Bullish belief might be going back to Bitcoin as an essential metric from Binance, the biggest crypto exchange by trading volume, reveals that purchasers are beginning to control the platform’s volumes.

The Binance Taker Purchase Offer Ratio, which determines the ratio of purchasers to sellers of Bitcoin (BTC) in Binance, “has actually gone back to neutral area,” CryptoQuant factor DarkFost stated in an April 15 note.

Bitcoin bullish momentum is “getting once again”

The ratio presently stands at 1.008. When the ratio is greater than 1, purchasers– generally a bullish belief indication– control volumes, alternatively, a ratio listed below 1 suggests that sellers, or bearish belief, are controling.

Bitcoin is trading at $83,810 at the time of publication. Source: CoinMarketCap

Bitcoin is trading at $83,810 at the time of publication, down 1.47% over the previous 7 days, according to CoinMarketCap information.

” Over the previous couple of days, the ratio has actually been primarily favorable, recommending that bullish belief is getting once again on Binance’s derivatives market,” Darkfost stated. On April 14, when Bitcoin was above $86,000, the ratio was above 1.1.

CoinGlass information reveals that if Bitcoin recovers $85,000, nearly $637 million simply put positions will be at danger of liquidation. A number of essential market indications recommend that financiers continue to prefer Bitcoin over altcoins.

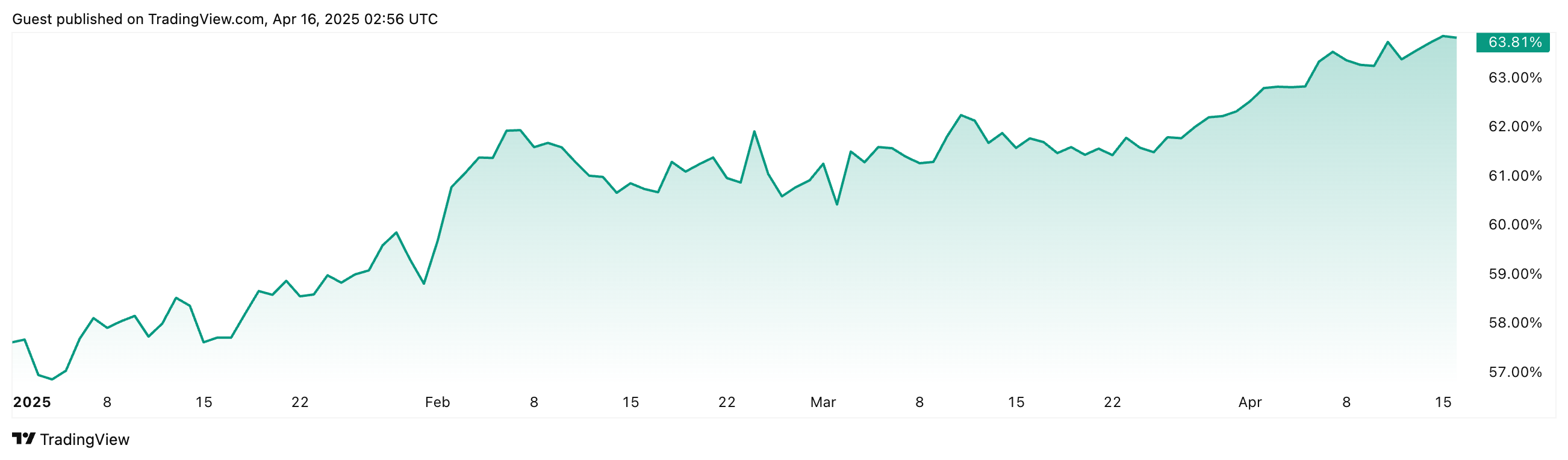

CoinMarketCap’s Altcoin Season Index is presently at 15 out of 100, signalling it is still quite “Bitcoin Season.” TradingView’s Bitcoin Supremacy Chart reveals the possession’s market share is sitting at 63.81%, up 9.82% up until now this year.

Bitcoin Supremacy is up 9.88% given that the start of 2025. Source: TradingView

Total, crypto market individuals are still appearing to feel reluctant. The Crypto Worry & & Greed Index reveals the general market belief on April 16 remains in “Worry” with a rating of 29 out of 100.

Some experts, consisting of DeFiDaniel, commented that Bitcoin’s current cost action is “so uninteresting.”

Nevertheless, Cointelegraph previously reported that Bitcoin obvious need is on a healing course, however it is not net favorable yet. Historically, 30-day obvious need can move sideways for an extended duration after Bitcoin reaches a regional bottom, causing its cost to slice sideways.

Related: Bitcoin cost healing might be topped at $90K– Here’s why

Experts have varying views over where Bitcoin is going to go next.

Genuine Vision chief crypto expert Jamie Coutts informed Cointelegraph in late March that “the marketplace might be undervaluing how rapidly Bitcoin might rise– possibly striking brand-new all-time highs before Q2 is out.”

AnchorWatch CEO Rob Hamilton stated in an April 15 X post that Bitcoin’s cost “is flat for the day since we remain in a legendary pull of war in between individuals who are offering Bitcoin to pay their taxes and individuals utilizing their refunds to purchase Bitcoin.” The tax due date in the United States was April 15.

Publication: Is Cambria S2 the riskiest, most ‘addicting’ crypto video game of 2025? Web3 Player

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.