Bitcoin (BTC) deals with “unmatched” United States dollar connection as brand-new BTC cost research study provides a $75,000 flooring.

In among his most current analyses on April 18, network financial expert Timothy Peterson computed that BTC/USD might increase as high as $138,000 within the next 3 months.

BTC cost possibilities provide bulls the advantage

Bitcoin is browsing extremely uncommon macroeconomic conditions as an outcome of the continuous United States trade war, however history still provides hints regarding where BTC cost action might head next.

For Peterson, the United States High Yield Index Reliable Yield, presently at over 8%, holds the secret.

” This has actually taken place 38 times given that 2010 (regular monthly information),” he summed up.

” 3 months later on: Bitcoin was up 71% of the time. The typical gain was +31%. If it went lower, the worst loss was -16%.”

With BTC/USD efficiency hence manipulated to the benefit, Peterson promised to those awaiting a rematch of all-time highs from January.

” This most likely puts Bitcoin in between $75k and $138k within 90 days,” he concluded.

Bitcoin would require to provide 62% gains within that duration to accomplish that optimum level.

As Cointelegraph reported, Peterson has actually been a regular factor to BTC cost projections in 2025, with among his proprietary tools, Lowest Cost Forward, providing 95% chances of a $69,000 flooring in March.

Bitcoin DXY connection will turn unfavorable

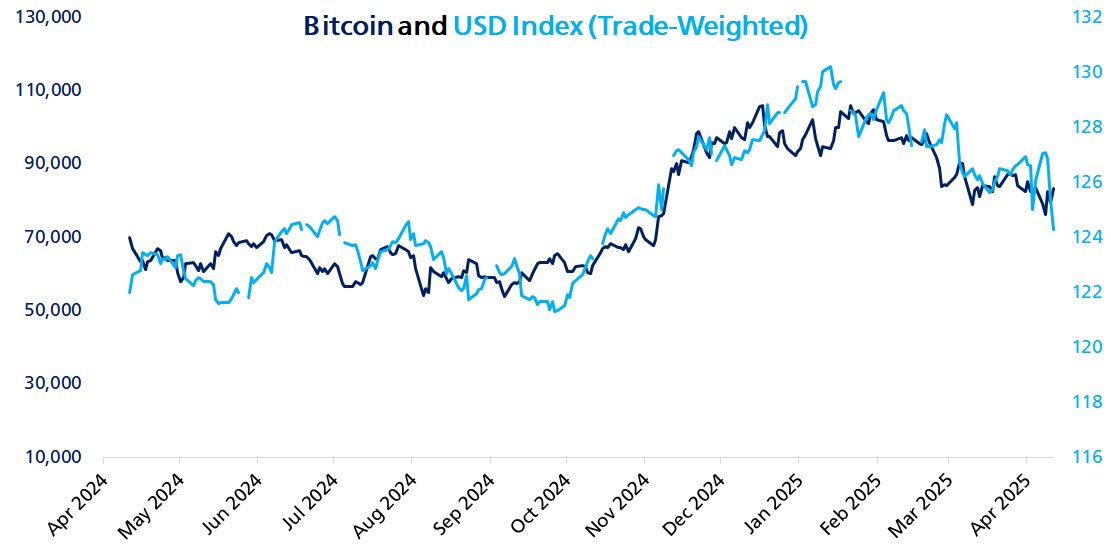

Turning his attention to the significant drop in the United States dollar index (DXY) thanks to United States trade tariffs, he anticipated that its uncommon favorable connection with BTC would eventually end.

Related: Bitcoin cost volatility ‘impending’ as speculators move 170K BTC– CryptoQuant

” This level of BTC-USD connection is unmatched. The relationship is not causal, however reflective of underlying conditions impacting both,” he discussed.

” Historically inverted, the relationship turned in 2024 as both properties started reacting to the exact same macro stress factors: tightening up liquidity, high genuine rates, and worldwide threat hostility. BTC will decouple and increase when genuine yields drop + liquidity returns.”

DXY continued to remain listed below the essential 100 mark on April 18, per information from Cointelegraph Markets Pro and TradingView, showing a few of its most affordable levels in the previous 3 years.

Previously, different analysis however saw the capacity for Bitcoin to straight gain from dollar weak point in a way comparable to the early innings of the bull run in 2023.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.