Bottom line:

-

Bitcoin still sells its 18-day variety in spite of a breakdown listed below $116,000.

-

The latency in between pro-crypto policy from United States regulators and the Trump administration and Bitcoin cost has actually left traders feeling distressed.

Bitcoin (BTC) sold greatly on Wednesday following the Federal Reserve’s release of the FOMC minutes and Fed Chair Jerome Powell’s presser, where he described why the reserve bank chose not to cut rate of interest. Costs rebounded on Thursday after United States equities and crypto markets returned their focus to the principles at hand and the predicted longer-term effect of President Trump’s financial required.

Regardless of the sharp drop listed below $116,000, BTC continues to sell the $115,000 to $121,000 variety it has actually remained in for the last 18 days, and information recommend a variety growth impends.

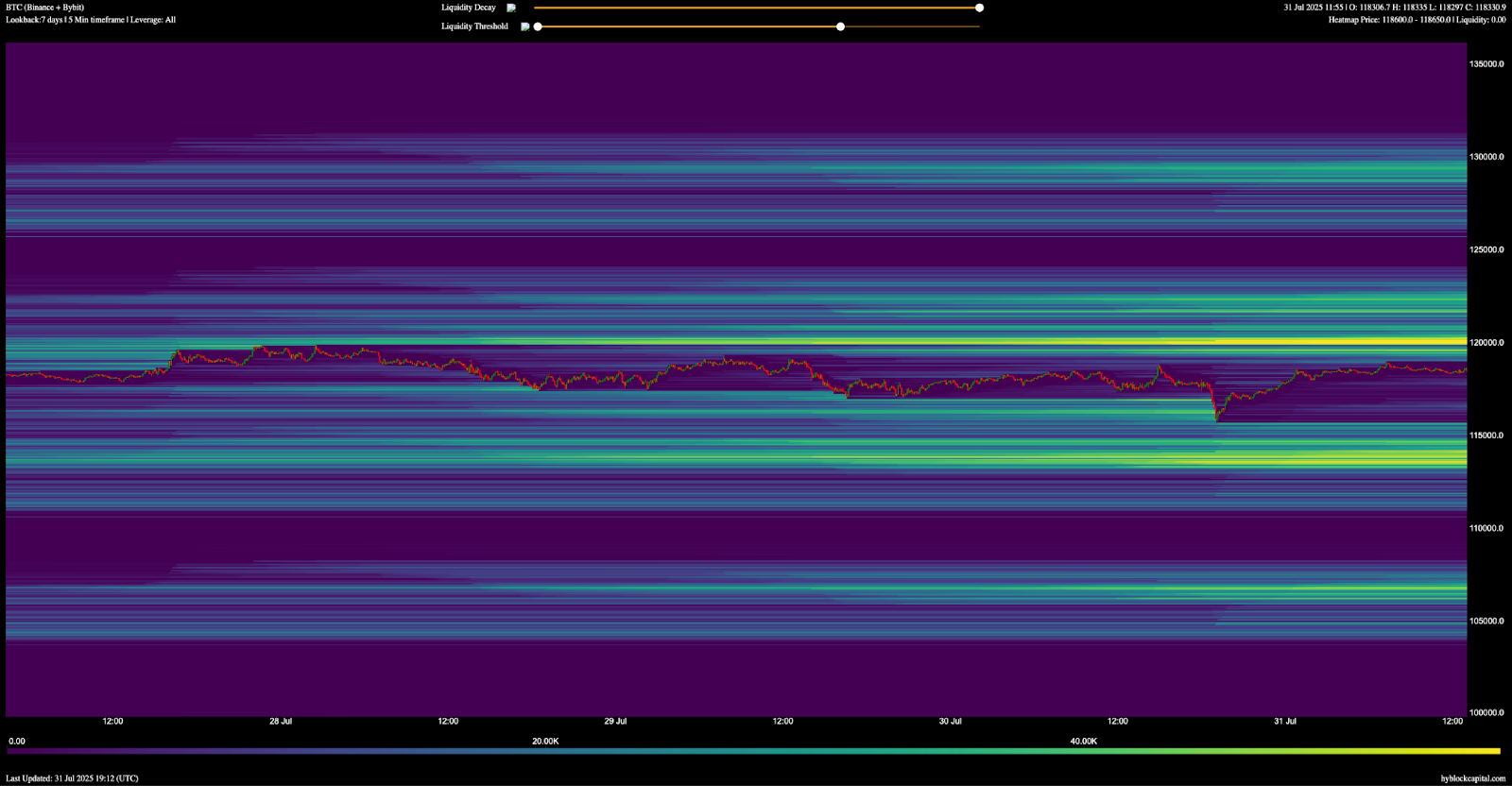

Experts at Hyblock Capital explained the pre- and post-FOMC cost action as a liquidity hunt where “a traditional indecision 15m candle light emerged with wicks on both sides as markets fluctuated.” The experts indicated the bid-ask-ratio metric at 10% orderbook depth reddening, which increased the possibility of cost tapping a liquidation level at $115,883.

Taking a look at the existing liquidation heat map for the BTC/USDT perps set at Binance and Bybit, the liquidation and cost variety stays the same, with brief liquidations speeding up above $120,000 and longs at threat of liquidation listed below $115,000.

