Bottom line:

-

Bitcoin traders’ capability to conquer rate resistance at $116,000 might depend upon Wednesday’s Fed choice on rates of interest and today’s US-China trade top.

-

Pro traders are dispersing into BTC rate rallies while retail-sized financiers are purchasing the dips in area, and likewise being liquidated in futures.

Bitcoin (BTC) rate continues to reveal strength, increasing 13% considering that its historical liquidation-driven sell-off on Oct. 10, however technical charts show that everyday closes above $116,000 are required to secure the bullish pattern turnaround.

Information from TRDR reveals sellers topping the most current intra-day breakouts above $116,000, and order book information at Binance and Coinbase exchanges highlight another wall of asks at $116,000 (Coinbase area) and $117,000 to $118,000 (Binance perps).

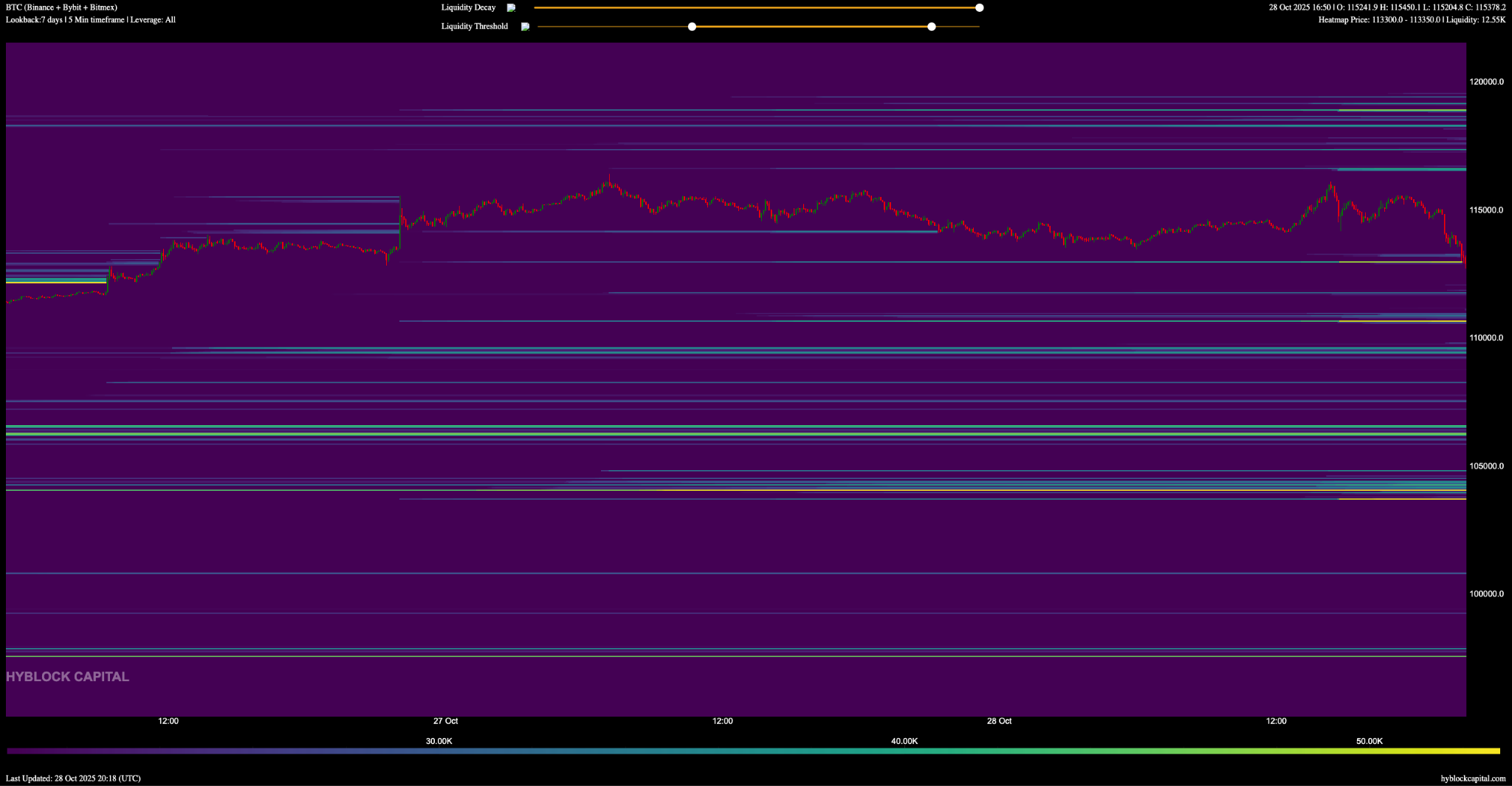

As displayed in the order book chart in the lower left-hand side, futures traders pulled their asks at $115,000 to $116,000 as the opportunity for a work on the resistance increased, and brief liquidations topped $49.83 million in the previous 12 hours.

