Open the Editor’s Digest free of charge

Roula Khalaf, Editor of the feet, chooses her preferred stories in this weekly newsletter.

Excellent early morning. The other day, Treasury secretary Scott Bessent and other United States authorities started another round of trade talks with their Chinese equivalents. On the table are semiconductors, unusual earths and magnets. Unhedged initially questioned that the Trump administration would work out with China– we were incorrect. However whether the settlements will be productive is another concern. Email us: unhedged@ft.com.

Metaplanet and Bitcoin

Why would you purchase a business that purchases bitcoin, instead of simply purchasing bitcoin itself? Some individuals, consisting of some individuals who compose this newsletter, would not purchase either. However let us presume that purchasing bitcoin is a great concept. Why do it through a business wrapper?

One apparent (if unfulfilling and slightly circular) response is that a few of the business that purchase bitcoin outperform bitcoin itself. Here is a chart comparing the efficiency of bitcoin, a leveraged bitcoin ETF, GameStop (which revealed it would begin purchasing bitcoin this spring) and Technique, the biggest business bitcoin purchaser:

Technique (previously MicroStrategy, back when it was a software application company) definitely controls here. However it is not the most remarkable example of this phenomenon. That honour goes to Metaplanet, a Japanese hotel designer that revealed on Monday that it would raise about $5.4 bn to purchase bitcoin– a possession it had been purchasing a much smaller sized scale for a year approximately:

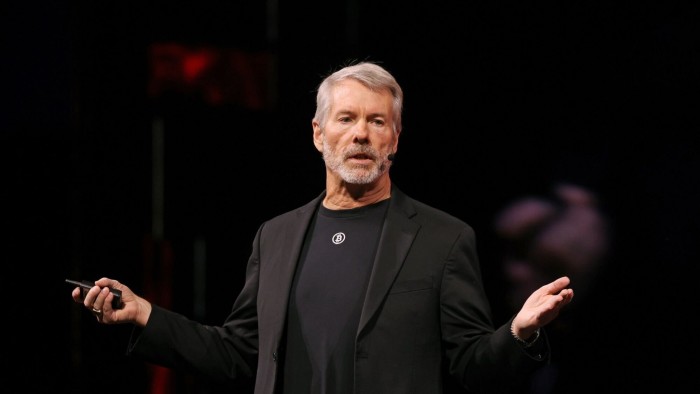

So where is the magic here? ETFs that own gold track the gold rate. ETFs that own bitcoin track the bitcoin rate. Why should a business that owns bitcoin do much better than bitcoin? Technique supplies a description of sorts. It presently trades at a 70 percent premium to its net property worth, which is comprised extremely of its bitcoin holdings. So when it offers equity and utilizes the earnings to purchase bitcoin, the deal is immediately accretive. The business can purchase more than a dollar of bitcoin by offering a dollar of equity. Here is Technique’s executive chair, Michael Saylor, speaking in April:

How do we produce gain? How do we produce investor worth? So if we were to offer $100mn of [our] equity at a numerous to net property worth of 2, then typically, what occurs is we record a. gain of half of that. The spread is 50 percent. We record $50mn of that as the gain. That is the accretive element to the existing typical stock investors.

Astute readers will have discovered that this is not a description of why Technique trades at a premium to NAV. It is a description of what Technique can do due to the fact that it trades at a premium to NAV. So the premium still requires describing. Saylor argues that the premium exists in part due to the fact that the stock is both really unstable and really liquid, that makes it appealing to investors who can offer at-the-market call alternatives versus it and produce a high yield. Now, most business do not think about remarkable volatility as a possession, however Saylor believes Technique’s volatility is unique:

You may get huge volatility either for a great factor or a bad factor. However the management group [in a high-volatility company] usually does not have trustworthiness and toughness. How are you going to keep it for a years? Therefore you see what we have actually done is we have actually produced a volatility engine. When you take volatility. if you’re clever, you make it a reactor and it ends up being a power plant.

Readers can make their own evaluation of this technique to business financing. However I will keep in mind that monetary techniques including selling volatility tend to work up until they do not.

Another sustainable source of bitcoin-holding business’ premium assessment is that they are an especially simple method to acquire bitcoin direct exposure. In the UK, for instance, getting bitcoin direct exposure can be fiddly. Purchasing bitcoin itself leaves you with the issue of keeping it. The restriction on purchasing bitcoin-linked exchange traded notes was only simply raised; purchasing United States bitcoin ETF shares, for both retail and institutional financiers, includes frustrating documents. Purchasing Technique shares is simple. And a comparable pattern might hold, to higher or lower degrees, in numerous other jurisdictions.

Undoubtedly, David Bailey, a Metaplanet board member, just recently informed my associate Philip Stafford that “Michael Saylor originated something with one insight: if you wish to offer somebody bitcoin you need to satisfy the purchaser where they are.” He went on: “The liquidity’s there all over, internationally, however it’s caught. We’re product packaging bitcoin into numerous kinds to satisfy them where they are.”

If that’s right, there is a paradox here. If the bitcoin-owning business are eventually offering bitcoin liquidity, their business will just include worth so long as the bitcoin market stays ineffective and troublesome. If Bitcoin, as we are guaranteed, ends up being a universal and useful option to fiat currency, and even simply an easily traded shop of worth like gold, the business’ premiums to NAV ought to vanish.

China and United States solar

We just recently discussed the outlook for United States solar business under the Trump administration. China, nevertheless, is the world centre for the solar market– in specific photovoltaic panel production. And China’s domestic solar market is substantial; 2 months back, China’s solar and wind energy capability surpassed nonrenewable fuel sources for the very first time, according to the nation’s energy regulator.

However that does not indicate that Chinese photovoltaic panel manufacturers are great financial investments. Over the previous 6 months, First Solar– the greatest western photovoltaic panel producer– has actually exceeded a lot of its Chinese rivals:

The Chinese solar market is completely competitive. Photovoltaic panel are now basically products. Margins are slim and unstable. Just recently, leading Chinese producers have actually struggled. JinkoSolar published a loss in its very first quarter; Trina Solar reported a huge loss for all of financial 2024. First Solar’s revenues last quarter were not especially strong, however it earned money.

Cheng Wang at Morningstar discusses:

While international oversupply has actually rendered numerous solar markets unprofitable, the United States market stays extremely rewarding due to trade barriers that limit supply. Because the majority of United States solar companies are locally focused, they continue to produce healthy revenues. This might discuss the assessment distinction.

Joe Osha of Guggenheim keeps in mind that United States has actually had solar import controls for a while. “The rate divergence [between the US and elsewhere] is remarkable; in the United States [panels cost] more than two times what they cost in other markets.” According to Osha, the possibility of even greater tariffs on China in fact provides a chance for Very first Solar and other United States manufacturers.

Solar devices tariffs are questionable. They may make good sense if having a domestic photovoltaic panel market is a genuine nationwide security top priority, or if the Chinese federal government is participated in predatory disposing. However the rate Americans pay is more costly solar energy. Having the tariffs in location might or might not deserve it. Domestic solar manufacturers earnings in any case.

( Reiter)

One great read

Cash versus power.