Bottom line:

-

Bitcoin cost action whipsaws around a cooler-than-expected CPI print.

-

Optimism on danger possessions increases, with the Federal Reserve seen continuing interest-rate cuts through 2026.

-

BTC discovers resistance at $112,000, as essential assistance recover levels emerge.

Bitcoin (BTC) saw fresh volatility Friday as United States inflation information sent out stocks to brand-new all-time highs.

CPI relief fuels brand-new highs for United States stocks

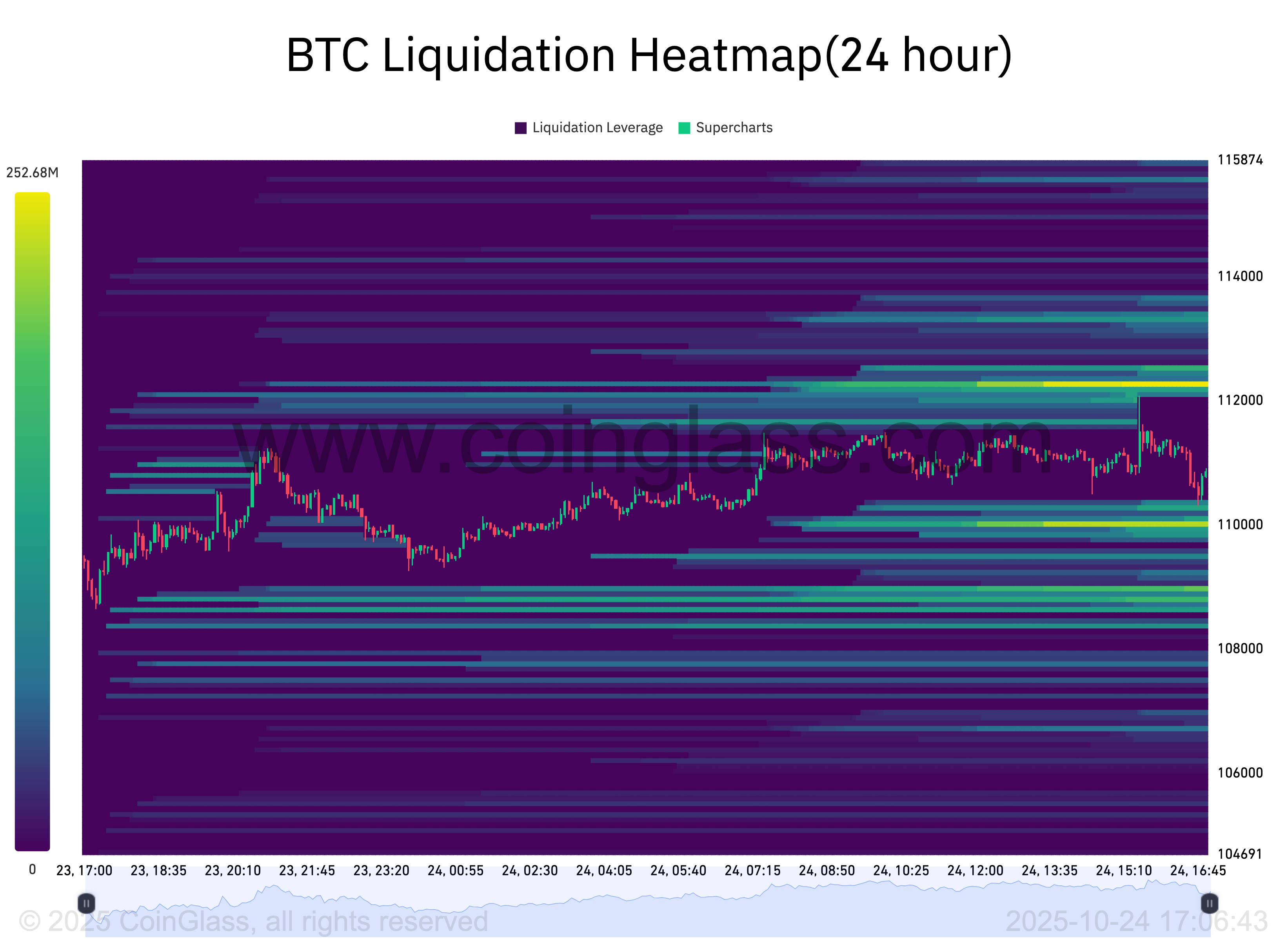

Information from Cointelegraph Markets Pro and TradingView revealed BTC cost gains tapping $112,000 before reversing at the Wall Street open.

