Bitcoin (BTC) acquired as much as 3% Sunday, however some traders declined to think that the BTC cost crash was over.

Bottom line:

-

Bitcoin cost contrasts alert that brand-new macro lows are due if the 2022 bearishness continues to repeat.

-

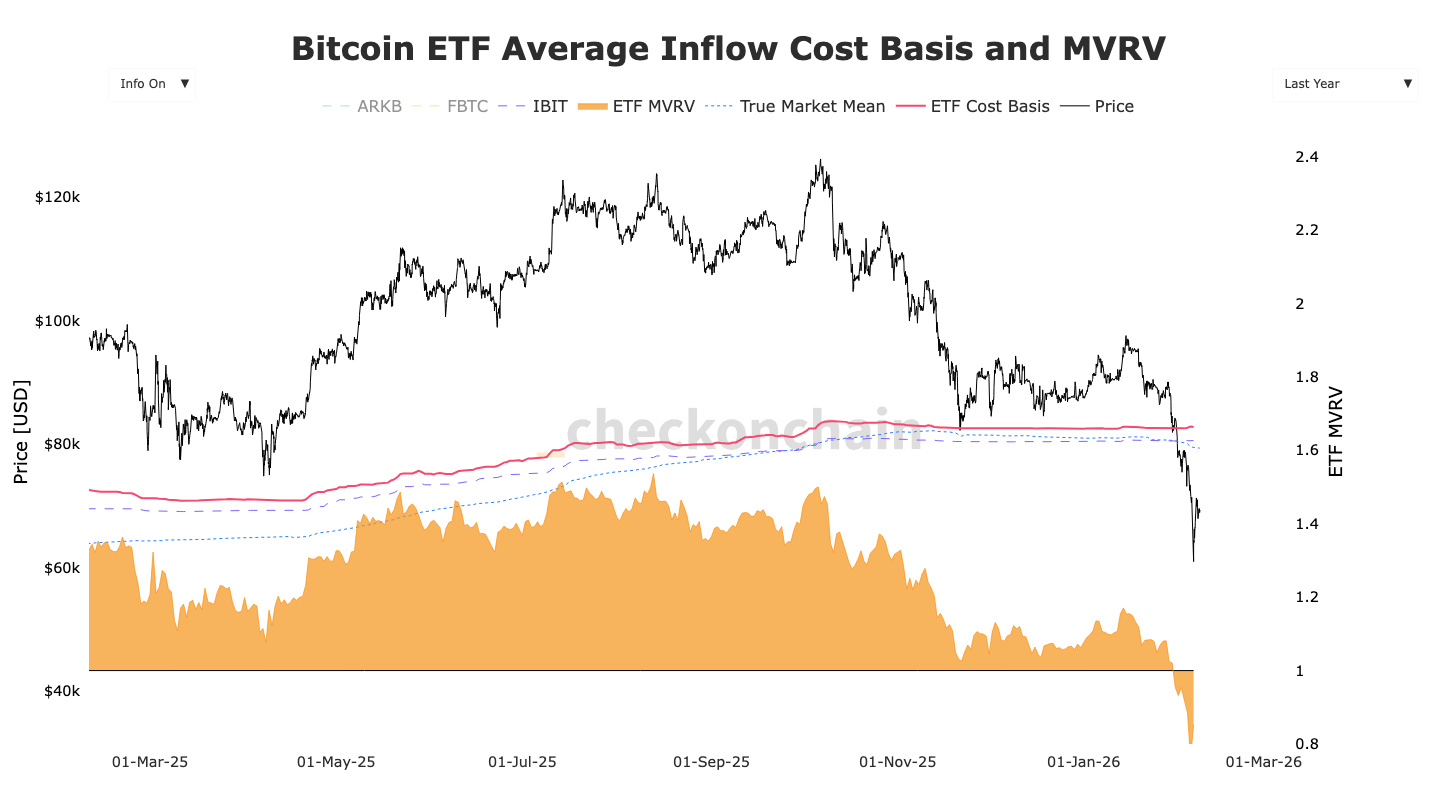

Moving averages and the expense basis of the United States area Bitcoin ETFs remain in focus.

-

Analysis states that a carbon copy of 2022 is not a certainty.

Bitcoin capitulation “hasn’t took place yet”

Information from TradingView revealed BTC/USD crossing $71,000, now up 20% versus Friday’s 15-month lows.

As the weekly close neared, Bitcoin included particular volatility, while market individuals stayed extremely hesitant that the rebound would last.

Submitting a chart to X which compared present BTC cost action to the 2022 bearishness, independent expert Filbfilb had no excellent news for bulls.

” Im not going to attempt to dress it up any method besides how it looks,” he commented together with a chart revealing area cost versus the 50-week rapid moving average (EMA) at $95,300.

Expert Tony Severino held comparable concepts, contributing numerous cost signs and concluding that brand-new lows were all however ensured.

4 more for your insight https://t.co/psM23MQiI2 pic.twitter.com/Qu0Pt5QeUz

— Tony Severino, CMT (@TonySeverinoCMT) February 8, 2026

“$ BTC last capitulation hasn’t took place yet,” trader BitBull concurred, like Filbfilb referencing 2022.

” A genuine bottom will form listed below $50,000 level where the majority of the ETF purchasers will be undersea.”

The United States area Bitcoin exchange-traded funds (ETFs) presently have a typical buy-in expense of $82,000, per information from keeping an eye on resource Checkonchain.

BTC cost deja vu continues

Previously, Cointelegraph reported on an essential bearishness function for Bitcoin based upon 2 other pattern lines: the 200-week simple (SMA) and rapid moving averages.

Related: What crashed Bitcoin? 3 theories behind BTC’s journey listed below $60K

Together, they form a “cloud” of assistance in between $58,000 and $68,000.

In among his newest market takes at the weekend, Caleb Franzen, developer of analytics resource Cubic Analytics, argued that here too, the ghost of 2022 remained in play.

” In May 2022, Bitcoin retested its 200-week MA cloud. Bulls stated ‘that’s it, we have actually retested the long-lasting moving typical & & can continue greater now.’ Cost instantly rebounded on that zone, produced a long wick, & & closed above the midpoint of the weekly variety,” he summed up.

” However then that rally faded … Cost returned into the 200W MA cloud a couple of weeks later on, stopped working to rebound, then sliced through the cloud in June 2022. What are we seeing today? The very first retest of the 200W MA cloud with a long wick.”

Franzen note that the marketplace might not reproduce the previous bearishness “completely.”

” The truth is that nobody understands what occurs next,” he acknowledged.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we aim to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might include positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage emerging from your dependence on this info.