Bitcoin’s (BTC) current rate weak point has actually restored financiers’ issues of a much deeper decline, however a number of market experts argue that a prolonged correction might be more useful over the longer term.

Secret takeaways:

-

Experts state Bitcoin’s drawback danger is focused around $65,000 to $75,000.

-

A prospective three-day bullish divergence is forming, a setup that might line up with a regional bottom as soon as momentum supports.

Supply rotation and oversold conditions specify BTC’s existing rate action

Crypto trader Jackis stated that the existing relocation is a macroeconomic variety for 2025, keeping in mind that even a decrease to $70,000 would not look like previous bearish market. Unlike 2022 or early 2024, the existing drawdown does not have systemic macro-driven risk-off pressure, rather showing a rotation of supply from early holders to institutional individuals.

On the other hand, market expert Jelle highlighted a possible bullish divergence forming on Bitcoin’s three-day chart. The previous three-day divergences in this cycle have actually accompanied regional bottoms, although the trader stated that a verification needs extra time and combination.

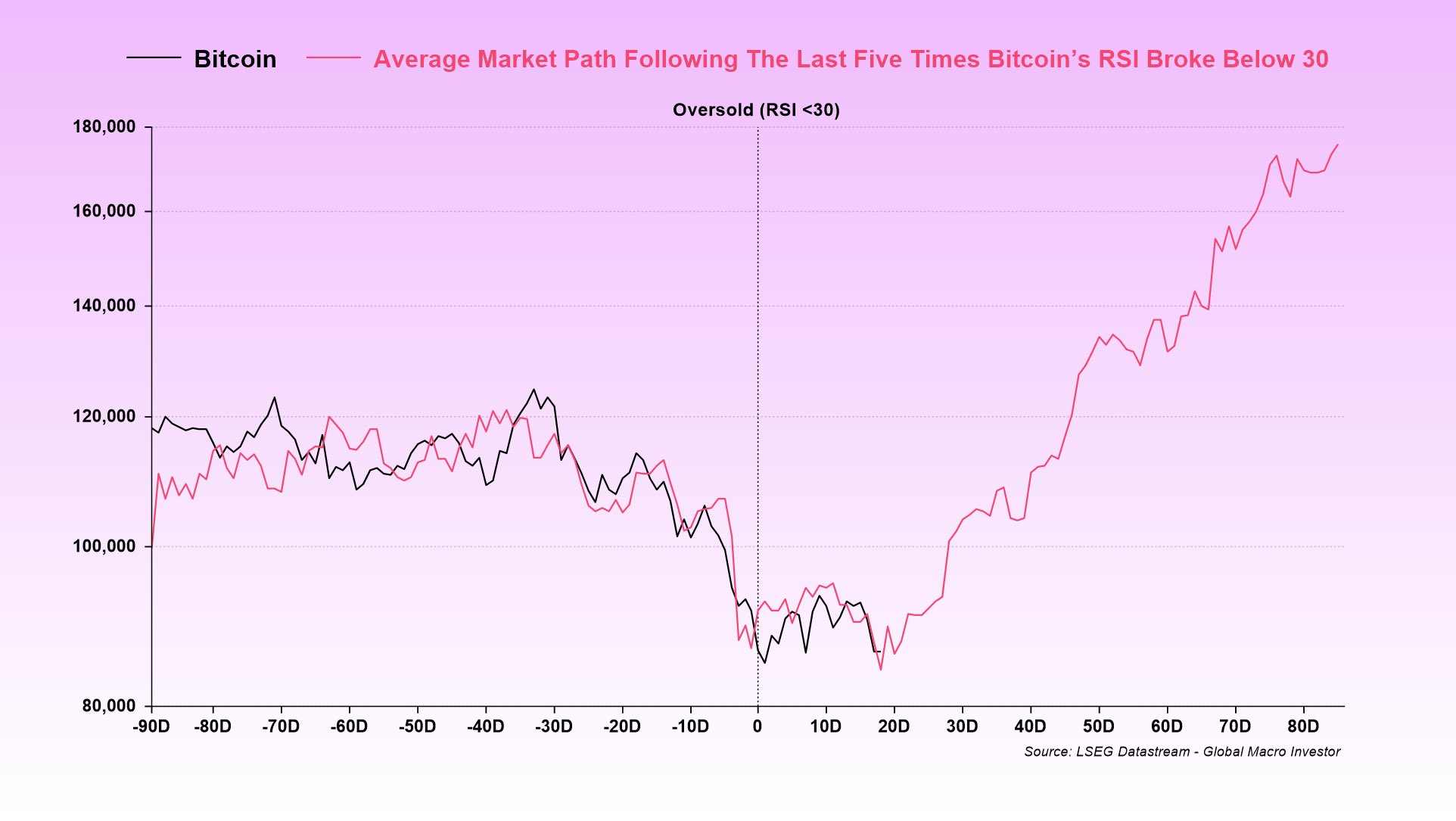

Julien Bittel, the head of macro research study at International Macro Financier, enhanced this view by indicating Bitcoin’s historic habits following oversold RSI readings listed below 30.

According to information, Bitcoin tends to track a distinct healing course after such conditions emerge. While short-term volatility stays most likely, Bittel argued that bases typically take some time to form and are typically accompanied by choppy rate action before a continual uptrend resumes.

