Bottom line:

-

Bitcoin bulls are hectic turning crucial levels back to support; can they split $118,000 next?

-

New all-time highs are on the horizon if the Fed response uptrend continues.

-

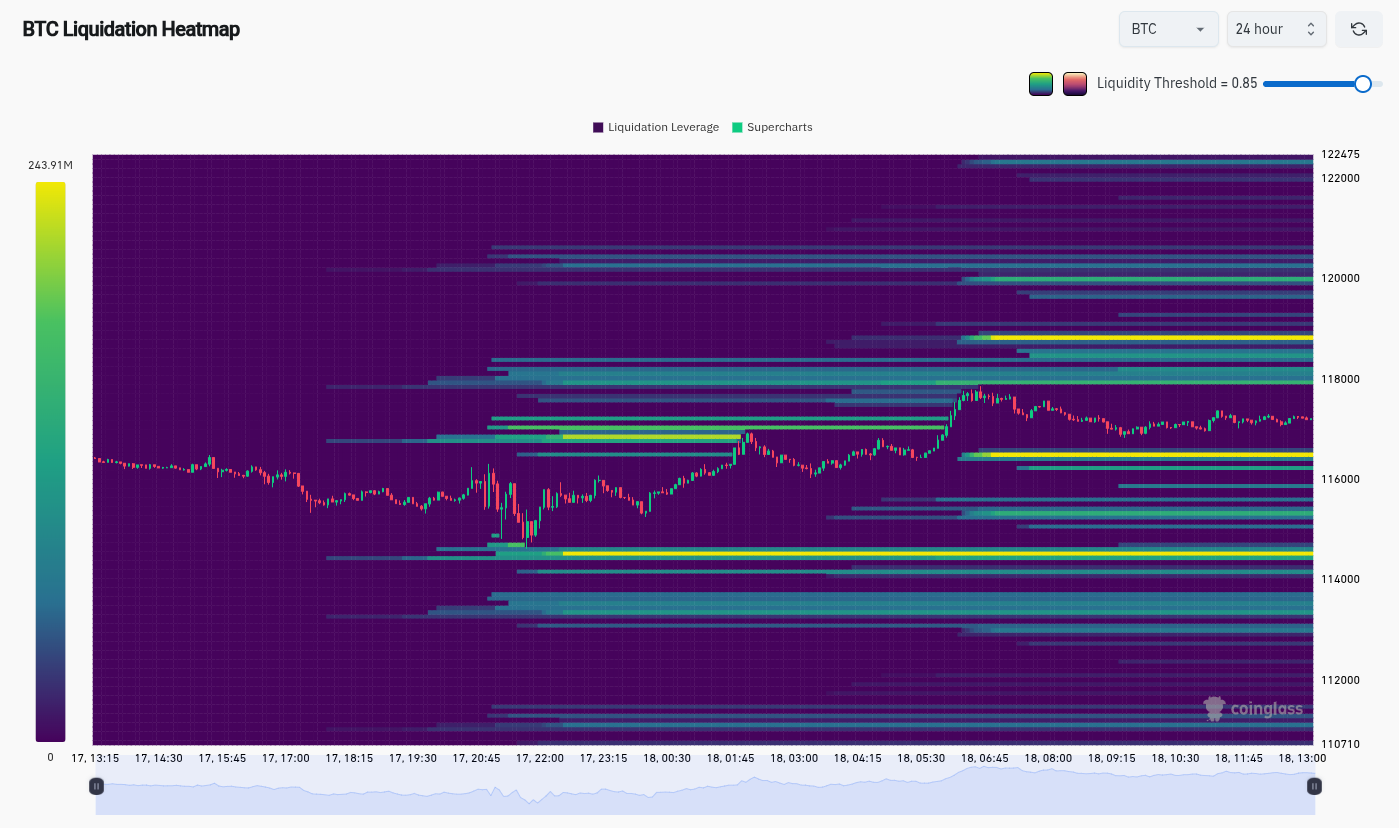

Exchange traders are currently generating big lines of liquidity on either side of rate.

Bitcoin (BTC) looked for to turn $117,000 to support on Thursday as the Federal Reserve interest-rate cut enhanced crypto markets.

Enjoy these Bitcoin rate levels next, state traders

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD acquiring approximately 1.3% after the everyday close.

Volatility struck as the United States Federal Reserve revealed its very first rate cut of 2025, can be found in at 0.25% to match market expectations.

After a quick dip listed below $115,000, Bitcoin rebounded, liquidating both long and brief positions to the tune of over $100 million over 24 hr.

$BTC upgrade:

FOMC Cost Action nailed

Boring Monday and Tuesday; Wednesday unstable with the timeless retrace of a preliminary incorrect relocation.

$ 105M liquidated in 30mins throughout FOMC, that’s what it is necessary to be familiar with this.

Definitely enjoy this market. Most likely $120k next. https://t.co/azE7Fg6J10 pic.twitter.com/x3EPCmIlOx

— CrypNuevo (@CrypNuevo) September 17, 2025

Amongst traders, hopes were high that bulls would seal assistance and advance to challenge all-time highs.

” The more vital part; will $BTC break through this essential resistance zone?” crypto trader, expert and business owner Michaël van de Poppe queried in a post on X.

An accompanying chart revealed the bulls’ next fight at $118,000.

” All I’m sure about is that, as soon as Bitcoin supports, we’ll begin to see huge breakouts on Altcoins happen,” he included.

Popular trader Daan Crypto Trades settled on the significance of the $118,000 mark. Throughout dovish remarks by Fed Chair Jerome Powell at the Jackson Hole seminar in August, that level formed a regional top as BTC rate action enhanced.

“$ BTC The $118K level is essential as it is the high volume node within this variety. Suggesting most volume traded at this rate level,” he kept in mind on X.

The post concluded that BTC/USD would “rapidly go to” all-time highs need to $118,000 turn to support.

Liquidity develops with BTC rate wedged

A take a look at exchange order-book information revealed thickening liquidity on either side of the area rate on Thursday.

Related: Bitcoin rate gains 8% as September 2025 on track for finest in 13 years

After the preliminary Fed shake-out, traders went back to set up “guardrails,” keeping rate pinned within the passage in between them.

Information from CoinGlass hence put $116,500 and $119,000 as the crucial levels to expect on the day.

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.