Bottom line:

-

Bitcoin declines to budge from a narrow variety as traders think about the most likely breakout instructions.

-

Cost discovery is acutely waited for, however disadvantage forecasts consist of levels even more towards $90,000.

-

BTC/USD has actually provided extremely patterned relocations considering that its rebound started in April.

Bitcoin (BTC) kept traders rating the Might 16 Wall Street open as debt consolidation stimulated both bullish and bearish projections.

” Substantial” liquidity constructs around BTC rate

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD shuttling in between $103,000 and $104,000 on the day.

In spite of beating expectations, the most recent United States macroeconomic information in the type of the Customer Cost Index (CPI) and Manufacturer Cost Index (PPI) prints on Might 13 and 15, respectively, stopped working to apply a strong impact on short-term rate habits.

Rather, traders concentrated on Bitcoin’s newest debt consolidation stage less than 10% far from brand-new all-time highs.

“$ BTC Has actually been doing approximately the very same thing considering that the April lows. Go up, tight debt consolidation, brand-new upper hand,” popular trader Daan Crypto Trades composed in part of continuous X analysis.

” Watch on this regional variety and await a breakout to either instructions would be my suggestion.”

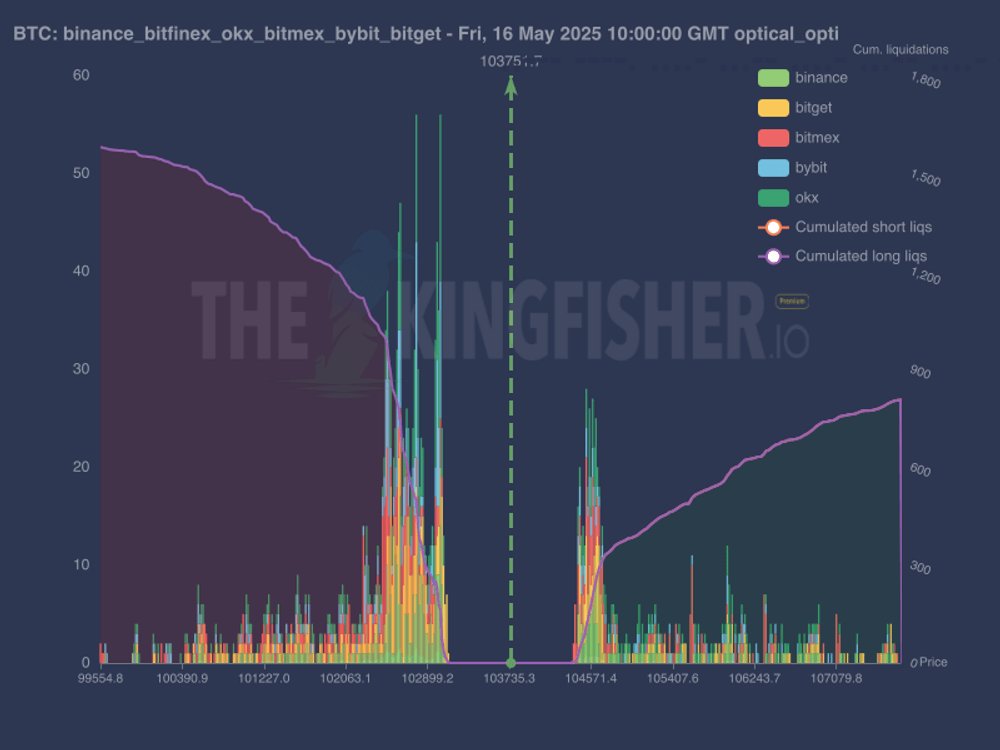

A different post kept in mind locations of thick liquidity on either side of the rate, possibly offering near-term targets ought to BTC/USD leave its narrow variety.

$BTC Liquidation Map revealing a big cluster at $105K-$ 106K and a heap sitting in between $99K-$ 103K.

This makes good sense as these are the highs/lows of the present small variety we’re combining in for the previous week or two.

Recently, we’ve seen a great deal of comparable combinations and we … pic.twitter.com/y387V1WzsC

— Daan Crypto Trades (@DaanCrypto) May 16, 2025

” Notification the huge concentration of long liquidations clustered securely simply listed below the present rate, especially around 10280-10300? This represents a considerable swimming pool of liquidity,” fellow trading TheKingfisher continued.

” Shorts are more expanded greater up. This imbalance makes the zone listed below a crucial location to enjoy. It might serve as a rate magnet, or a trigger point for cascading liquidations if rate relocations down.”

Another popular trader, Crypto Caesar, recommended that a variety breakout might run much deeper and take Bitcoin even more listed below the $100,000 mark.

” If rate breaks and holds above this zone, we might see brand-new insane highs,” he informed X fans, referencing a bullish crossover on the weekly moving typical convergence/divergence (MACD) indication.

” Nevertheless: a rejection right here may result in a pullback towards $90K.”

A rinse-and-repeat Bitcoin breakout?

Like Daan Crypto Trades, expert Kevin Svenson was eager to see an extension of the stop-start rebound in location considering that April.

Related: Bitcoin striking $220K ‘sensible’ in 2025, states gold-based projection

Evaluating 4-hour timeframes on the day, he provided his next benefit BTC/USD target well inside rate discovery.

” Up until now, the determined relocation projections of each upper hand in this run have actually been determine precise,” he composed.

” If this pattern continues, if this pattern holds, the next target is $115,000.”

Previously, Cointelegraph reported on a range of BTC rate forecasts now in force, with analysts extremely preferring upside next.

Zooming out, $1 million per coin might end up being truth in 3 years’ time and even quicker, according to previous BitMEX CEO Arthur Hayes.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.