Bottom line:

-

Bitcoin brings upside volatility into the weekly close with a charge through $112,000 resistance.

-

Traders expect brand-new regional highs next as the BTC cost healing continues.

-

The United States Federal Reserve is tipped to cut rate of interest once again next week.

Bitcoin (BTC) challenged $112,000 into Sunday’s weekly close as traders wished for brand-new regional highs.

Bitcoin eyes traders’ targets in fresh volatility

Information from Cointelegraph Markets Pro and TradingView showed that a range-bound BTC cost action defined the weekend.

A late rebound on Friday assisted bulls relocate to a greater level in the week’s variety, assisted by pleasing United States inflation information.

Now, market individuals saw the capacity for fresh highs to emerge, with the weekly close usually experiencing increased volatility.

Holding my long over $108,200. Targeting $113,000 highs next. pic.twitter.com/aXZtvseqtO

— Crypto Tony (@CryptoTony__) October 26, 2025

Trader Crypto Caesar observed the $112,000 resistance level being retested on the day.

” A CLEAN break and close above it might validate a bullish extension towards $123K,” he composed in a post on X.

Crypto financier and business owner Ted Pillows had comparable concepts.

“$ BTC appears to be in a short-term uptrend. 4 successive green everyday candle lights, which indicates somebody is regularly TWAPing Bitcoin here,” he informed X fans on the day.

” I’m still considering a $112,000-$ 114,000 zone, as a recover might press BTC above $118,000 truly quickly.”

Others waited in the wings, with the X analytics account called after popular economic expert Frank Fetter “viewing” for a break of $113,000.