Bittel competes that the conventional four-year halving cycle is no longer the dominant chauffeur of Bitcoin’s rate habits. Rather, extended financial obligation refinancing cycles and developing liquidity characteristics recommend the existing market structure might continue well into 2026.

Related: Bitcoin rate at ‘important’ point as whale moves $348M BTC to exchanges

Longer Bitcoin cycles prefer flatter however greater returns

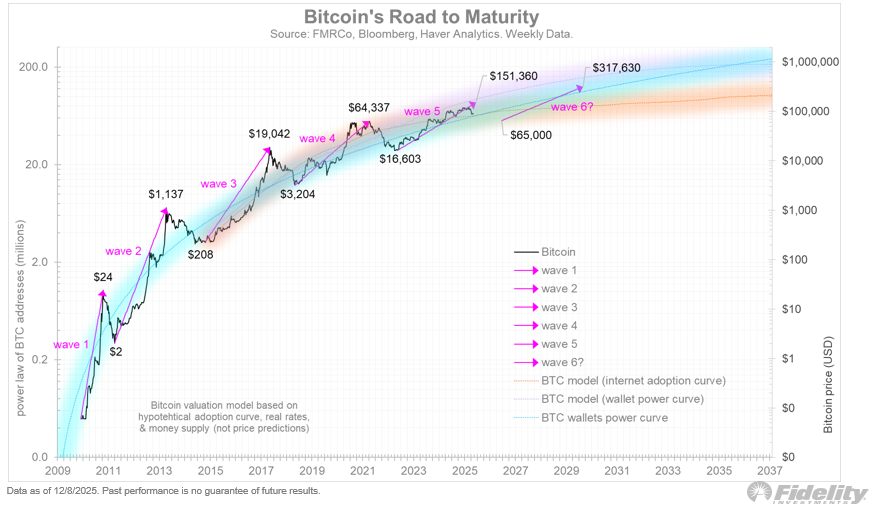

Jurrien Timmer, the director of International Macro at Fidelity, put the existing stage within a more comprehensive wave structure covering 2022 to 2025. That duration has actually currently provided a 105% substance yearly development rate (CAGR) over 145 weeks, carefully tracking long-lasting regression designs.

While Timmer acknowledged that Bitcoin might still experience a much deeper correction into the $65,000 to $75,000 variety in 2026, he stressed that such zones have actually served as strong buy zones.

Looking even more ahead, Timmer anticipates future cycles to develop with flatter slopes as adoption grows. However, the rate modelling recommends a possible course towards $300,000 by 2029 if a brand-new growth stage emerges.

In this context, restorative stages might function as the structure for Bitcoin’s next structural improvement.

Related: Did Bitcoin’s 4-year cycle break, and is the booming market actually over?

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding. While we aim to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might consist of positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage emerging from your dependence on this info.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding. While we aim to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might consist of positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage emerging from your dependence on this info.