Secret takeaways:

-

Bitcoin’s drop listed below $100,000 comes as a Wyckoff Circulation pattern indicate a prospective decrease towards $86,000.

-

Some experts stay positive, arguing that the booming market will hold as long as the $94,000 assistance level stays undamaged.

Bitcoin (BTC) has actually simply slipped under the crucial $100,000 assistance level, driven by hawkish Federal Reserve potential customers and relentless whale selling.

Now, a traditional technical breakdown setup is enhancing the case for extended selling in the Bitcoin market.

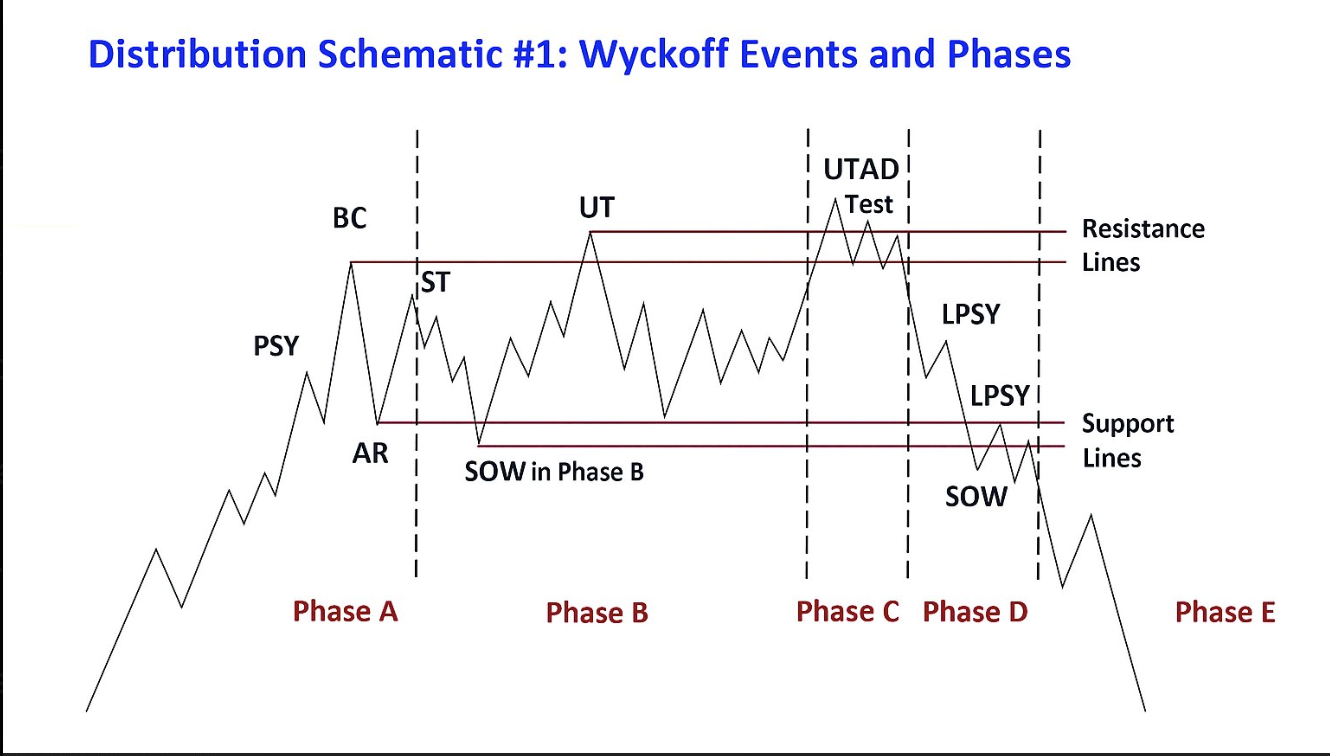

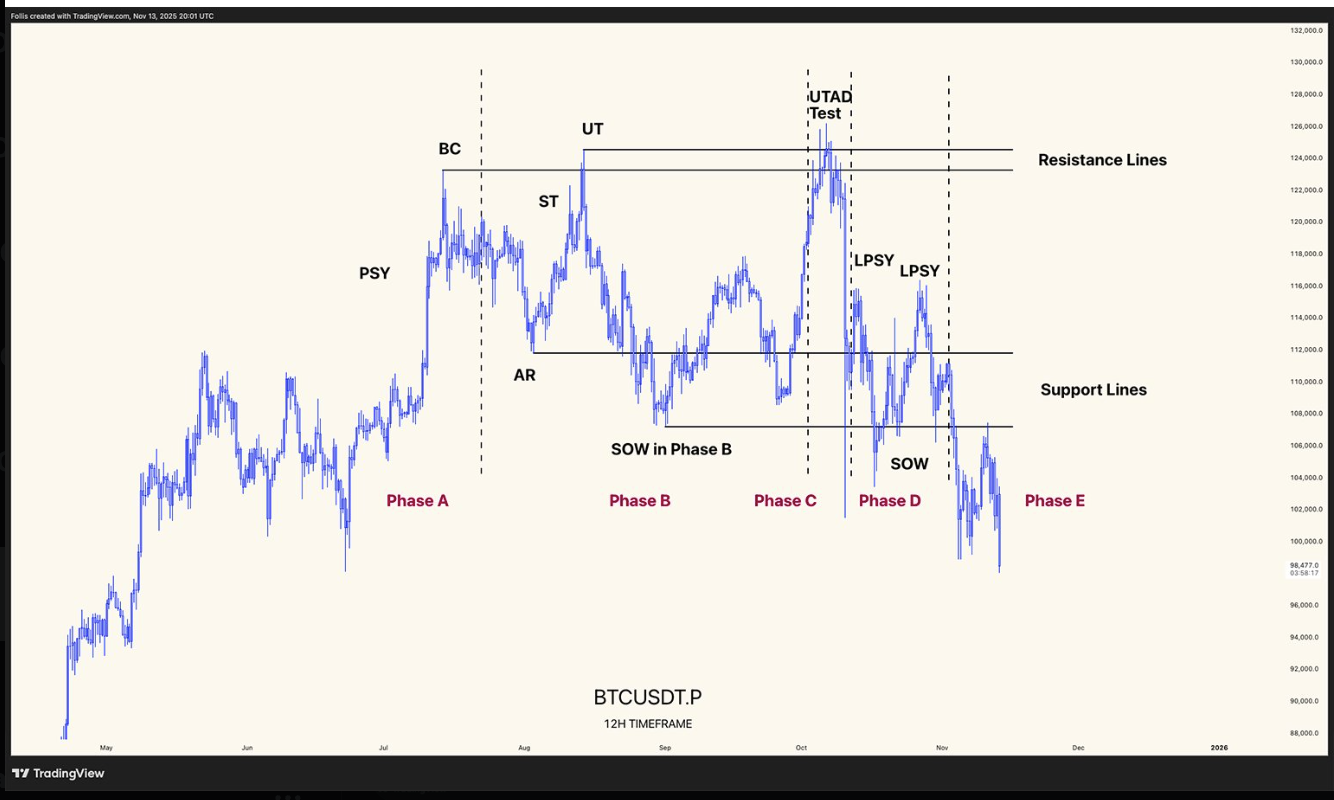

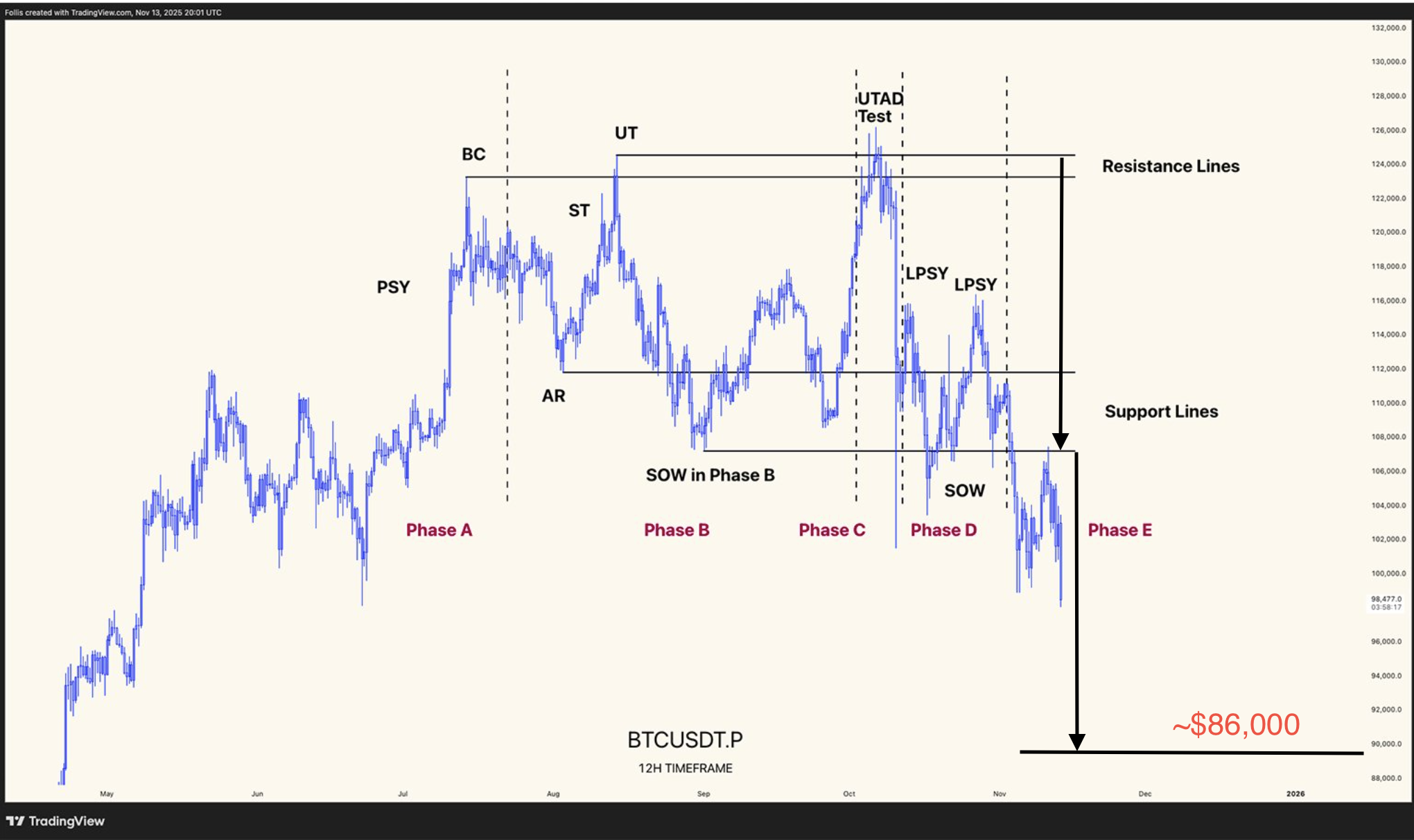

Wyckoff circulation design cautions of BTC rate drop to $86,000