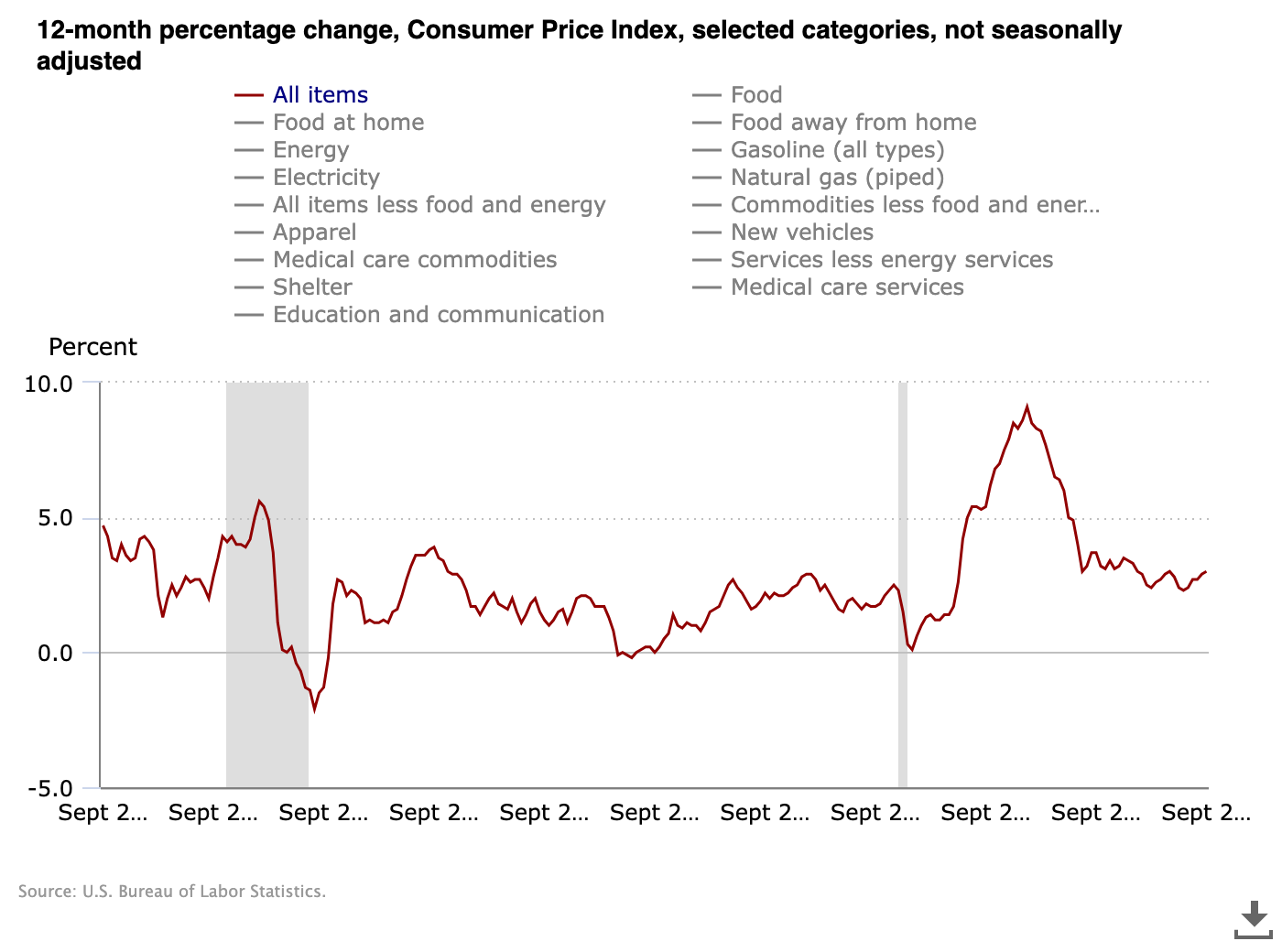

The September print of the Customer Rate Index (CPI) was available in listed below expectations throughout the board– an essential tailwind for crypto and danger possessions.

Both the CPI and core CPI were 0.1% listed below their expected levels, circling around 3%, according to a main release from the United States Bureau of Labor Data (BLS).

