Bottom line:

-

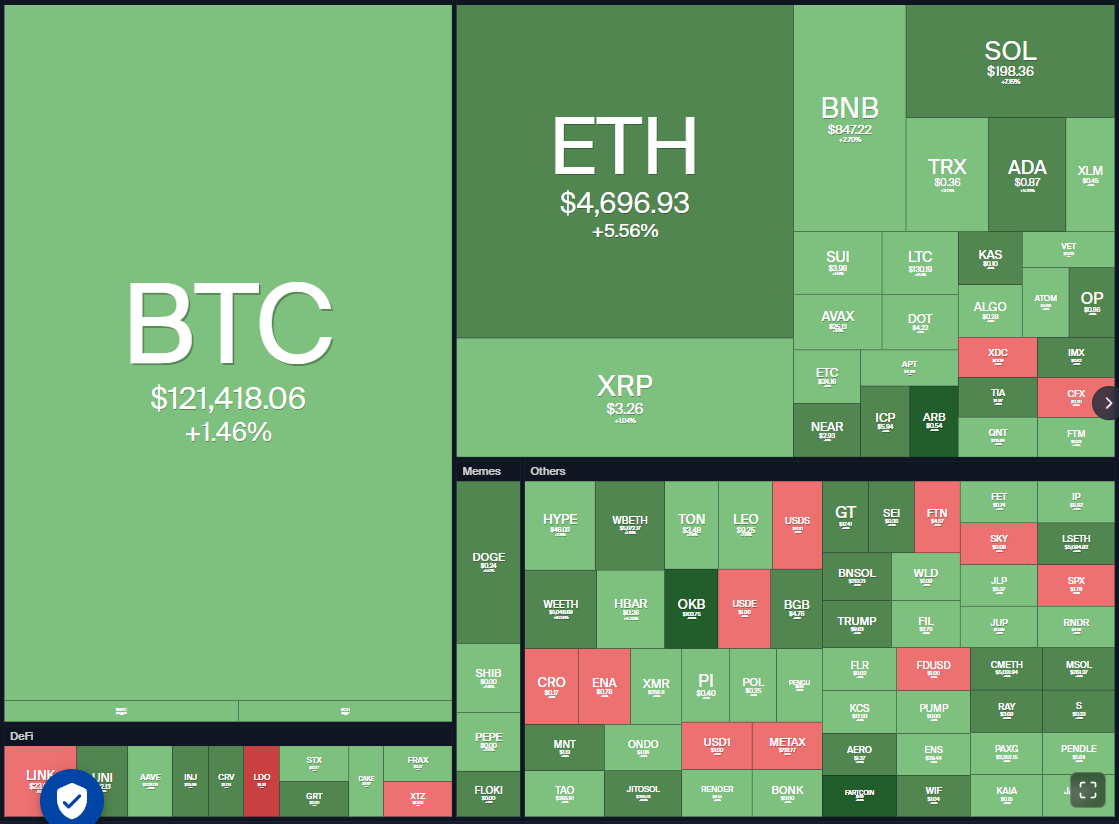

Bitcoin bulls are chasing BTC’s $123,218 all-time high as purchasing pressure rises.

-

Ether has actually played catch-up to Bitcoin and is close to making a brand-new all-time high.

Bitcoin (BTC) increased above $122,000 on Wednesday, showing that the bulls have actually maintained the pressure. The duplicated retest of a resistance level tends to damage it, increasing the probability of a breakout above the all-time high of $123,218.

BTC is not alone. Ether (ETH) has actually likewise charged towards its all-time high of $4,868. Crypto sentiment-tracking platform Santiment stated in a post on X that ETH might break out to a brand-new all-time high as retail traders remain in shock of the present rally. History reveals the cost relocations in “the opposite instructions of retail traders’ expectations.”

In a report shown Cointelegraph, Requirement Chartered stated aggressive purchasing by ETH treasury business and exchange-traded funds, in addition to the speed of stablecoin adoption, enhances the outlook for ETH. This led the bank to increase their ETH cost target to $7,500 in 2025 from $4,000 formerly.

Could BTC break above the all-time high, pulling altcoins greater? Let’s evaluate the charts of the leading 10 cryptocurrencies to learn.

Bitcoin cost forecast

Purchasers have actually once again pressed BTC towards the all-time high of $123,218, showing strong purchasing on every small dip.

The flattish 20-day easy moving average ($ 116,957) signifies a balance in between supply and need, however the relative strength index (RSI) above 65 shows favorable momentum. That increases the probability of a break above $123,218. The BTC/USDT set might then rise towards $135,000.

Time is going out for the bears. They will need to quickly pull the cost listed below the 50-day SMA ($ 114,682) to damage the bullish momentum. If they do that, the Bitcoin cost might topple to $110,530.

Ether cost forecast

ETH extended its rally above $4,700 on Wednesday, showing continual need from the bulls.

Sellers will attempt to protect the $4,868 level, which might activate a short-term correction or debt consolidation. The overbought level on the RSI likewise recommends the rally might cool down in the near term. If that occurs, the ETH/USDT set might come down to $4,350 and after that to the breakout level of $4,094.