The schematic, highlighted by expert @follis_ on X, reveals Bitcoin’s current structure tracking the timeless five-phase Wyckoff Circulation, a pattern frequently seen near macro market tops, as revealed listed below.

The positioning is strong enough that the Bitcoin booming market “may really be over,” @follis_ stated.

BTC’s rise above $122,000 marked the Purchasing Climax (BC), followed by an Automatic Response (AR) and Secondary Tests (ST) that stopped working to develop greater highs.

The early-October push towards $126,200 looked like an Upthrust After Circulation (UTAD), a last bullish discrepancy that indicates need fatigue.

From there, Bitcoin printed numerous Last Points of Supply (LPSY) and lost mid-range assistance near $110,000, validating Stage D.

It dropped listed below the AR/SOW zone at $102,000–$ 104,000, then moved BTC into Stage E, the markdown stage, speeding up the decrease. By Friday, BTC had actually dropped listed below $95,000 on Binance.

Based upon Wyckoff’s measured-move technique, the $122,000–$ 104,000 circulation band indicates an $18,000 disadvantage forecast, i.e., $86,000 as the main target.

The bearish shift happened as international danger hunger degraded, driven by worries that the Federal Reserve would not cut rates of interest in December.

The United States federal government shutdown, which ended on Thursday, limited access to crucial financial information, making policymakers less positive about alleviating financial policy. That unpredictability rippled through danger possessions, injuring Bitcoin together with United States stocks.

