Bottom line:

-

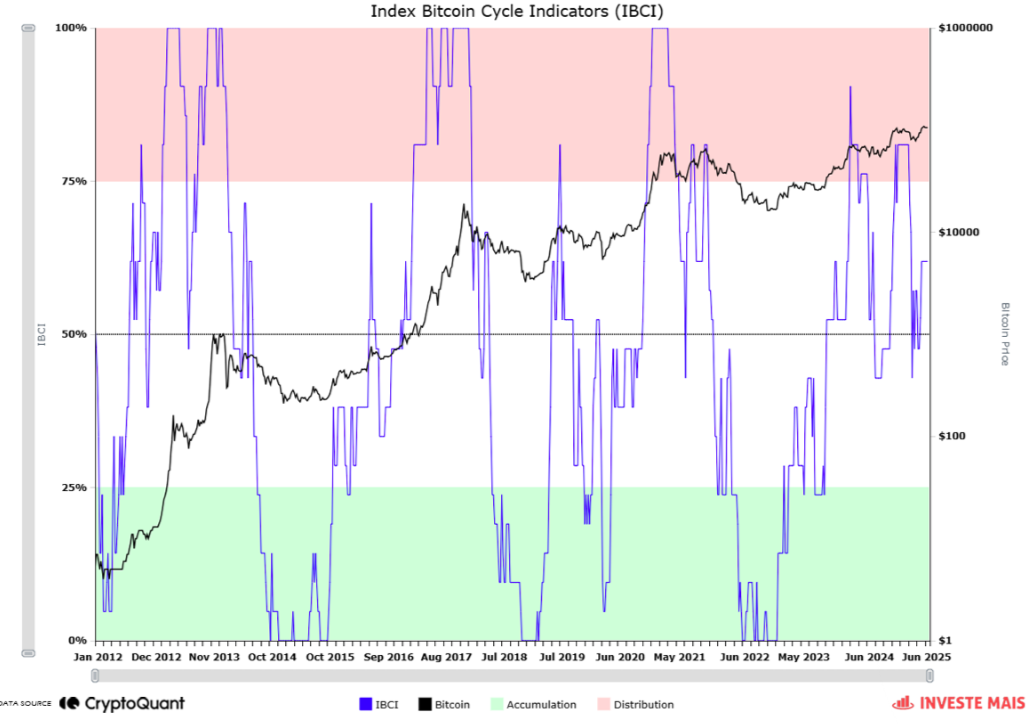

The Index Bitcoin Cycle Indicators (IBCI) tool from CryptoQuant reveals that the booming market has a lot of space to run.

-

” Neutral” readings come in spite of all-time highs on BTC/USD, with the marketplace at a “point of meaning.”

-

Bitcoin’s Puell Numerous metric is circling around lows– uncommon habits for the most popular stage of the bull cycle.

Bitcoin (BTC) is due a “brand-new upward leg” as a BTC rate tool with a decade-long performance history remains bullish.

New information from onchain analytics platform CryptoQuant reveals the Index Bitcoin Cycle Indicators (IBCI) tool requiring booming market extension.

Bitcoin rate at “point of meaning”

Bitcoin is far from done when it concerns its existing booming market, the most recent IBCI readings appear to validate.

IBCI, which integrates numerous timeless onchain indications, consisting of the Puell Numerous and Market Price to Recognized Worth (MVRV), stays well listed below the zone, which typically represents booming market tops.

” The current upgrade of the Index Bitcoin Cycle Indicators (IBCI) reveals a market at a point of meaning,” CryptoQuant factor Gaah composed in among its “Quicktake” post on June 17.

Gaah explained the information as signifying a “extension” of the booming market, which started at the start of 2023.

” After the strong upward motion in between completion of 2023 and the very first quarter of 2024 – when the IBCI reached the circulation area (above 75%) – the sign went through a correction following the fall in the rate of BTC,” the post continued.

” Currently, IBCI has actually supported in the 50% variety, suggesting a neutral point in the market cycle.”

IBCI has actually held the 50% mark considering that BTC/USD broke through old $73,800 all-time highs last October.

Unlike the crazy profit-taking environment that marked the occasion and the rest of the year, nevertheless, Gaah notes that financier habits is now much calmer– possibly leaving the door available to brand-new highs.

” Historically, stability zones like this take place in between 2 definitive stages: completion of an awareness motion and the start of a brand-new upward leg,” he discussed.

” The lack of severe bliss and the steady healing of the Bitcoin rate recommend that the marketplace remains in a transitional stage – not fatigue.”

Historic information reveals comparable patterns playing out on IBCI relative to long-lasting BTC rate peaks.

An uncommon Bitcoin all-time high

As Cointelegraph continues to report, a progressively substantial series of market yardsticks indicate Bitcoin going back to rate discovery in the future.

Related: $ 112K BTC was not ‘booming market peak’: 5 things to understand in Bitcoin today

Amongst them is a list of 30 “booming market peak” metrics, none of which have actually flashed red in spite of BTC/USD reaching $112,000.

BTC rate targets for the rest of the booming market on the other hand consist of $200,000 and greater.

In different Puell Numerous analysis in current days, Gaah flagged an uncommon variation in between rate and miner incomes.

” Historically, when Puell Numerous is listed below 1.0 we associate durations of build-up or undervaluation, where the rate of Bitcoin does not yet show the complete capacity for long-lasting development,” he composed, with the Numerous at 1.27.

” Seeing this sign at such low levels throughout a brand-new all-time high is unusual – and might show that the marketplace has actually not yet reached its complete blissful stage. There is space for growth, both in mining incomes and in favorable market belief.”

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.