Rather, if purchasers pierce the $4,868 level, the Ether cost might increase to the mental level of $5,000 and after that to $5,662.

XRP cost forecast

XRP (XRP) bounced off the 20-day SMA ($ 3.11) on Tuesday, however the bulls are having a hard time to sustain the greater levels.

The flattish 20-day SMA and the RSI simply above the midpoint do not offer a clear benefit either to the bulls or the bears. If the cost increases above $3.40, the XRP/USDT set might reach $3.66.

Additionally, a drop listed below the 20-day SMA signals that the bears are attempting to acquire the edge. The XRP cost might then drop to the 50-day SMA ($ 2.85), which is most likely to draw in purchasers. The short-term pattern turns unfavorable listed below $2.72.

BNB cost forecast

BNB (BNB) has actually made a V-shaped healing from $730 on Aug. 3, showing aggressive purchasing at lower levels.

The BNB/USDT set rallied near the $861 overhead resistance, where the bears are presenting a strong obstacle. If the cost denies from $861, however rebounds off the 20-day SMA ($ 794), it recommends that dips are being acquired. That boosts the potential customers of a break above $861. The BNB cost might then rise to $900 and later on to $1,000.

The very first indication of weak point will be a break and close listed below the 20-day SMA. That recommends revenue reservation at greater levels. The BNB cost might then collapse to the strong assistance at $732.

Solana cost forecast

Solana (SOL) showed up greatly from the 20-day SMA ($ 176) and rose above the $185 resistance on Tuesday.

The SOL/USDT set increased near the $209 overhead resistance on Wednesday, however the long wick on the candlestick reveals the bears are protecting the level. The Solana cost might skid to the $185 assistance, where the purchasers are anticipated to action in.

If the cost rebounds off the $185 assistance with strength, the bulls will once again attempt to thrust the set above $209. If they can pull it off, the set might rally to $240.

On the contrary, a break and close listed below $185 recommends a variety development in between $209 and $155.

Dogecoin cost forecast

Dogecoin (DOGE) stays stuck inside a big variety in between $0.14 and $0.29 for the previous a number of months.

The cost bounced off the 20-day SMA ($ 0.22) on Tuesday, showing that the purchasers are attempting to take charge. There is resistance at $0.25, however if the level is crossed, the DOGE/USDT set might increase to $0.29. Sellers are anticipated to protect the $0.29 level with all their may since a close above it unlocks for a prospective rally to $0.44.

The very first assistance on the disadvantage is at the 20-day SMA and after that at the 50-day SMA ($ 0.20). A slide listed below the 50-day SMA might drag the Dogecoin cost to $0.18.

Cardano cost forecast

Cardano (ADA) showed up greatly from the 20-day SMA ($ 0.77) on Tuesday, indicating aggressive purchasing at lower levels.

The bulls are attempting to sustain the cost above the $0.86 resistance. If they prosper, the ADA/USDT set might reach $0.94 and later on to $1.02.

The very first indication of weak point on the disadvantage will be a break and close listed below the 20-day SMA. That might sink Cardano’s cost to the 50-day SMA ($ 0.72). This is a vital level for the bulls to protect since a break and close listed below the 50-day SMA might tilt the benefit in favor of the bears.

Related: Ether ‘marching’ towards all-time highs as traders anticipate $13K ETH cost

Chainlink cost forecast

Chainlink (LINK) has actually been marching towards the $27 level, showing aggressive purchasing by the bulls.

Sellers are most likely to present a considerable obstacle in the $26 to $27 resistance zone. If the cost denies from the overhead zone, the LINK/USDT set might drop to $20.84. Purchasers are anticipated to protect the $20.84 level since a break listed below it might sink the Chainlink cost to $18.

Alternatively, if purchasers pierce the $27 resistance, the uptrend might resume and the set might extend its up transfer to $31.

Hyperliquid cost forecast

Hyperliquid (BUZZ) has actually been stuck in between the moving averages and the assistance line of the rising channel pattern.

The flattish moving averages and the RSI simply above the midpoint do not offer a clear benefit either to the bulls or the bears. If purchasers attain a close above the assistance line, the HYPE/USDT set might rally to $50. Sellers will attempt to stop the up relocation at $50, however the rally might encompass the resistance line of the channel near $64 if the bulls dominate.

This favorable view will be revoked in the near term if the cost denies and breaks listed below the moving averages. The Hyperliquid cost might then come down to $36.

Excellent cost forecast

Excellent (XLM) has actually been taking assistance at the 20-day SMA ($ 0.42), showing a favorable belief.

The 20-day SMA is flattish, however the RSI remains in the favorable area, showing that the momentum prefers the bulls. If purchasers press the cost above $0.47, the XLM/USDT set might rise towards $0.52. The Excellent cost will finish a bullish inverted head-and-shoulders pattern on a close above $0.52.

Sellers will need to quickly pull the cost listed below the 20-day SMA to indicate strength. The set might then plunge to the 61.8% Fibonacci retracement level of $0.34.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.