Secret takeaways:

-

Bitcoin alternatives alter and futures financing rates highlight relentless care, regardless of BTC protecting the $110,000 assistance level.

-

area Bitcoin ETF outflows and Method’s S&P 500 index unfavorable choice continue weighing on trader belief.

Bitcoin (BTC) climbed up above $112,000 on Monday, retreating from the $108,000 level seen the previous week. The advance, nevertheless, has actually not been strong enough to bring back self-confidence, according to BTC derivatives metrics. Traders are now attempting to identify what is avoiding belief from enhancing and whether Bitcoin has the momentum to press previous $120,000.

The BTC alternatives delta alter presently stands at 9%, indicating put (sell) alternatives are priced at a premium compared to comparable call (buy) instruments. This normally signals run the risk of hostility, though it might just show recently’s trading conditions instead of a clear expectation of a sharp decrease. A real rise in need for drawback defense would appear in the alternatives put-to-call ratio.

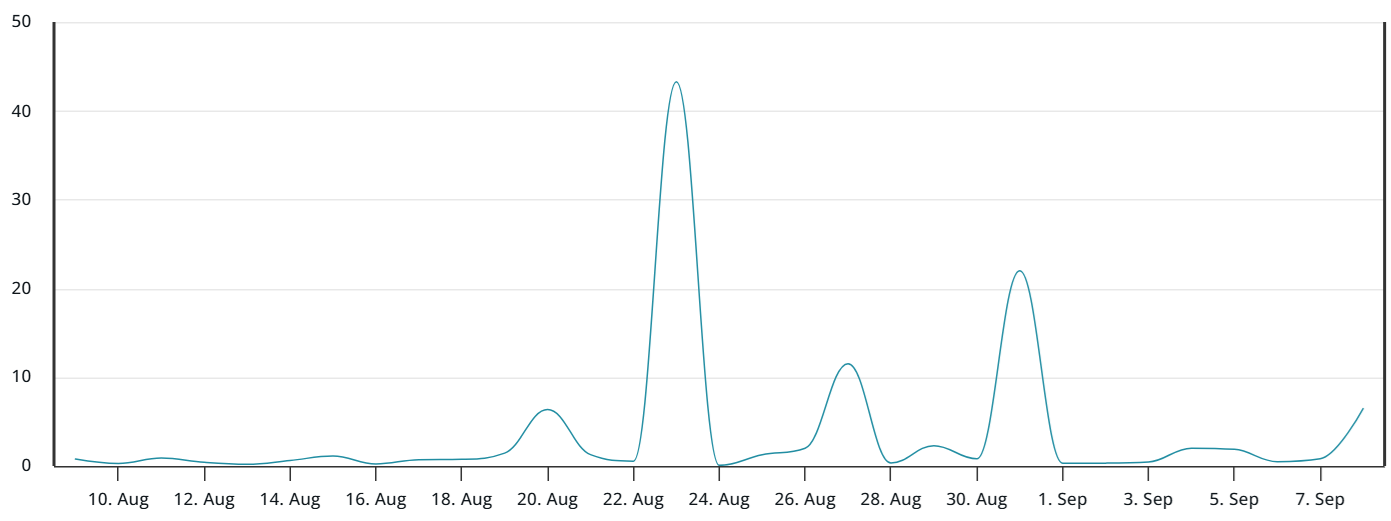

On Monday, need for put alternatives leapt, reversing the pattern of the previous 2 sessions. The information indicate a more powerful cravings for neutral-to-bearish methods, recommending traders stay careful about a possible drop listed below $108,000.

A few of this absence of interest originates from Bitcoin’s failure to mirror the fresh all-time highs in both the S&P 500 and gold. Weaker-than-expected labor market figures in the United States strengthened expectations of financial alleviating.

