Bitcoin (BTC) can strike $105,000 within weeks as a timeless leading sign remains bullish, states the current market analysis.

Bottom line:

-

Bitcoin is delighting in bullish RSI signals on several timeframes as cost action combines.

-

A weekly RSI breakout took place in December and continues to hold.

-

Issues about BTC cost strength stay as traders still see brand-new lows to come.

RSI uses $105,000 BTC cost target

In an X post on Thursday, trader BitBull kept in mind a continuous breakout on Bitcoin’s weekly relative strength index (RSI).

While BTC cost action remains rangebound, a crucial RSI pattern shift has in reality currently remained in play given that December.

A sag on the sign, which determines how “overbought” or “oversold” BTC/USD is at a provided level, started in September, with cost breaking through it before the 2025 annual candle light close.

“$ BTC weekly RSI is requiring more upside here. Broke out of its 3-month drop and holding above the breakout line,” BitBull commented.

An accompanying chart compared the current breakout with one from earlier in 2015, which led to a number of months of BTC cost gains after April’s regional lows of $75,000.

” I believe BTC might strike $103K-$ 105K in 3-4 weeks,” he included.

Today, James Easton, host of crypto trading podcast DeCRYPTion, had great news about RSI on the two-week chart.

The sign, he kept in mind, is now at lower levels than throughout the pit of Bitcoin’s last complete bearishness in late 2022.

” It has likewise simply turned bullish. Strap in,” he informed X fans.

On lower timeframes, RSI signals likewise appear motivating, per information from TradingView.

The four-hour chart revealed a possible concealed bullish divergence, where lower lows for RSI contrast with greater lows for cost itself.

This has the ramification of compromising sell-side pressure as Bitcoin tries to seal $90,000 as an assistance zone.

” Clear United States purchaser” fights Bitcoin offer pressure

As Cointelegraph reported, traders still anticipate lower levels to become the marketplace tries to discover a long-lasting assistance base.

Related: Bitcoin ‘not most likely’ to make brand-new all-time high in 2026, brand-new research study states

Amongst the more bearish takes is a require the cost to review its April lows around $75,000. A journey listed below the 2026 annual open is likewise on the cards.

If we can not fill the resistance to support quickly on $BTC I believe a sweep of these lows follows pic.twitter.com/nHpBzdtF00

— Johnny (@CryptoGodJohn) January 9, 2026

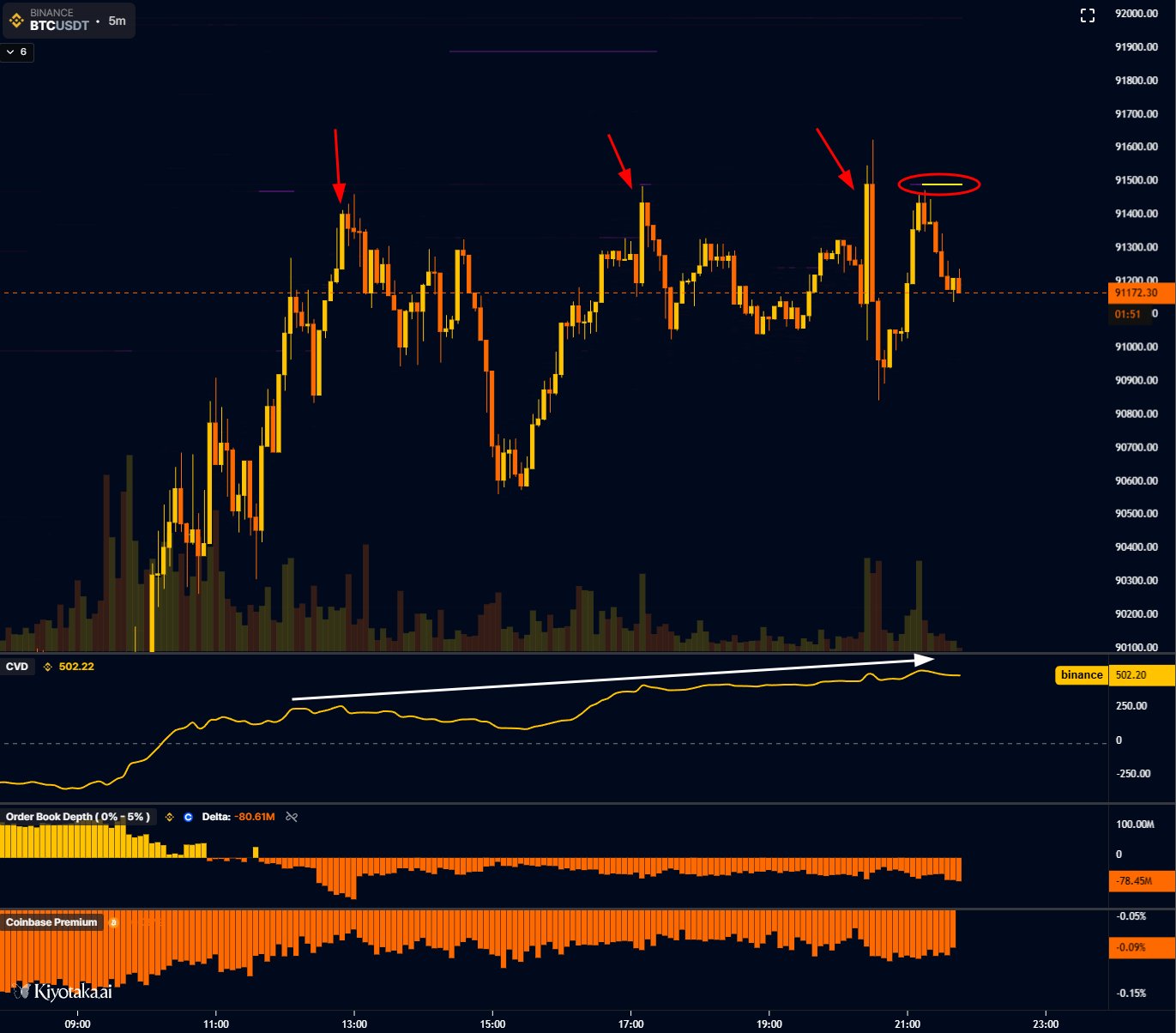

Evaluating exchange order-book habits on the day, trader Alter flagged a passive seller active at $91,500, keeping cost reduced.

” They’re pricing estimate around 60 – 100 BTC each time so not actually that substantial however it likely informs me the buy pressure throughout United States session was associated with a clear United States purchaser,” he concluded.

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we make every effort to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this post. This post might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage emerging from your dependence on this details.