Bottom line:

-

Bitcoin rate losses near 2% on the day as 14-year-old coins unexpectedly move onchain.

-

Descriptions consist of a dubious claim connecting the BTC wallets included to developer Satoshi Nakamoto.

-

Rate comes for BTC longs as an outcome, with shorts massing above $110,000.

Bitcoin (BTC) slipped underneath the crucial $108,000 level on July 4 as deals including long-dormant coins surprised markets.

Reports swirl as Bitcoin “OG” moves millions

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD going to $107,564 on Bitstamp before a modest bounce.

Down 1.6% on the day, Bitcoin developed on weak point that followed a fresh rejection at $110,000 the day prior.

The most recent BTC rate action, which happened in the lack of Wall Street trading thanks to the United States Self-reliance Day vacation, accompanied a huge tranche of 80,000 BTC rekindling after 14 years.

The deals were connected to a single whale entity, with keeping an eye on resource Lookonchain verifying an overall of 8 wallets.

A Bitcoin OG holding a minimum of 80,009 $BTC($ 8.69 B) awakened after 14+ years of inactivity and moved out 40,000 $BTC($ 4.35 B) today!

This OG manages about 8 wallets, 2 of which got 20,000 $BTC($ 15,600 at the time, $2.18 B now) on April 2, 2011, when the rate of $BTC was … pic.twitter.com/F8jULZ6Ee7

— Lookonchain (@lookonchain) July 4, 2025

The transfers were continuous at the time of composing, with markets plainly anxious of the ramifications of such old coins unexpectedly moving onchain, possibly as part of a sale.

Reports on social networks was plentiful, with popular trader CryptoBeast even connecting the deals to Satoshi Nakamoto.

Commenting, popular X trading account TheKingfisher observed a spike in so-called “hazardous” order circulation– deals which lead to losses for market makers.

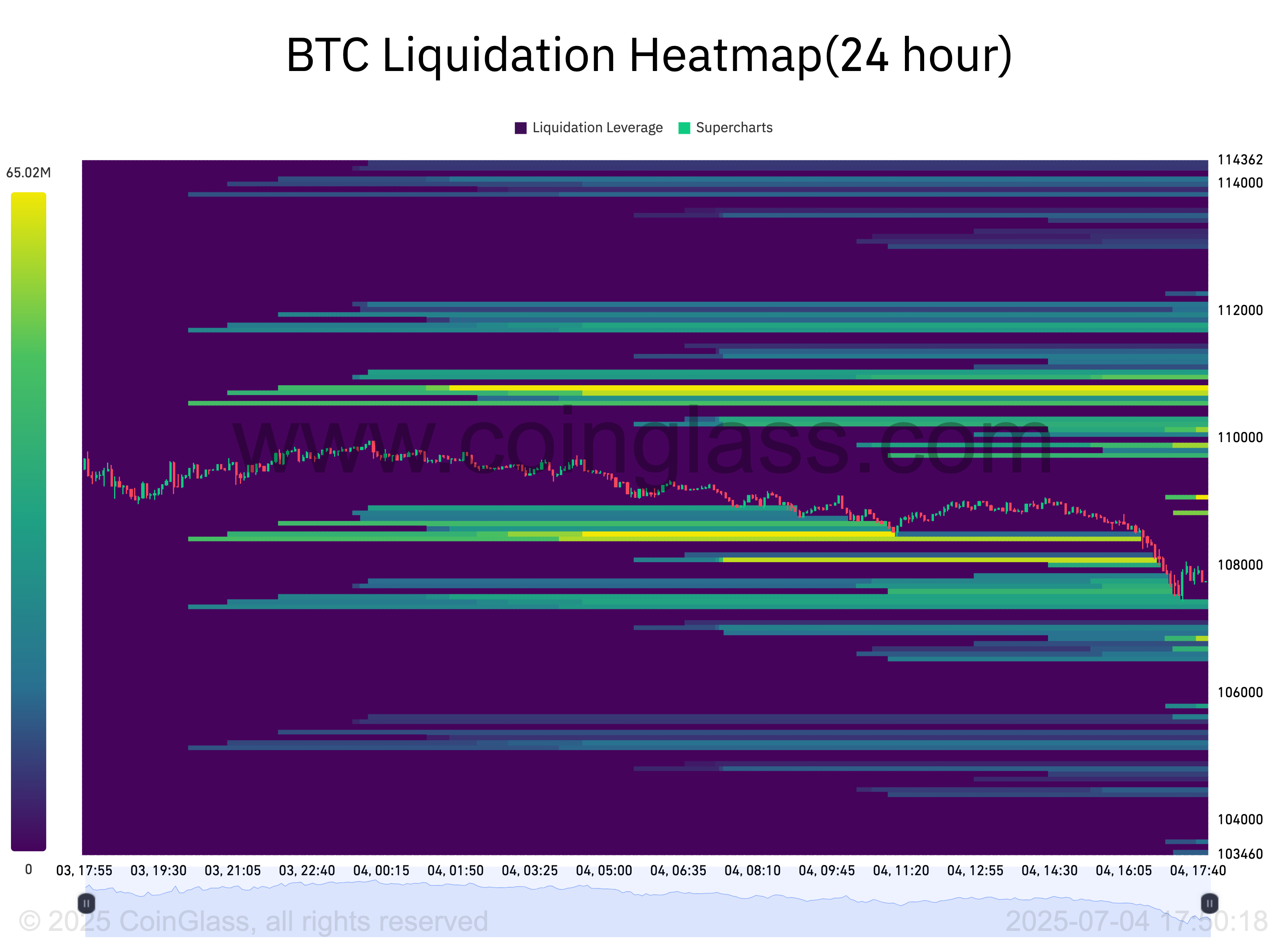

” I ‘d anticipate it to backtrack, possibly liq those high utilize shorts,” part of a post recommended, describing an accumulation of BTC brief liquidity on exchange order books.

Information from keeping an eye on resource CoinGlass revealed BTC/USD consuming through long liquidity levels while overhead resistance– specifically above $110,000– increased.

BTC rate dangers canceling breakout

Advancing Bitcoin rate action, popular trader and expert Rekt Capital flagged a prospective danger to booming market upside.

Related: Bitcoin rate can strike $150K in weeks thanks to Trump’s ‘Big Beautiful Costs’

A day-to-day chart submitted to X revealed BTC/USD undoing the resistance/support turn of an essential trendline, which has actually remained in location considering that the present all-time highs of $112,000.

” Bitcoin is losing the diagonal for the minute,” he verified.

” However if rate Day-to-day Closes above the diagonal then this will have ended as a drawback wick as part of an unpredictable retest. Upcoming Daily Close will be critical.”

Formerly, other crypto market individuals had actually consistently highlighted $108,000 as the level that bulls required to hold moving forward.

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.