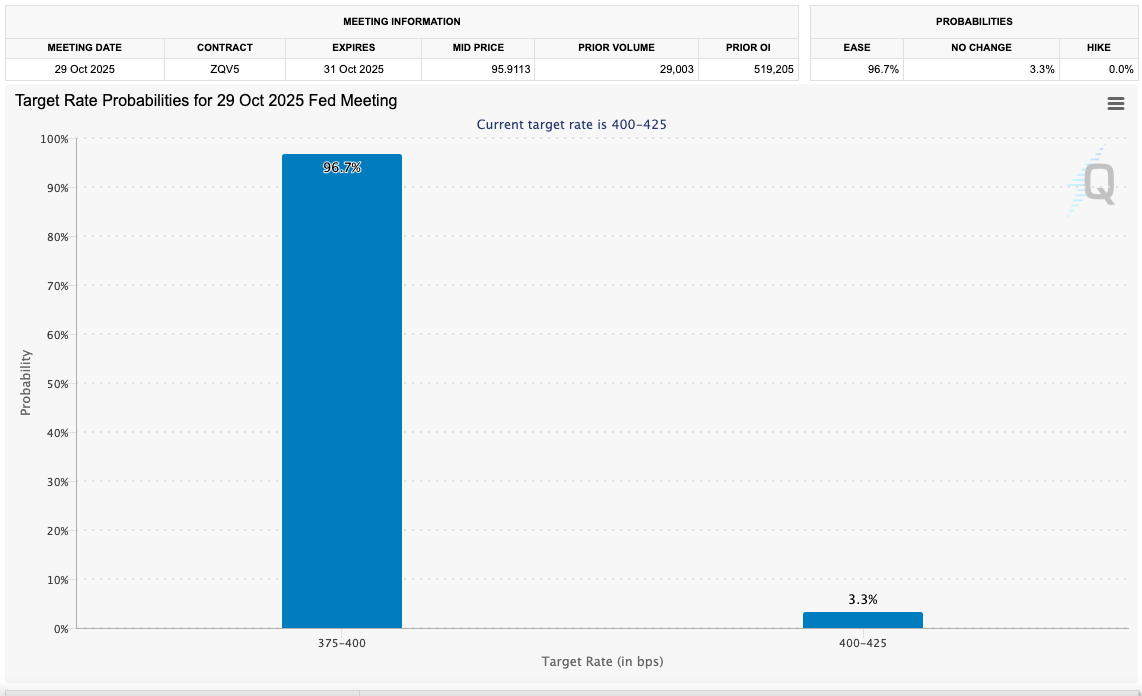

Responding to the news, The Kobeissi Letter, a trading resource, stated that the figure “paves the course for another Fed rate cut next week.”

” This report was released as a ‘unusual exception’ throughout the United States federal government closed down,” it kept in mind, as the S&P 500 rose to fresh record levels.

CME Group’s FedWatch Tool, which tracks market chances of interest-rate relocations by the Federal Reserve, extremely preferred a 0.25% decrease on Oct. 29.

” Monetary conditions stay loose total and are getting another increase as the Federal Reserve is anticipated to cut rates of interest at its 2 staying conferences this year,” trading resource Mosaic Property Business composed in its most current analysis.

” That need to be helpful for the economy and business incomes background, which is required to drive the rally into next year.”

BTC cost has a hard time regardless of CPI relief

Bitcoin still needed to compete with sell-side pressure at the United States market open on the day.

Related: Worst Uptober ever? Bitcoin cost threats very first ‘red’ October in years

Traders stayed on edge, with X analyst Exitpump cautioning that little assistance remained in location listed below the area cost.

$BTC Thin quote side on perps orderbook btw, can discard rapidly pic.twitter.com/udWTGVJuqS

— exitpump (@exitpumpBTC) October 24, 2025

Trader Diego White explained exchange order-book liquidity conditions as “heavy,” as information from CoinGlass revealed cost approaching a brand-new ladder of quotes around $110,000.

Caleb Franzen, developer of monetary research study resource Cubic Analytics, flagged 3 rapid moving averages (EMAs) that were now important to recover as assistance.

“$ BTC is rebounding on the 200-day EMA, up until now. Today it requires to break & & close above the 21/55, which worked as resistance throughout the retest previously today,” he informed X fans.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.