Some Bitcoin experts are still bullish

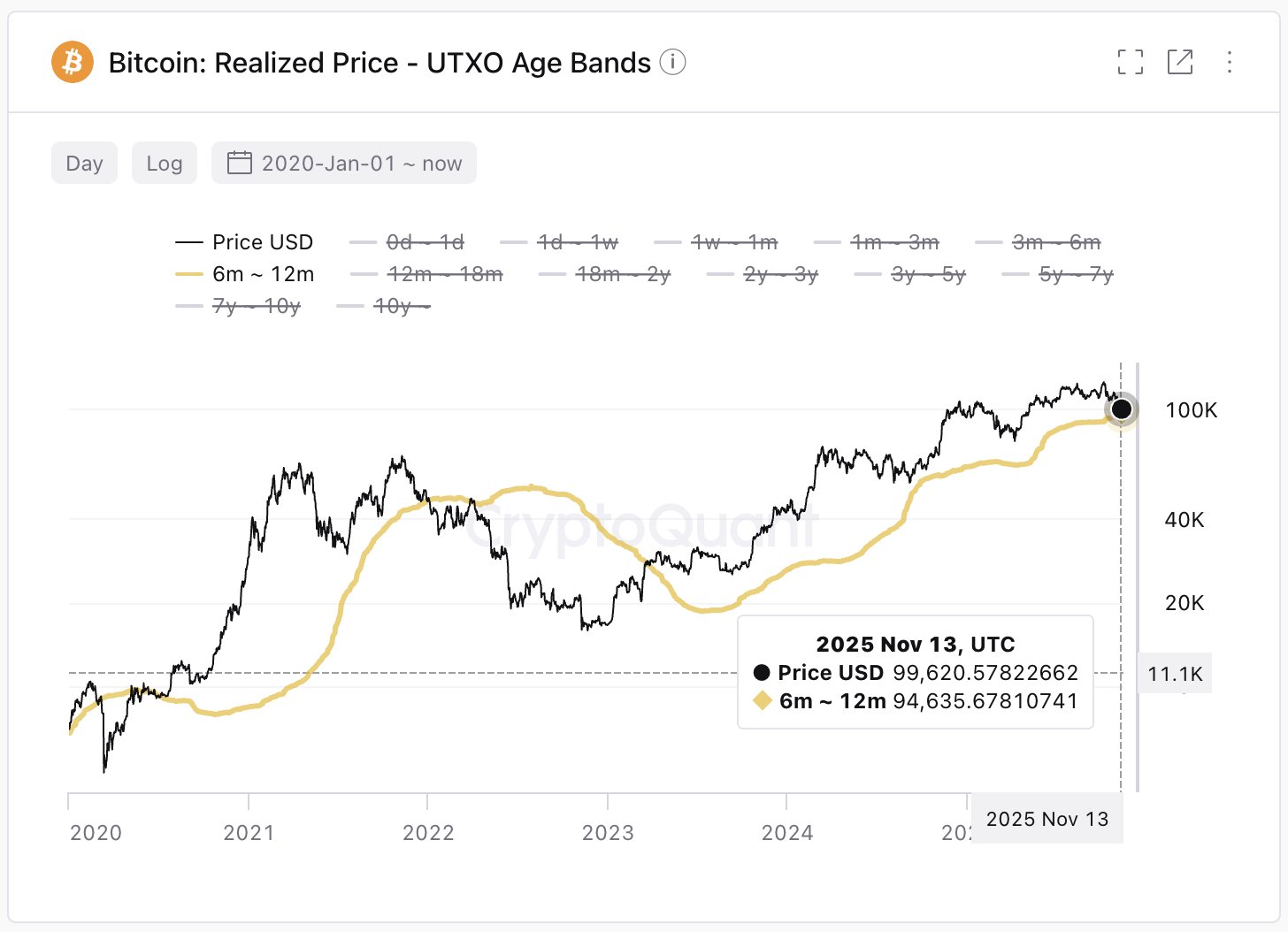

Bitcoin’s more comprehensive uptrend stays undamaged unless the rate falls listed below the crucial $94,000 level, the typical expense basis of 6- to 12-month holders, according to CryptoQuant CEO Ki Young Ju.

Related: Bitcoin ETFs bleed $866M in second-worst day on record, however some experts still bullish

Bitwise CEO Hunter Horsley stated Bitcoin “might have remained in a bearish market for practically 6 months” and is now nearing completion of it, including that “the setup for crypto today has actually never ever been more powerful.”

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.