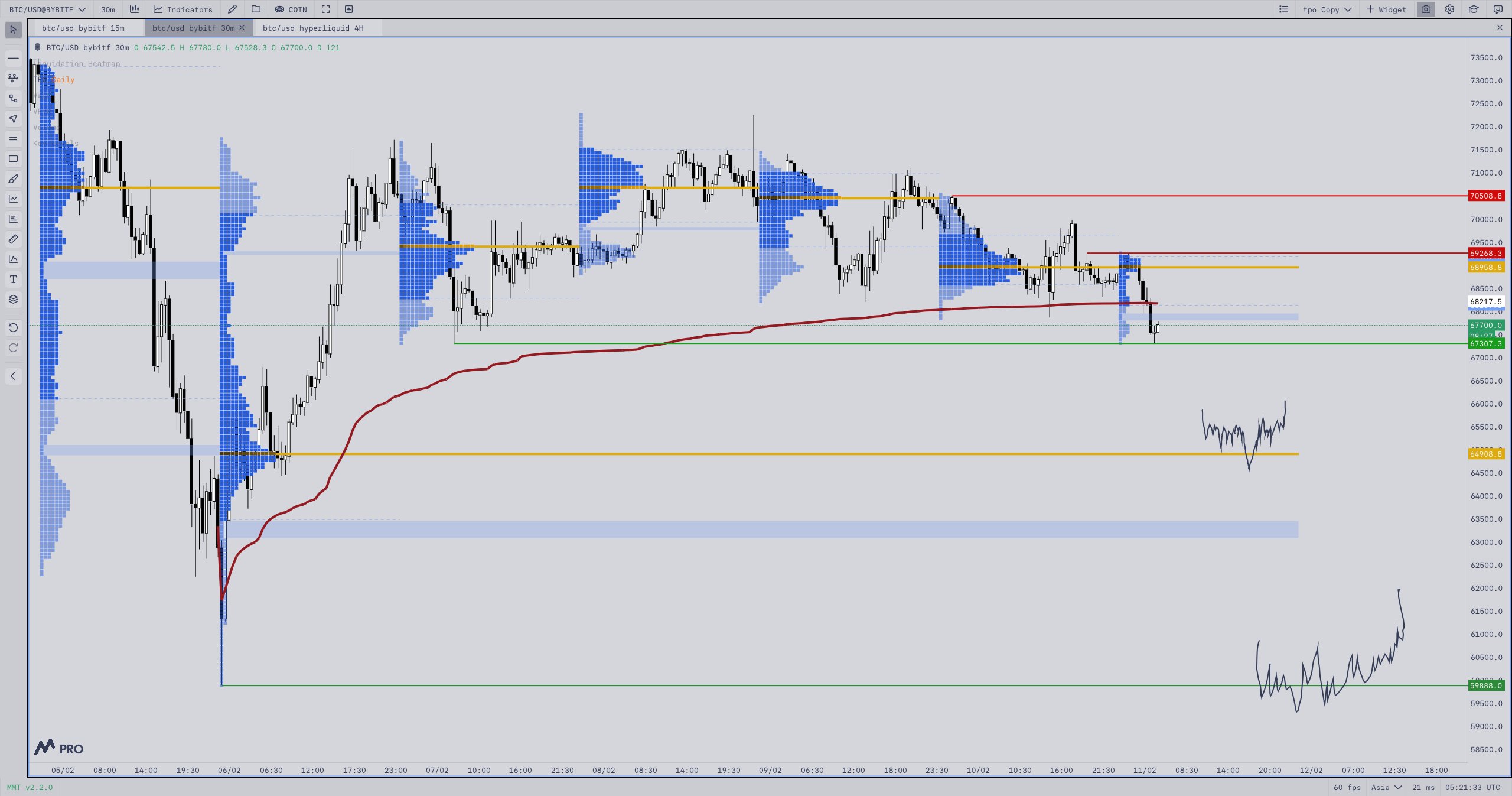

The liquidation heatmap showed a lack of liquidity as much as $60,500, keeping the threat of a drawback cost relocation open.

Failure to hold $70,000 deteriorates Bitcoin’s short-term potential customers

Bitcoin’s one-hour chart reveals several stopped working efforts to hold above $70,000. Each rejection has actually caused lower cost highs and consistent selling pressure.

BTC’s cost briefly pressed into intraday highs of $69,800 before reversing greatly throughout the New york city session on Wednesday, forming a traditional swing failure pattern. The relocation caught breakout longs and sped up drawback momentum.

BTC likewise traded listed below both the 50-period and 100-period rapid moving averages, verifying short-term bearish control. The RSI stayed listed below 50, showing restricted purchasing pressure.

A 15-minute order block sits near the $60,800–$ 61,000 area, a location where strong purchasing pressure formerly actioned in after BTC printed an annual bottom at $59,800. This area stays a liquidity target if $64,000 stops working to hold.

Related: When will Bitcoin begin a brand-new bull cycle towards $150K? Try to find these indications

Heatmap information reveals $60,000 is a liquidity magnet

Bitcoin’s liquidity heatmaps expose stacked orders above $72,000, however it likewise highlights a “liquidity space” from $66,000 to $60,500. This “liquidity space” might serve as a magnet, as cost tends to move rapidly through low-liquidity locations to tap focused stop clusters listed below.

In spite of more noticeable liquidity being greater, the drawback stays open as a last stack of leveraged longs worth over $350 million is still placed near $60,500.

Bitcoin trader Husky stated Bitcoin is slipping listed below the anchored volume-weighted typical cost (VWAP) drawn from recently’s lows at $59,800, a level that is serving as a short-term reasonable worth.

With the total market structure beginning to deteriorate, an absence of a speedy healing above $68,000 increases the threat of additional drawback towards lower assistance levels near $65,000. In the meantime, Bitcoin is anticipated to trade within a broad $60,000 to $72,000 variety, according to the trader.

Also, market expert EliZ kept in mind that BTC is combining near $66,500 inside a coming down channel. A break listed below this level might send out the cost towards the $63,400–$ 64,600 assistance zone, increasing the chances of a review to $60,000.

Related: Bitcoin responds to significant United States tasks information beat as Fed rate stop briefly chances near 95%

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding. While we aim to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might consist of positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage emerging from your dependence on this details.