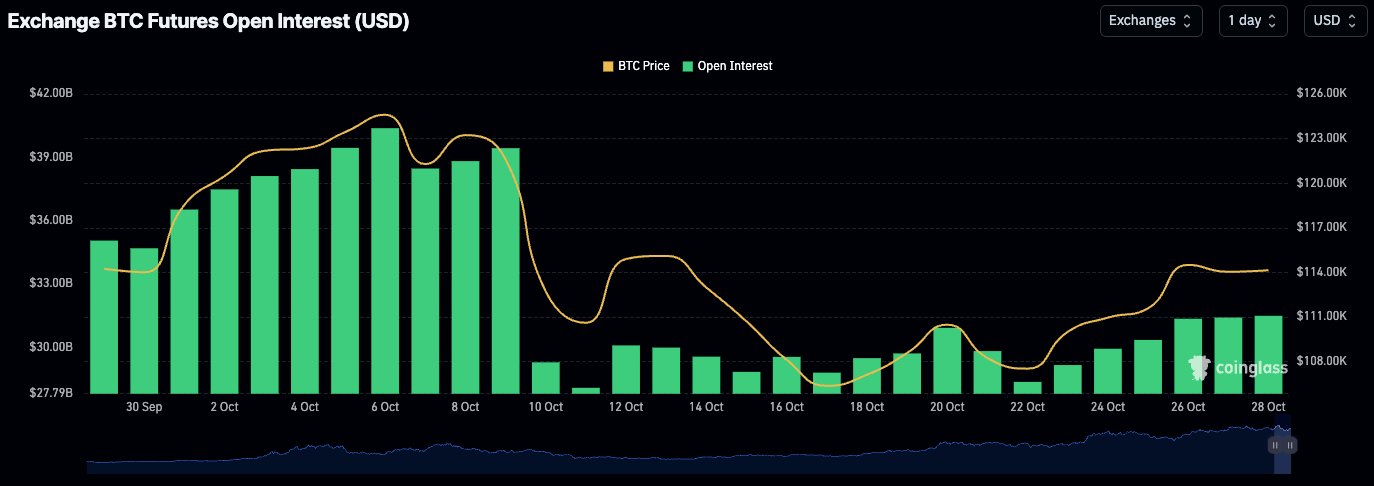

While bulls are having a hard time to press BTC over $116,000, a couple of positives shine through the information. International exchange open interest has actually recuperated to $31.48 billion from its Oct. 11 low of $28.11 billion, however it is still rather a range from the $40.39 billion seen when Bitcoin traded for $124,600.

Area Bitcoin ETF inflows are likewise on the growth, with $260.23 million in net circulations over the last 3 trading sessions, and a noteworthy $477 million inflow on Oct. 21, which was a couple of days after BTC rate fell listed below $108,000.

Information from Hyblock reveals bigger order-size financiers (1 million to 10 million) continuing to offer the rips as retail financiers (smaller sized order-size, 1,000 to 10,000) have actually purchased the dips.

Presently, Hyblock’s aggregate orderbook bid-ask ratio (set to 10% depth) reveals an ask-heavy orderbook, while the real retail longs and shorts accounts metric programs brief placing increasing at Binance.

From an intra-day trading perspective, some financiers might be lowering danger direct exposure ahead of Wednesday’s FOMC, where the United States Federal Reserve will reveal its choice on rates of interest.

While the Fed is anticipated to cut its benchmark rate by 25 basis points, traders changing their placing ahead of the statement have actually ended up being a routine event in the crypto market.

Related: Bitcoin rate taps $116K as analysis weighs chances of CME space fill

Activity in the futures markets maybe reveals some traders preparing for perps running the risk of off and the taking place drop in long liquidity, or on the other hand, the boost in shorts released as a chance to set off liquidations on the disadvantage.

Such a result can be seen in the chart below, where a cluster of leveraged longs at $112,000 to $113,000 is presently being liquidated.

While Wednesday’s FOMC is anticipated to create a bullish result, an overarching danger occasion is President Trump’s Thursday conference with Chinese President Xi Jinping. If talks break down for some factor, or the marketplace does not view the resulting trade offer to be beneficial to the United States and worldwide markets, unfavorable reverberations might be felt throughout equities and crypto.

Till today’s FOMC and US-China trade offer is solved, it promises that Bitcoin rate will continue to bounce in between resistance at $116,000 and assistance at $110,000.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.