Enjoying$BTC pic.twitter.com/8FOK6ntCxo

— Frank (@FrankAFetter) October 25, 2025

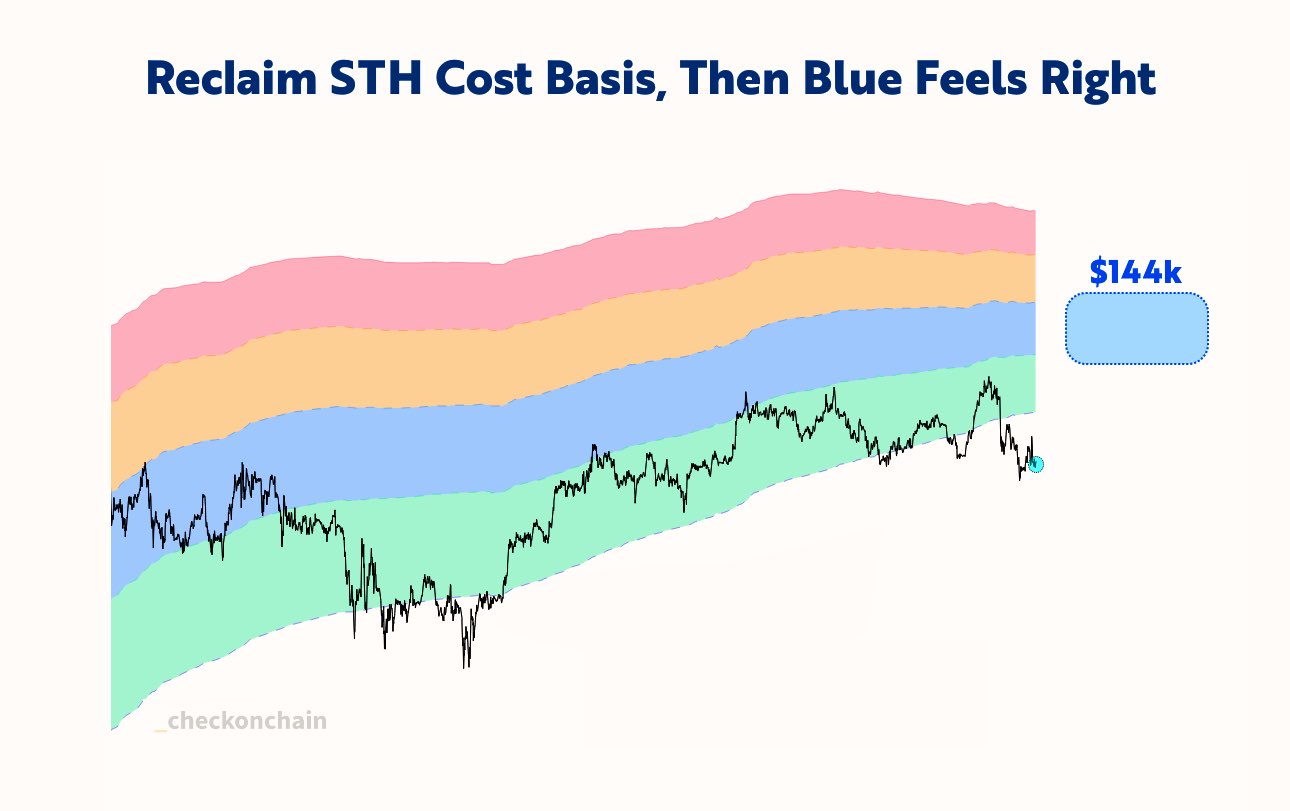

This, it included recently, represented the present aggregate expense basis for Bitcoin’s short-term holders– entities hodling for as much as 6 months.

” If BTC can recover the short-term holder expense basis at $113k, a relocation into the blue band of $130k– $144k feels right,” it stated.

Fed rate-cut chances enhance risk-asset play

Looking ahead, the coming week holds another essential occasion for crypto and risk-asset financiers.

Related: Worst Uptober ever? Bitcoin cost threats very first ‘red’ October in years

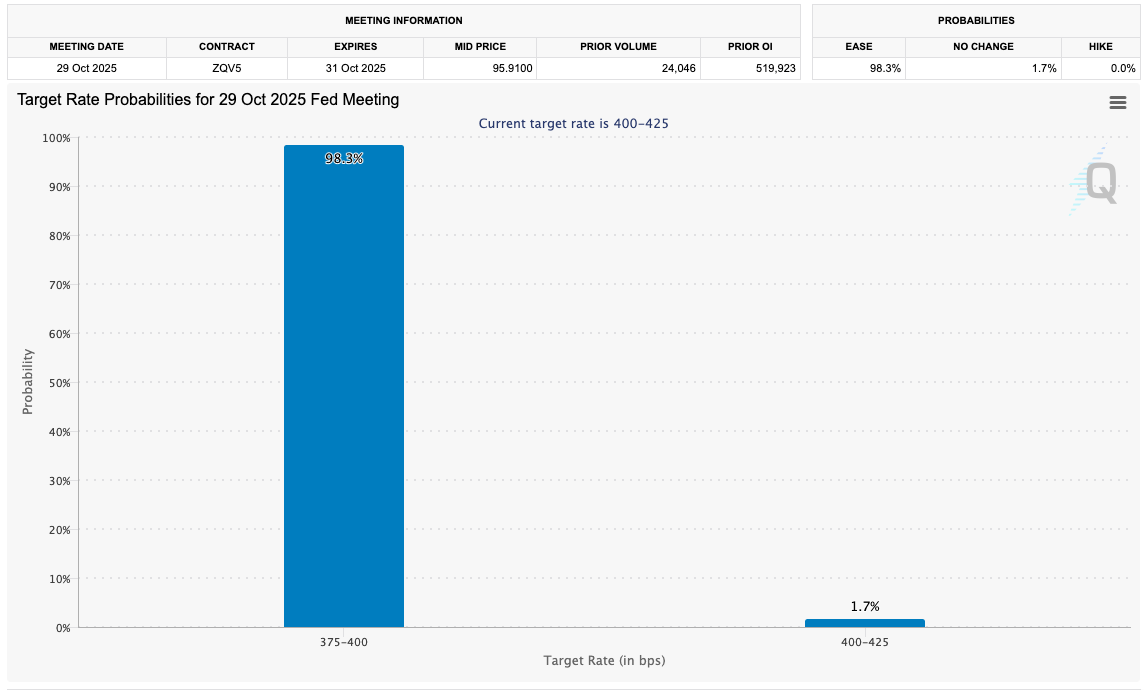

The United States Federal Reserve, fresh from cooler-than-expected inflation numbers, was anticipated to cut rate of interest by 0.25% at its Oct. 29 conference.

Information from CME Group’s FedWatch Tool put the chances of that result at more than 98% at the time of composing.

Commenting, trading resource The Kobeissi Letter put the Fed’s cuts in context as part of an around the world rates “pivot” by reserve banks.

” Up until now, 82% of world reserve banks have actually cut rates over the last 6 months, the greatest share given that 2020. This century, reserve banks have actually slashed rates at a rate just seen throughout economic downturns,” it composed on X.

” Worldwide financial easing remains in full speed.”

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.