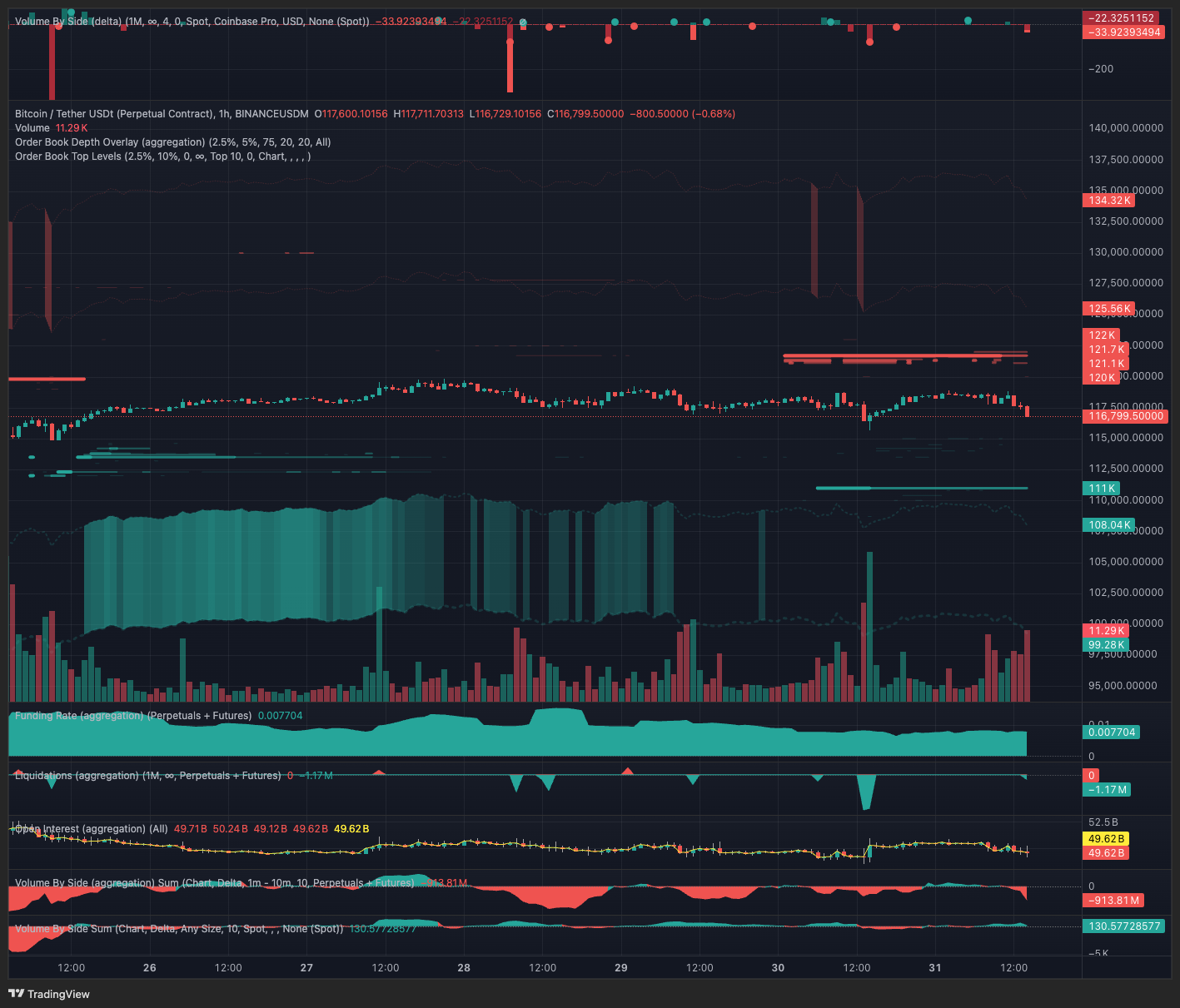

Aggregate orderbook (2.5% to 10% depth) information from TRDR programs offer walls thickening at $121,100 and considerable quotes appearing at $111,000.

Rate compression caused disadvantage variety growth

On Wednesday, Cointelegraph experts recommended that Bitcoin’s cost compression and lack of aggressive take advantage of usage in its futures markets are indications that BTC is on the edge of a variety growth. At the time, the Bollinger Bands had actually likewise narrowed, with BTC cost trading above the 20-day moving average, leading lots of traders to anticipate a benefit breakout.

Although the marketplace has actually selected to target Bitcoin’s disadvantage liquidity, numerous favorable actions stay at play. Capriole Investments creator Charles Edwards stated that Bitcoin treasury purchasers each day have actually removed over the previous 6 weeks, “with more than 3 business purchasing Bitcoin every day.” Edwards likewise kept in mind that his ‘treasury purchases and offers’ metric programs that “there’s presently 100:1 purchasers versus sellers monthly.”

Related: Bitcoin cost retargets $119K as treasuries purchase 28K BTC in 2 days

Inflows to the area Bitcoin ETFs have actually likewise resumed after experiencing $285 million in outflows recently. Information from SoSoValue reveals that given that July 23, the ETFs have actually seen $641.3 million overall netflows, in spite of Bitcoin’s cost selling off.

Today’s White Home crypto report and Thursday’s American Management in the Digital Financing Transformation speech by SEC chairman Paul S. Atkins likewise set a precedent by setting out a clear set of policy goals for how the Trump administration and regulators mean to focus on the development of the cryptocurrency sector in the United States.

While their instant effect might not be shown by crypto rates, they do set the structure for wider adoption and provide institutional financiers the signal to with confidence increase their allowances to Bitcoin and other cryptocurrencies.

In the short-term, if Bitcoin sellers continue to control the marketplace, a cost drop to take in long liquidity in the $115,000 to $111,000 variety promises. For the bulls, the most wanted result would be a strong quote at $111,000, producing a high volume spike to recover the variety above $116,000. An even much better result would include the area and continuous futures CVD turning favorable as purchasers make a push in both markets to protect an everyday close above the $120,000 resistance.

This post is for basic details functions and is not meant to be and ought to not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.