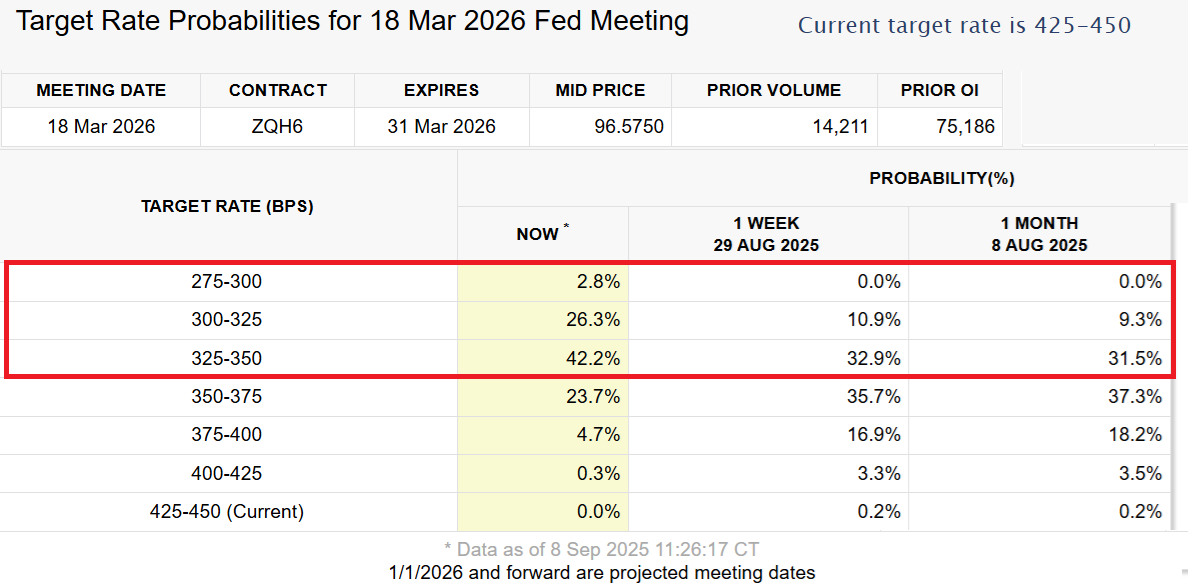

Traders now appoint a 73% likelihood that rate of interest will be up to 3.50% or lower by March 2026, up from 41% simply one month earlier, according to the CME FedWatch tool.

Area Bitcoin ETFs deal with outflows as business Ether reserves get traction

Contributing to the care, area Bitcoin ETFs tape-recorded $383 million in net outflows in between Thursday and Friday. The withdrawals most likely tense financiers although Bitcoin effectively held the $110,000 assistance. Competitors from Ether (ETH) as a business reserve possession might likewise be affecting belief, as business have actually assigned an extra $200 million over the previous week alone, according to StrategicETHReserve information.

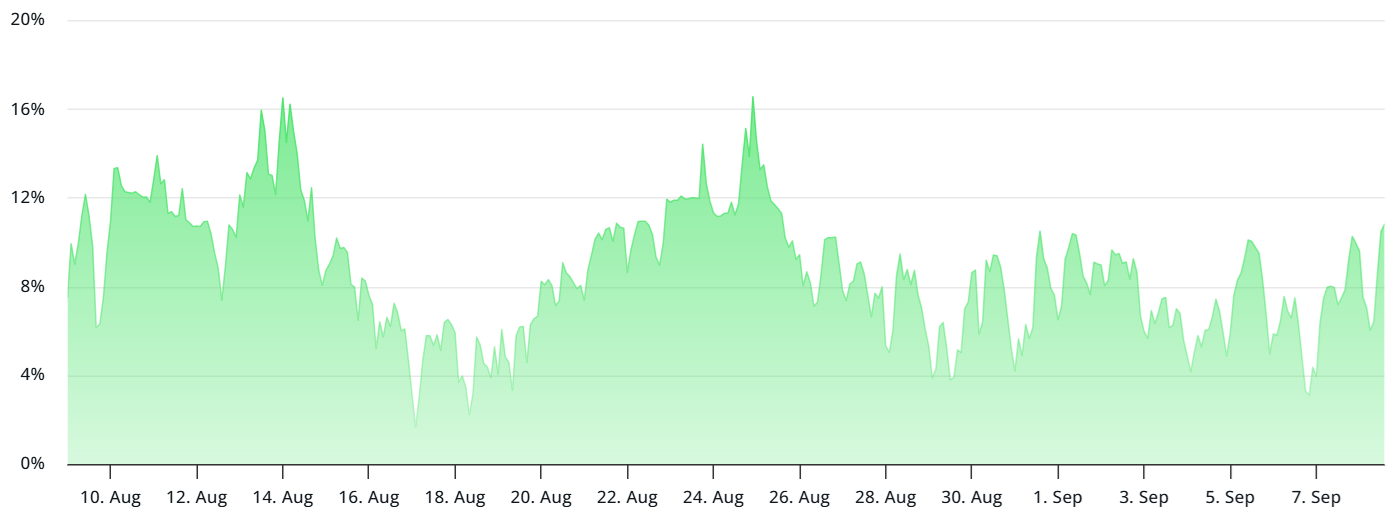

To identify whether bearish belief is restricted to BTC alternatives, it is needed to take a look at the Bitcoin futures market. Under regular conditions, financing rates on continuous agreements normally vary from 6% to 12% to represent the expense of capital and exchange-related dangers.

At present, Bitcoin’s continuous futures financing rate sits at a neutral 11%. While neutral, this marks an enhancement from the bearish 4% level observed on Sunday. Traders might be reacting to increased competitors from altcoins, especially after Nasdaq submitted with the United States Securities and Exchange Commission to note tokenized equity securities and exchange-traded funds (ETFs).

Related: Crypto ETFs log outflows as Ether funds shed $912M– Report

Bitcoin derivatives continue to show hesitation towards the most recent rally, as both alternatives and futures reveal little interest for the relocation above $112,000. What might move traders out of this careful position stays unsure. The frustration that Method (MSTR) was omitted from the S&P 500 rebalance on Friday might likewise discuss a few of the soft belief amongst bulls.

In the meantime, a rise to $120,000 appears not likely. Still, if area Bitcoin ETFs handle to support, general belief might rapidly enhance and set the phase for restored rate momentum.

This short article is for basic info functions and is not meant to be and ought to not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.