Secret takeaways:

-

Bitcoin dropped listed below $100,000 and might retest its annual open at $93,500 as its momentum damages.

-

The Coinbase Premium struck a seven-month low, showing strong United States area Bitcoin selling pressure.

-

Short-term holders are collecting BTC, while long-lasting holders continue taking earnings.

Bitcoin’s (BTC) current weak point extended into Friday’s trading session, with BTC as soon as again slipping listed below the $100,000 mark. The cryptocurrency might possibly retest its previous low of $98,200, a level formed on June 23.

On Nov. 6, the Bitcoin Coinbase Premium Index, a metric that tracks the distinction in between Bitcoin’s cost on Coinbase and other international exchanges like Binance, dropped to its least expensive level given that April 11.

The premium turning unfavorable indicated that Bitcoin is trading at a discount rate on Coinbase, frequently showing more powerful selling pressure from US-based financiers and ETF-related outflows. Historically, extended durations of unfavorable premiums have actually accompanied short-term cost weak point.

Nevertheless, Crypto trader Daan Trades kept in mind that such stages are not uncommon throughout more comprehensive drops. The expert described that the discount rate tends to emerge when the marketplace deals with focused area selling from Coinbase-linked circulations. While not a bullish check in itself, Daan included,

” The marketplace hardly ever bottoms in your area without very first seeing such a discount rate.”

Simply put, a continual cost healing following this discount rate might signify that the marketplace is soaking up sell pressure, possibly marking the early phases of build-up.

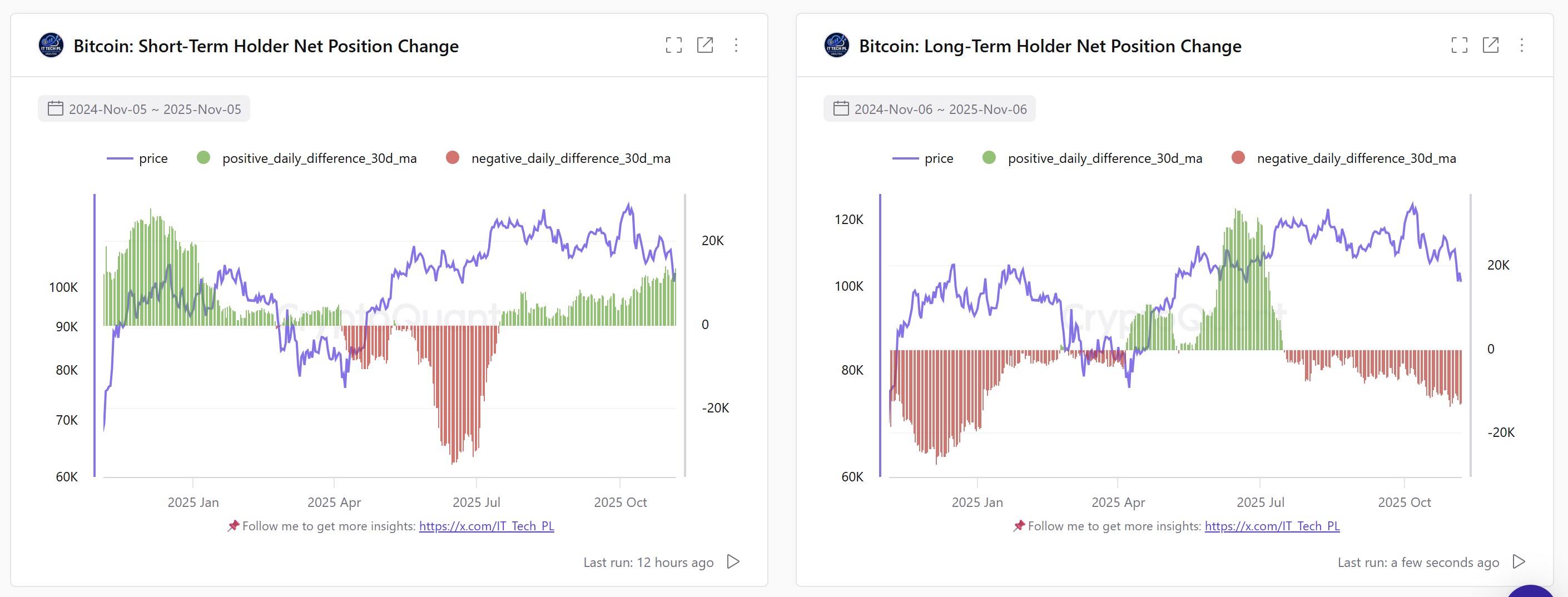

Onchain information even more supported this blended setup. The short-term holder (STH) net position modification just recently rose to an annual high, recommending that traders who generally hold coins for less than 155 days are contributing to their positions regardless of the pullback.

On the other hand, the long-lasting holder (LTH) net position modification approaches annual lows, showing continuous profit-taking from experienced financiers. This divergence suggests that while brand-new purchasers are actioning in, the absorption isn’t yet strong enough to develop a conclusive bottom variety.

Related: Why this essential Bitcoin cost trendline at $100K is back in focus

Bitcoin might evaluate the annual open before healing

From a technical viewpoint, Bitcoin’s short-term charts, both the one-hour and four-hour timeframes, reveal no indications of a bullish turnaround setup. The current uptick in cost was mostly driven by shorts covering, not authentic purchasing pressure. Nevertheless, over the previous couple of hours, BTC open interest has actually progressively increased while financing rates stayed raised, indicating that traders might be opening brand-new long positions.

Yet, unless BTC recovers the $104,000 level as firm assistance, a much deeper pullback towards $95,000 may happen, and possibly the annual open near $93,500, in the coming week. Such a relocation might eliminate staying longs before setting the phase for a possible rebound led by brief liquidations.

Related: $100B in old Bitcoin moved, raising ‘OG’ versus ‘trader’ dispute

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.