Bottom line:

-

Bitcoin bulls can kiss bye-bye to the whole booming market if they lose $100,000 assistance, a brand-new projection anticipates.

-

BTC cost action deals with a fight of RSI signals as bullish and bearish divergences complete.

-

Some see a chance to purchase the dip simply above the $100,000 mark.

Bitcoin (BTC) will end its booming market if it loses $100,000 assistance, a brand-new caution states.

In his most current analysis on X, popular trader Roman forecasted that if six-figure BTC rates end up being a distant memory, the bull cycle will too.

Bitcoin bull run “formally” depends upon $100,000

Bitcoin has actually overthrown market belief once again with its most current dip, which at one point took BTC/USD down 15% versus all-time highs above $125,000.

BTC cost targets have actually changed in action, with Roman amongst those seeing a retest of levels closer to $100,000 and under.

If bulls stop working to hold that mentally essential location totally, nevertheless, the outlook will be far even worse.

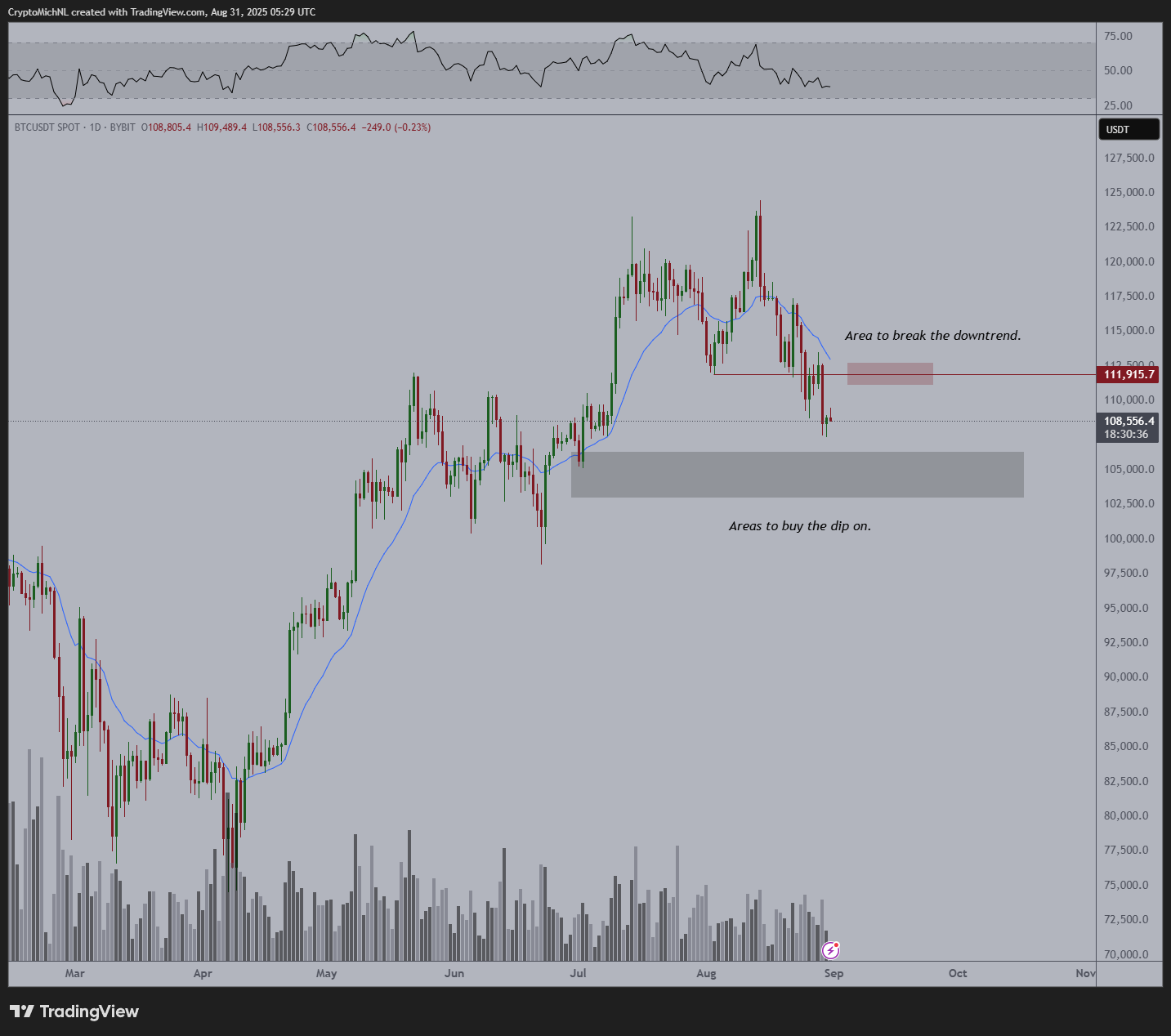

” Certainly looks unsightly as we have actually lost our uptrend and 112k assistance,” he summed up along with the everyday BTC/USDT chart.

” 98-100k is the level to enjoy. We lose that and * formally * verifies the bull run being over.”

Roman included that on high timeframes, Bitcoin is “still revealing great deals of fatigue,” describing previous posts from August and earlier.

These flagged phenomena consist of low trading volume at the highs and a bearish divergence on the relative strength index (RSI) indication.

As Cointelegraph reported today, four-hour timeframes are starting to reveal a brand-new bullish divergence on RSI– typically an advance notification of an uptrend returning.

Information from Cointelegraph Markets Pro and TradingView validated the bullish divergence still playing out at the time of composing Sunday.

RSI bullish divergences provide traders hope

Some market individuals stayed confident for a wider crypto market rebound based upon the existing structure.

Related: Will Bitcoin cost drop in September?

” If this level holds, a brand-new ATH in the next 4– 6 weeks is on the table,” fellow trader ZYN informed X fans in part of a post revealing a weekly RSI bullish divergence.

” That’s not hope. That’s structure.”

Others considered around $100,000 as a perfect entry zone instead of a hint to cut direct exposure.

” It’s rather clear that we’re, in the short-term, not in an uptrend on Bitcoin,” crypto trader, expert and business owner Michaël van de Poppe acknowledged on the day.

” I’m targeting the location around $102-104K for assistance. I still believe that this is the very best duration to collect your positions on.”

BTC/USD was down around 6.5% for August at the time of composing– still faring much better than the previous 4 years, information from CoinGlass revealed.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.