The United States Federal Reserve revealed its 3rd rates of interest cut of the year on Wednesday, raising United States equities while Bitcoin (BTC) slipped before recuperating.

That dynamic has actually specified the 2nd half of 2025. Even as capital streams into Bitcoin are progressively connected to standard equity financiers, the cryptocurrency has actually continued to diverge from the stock exchange.

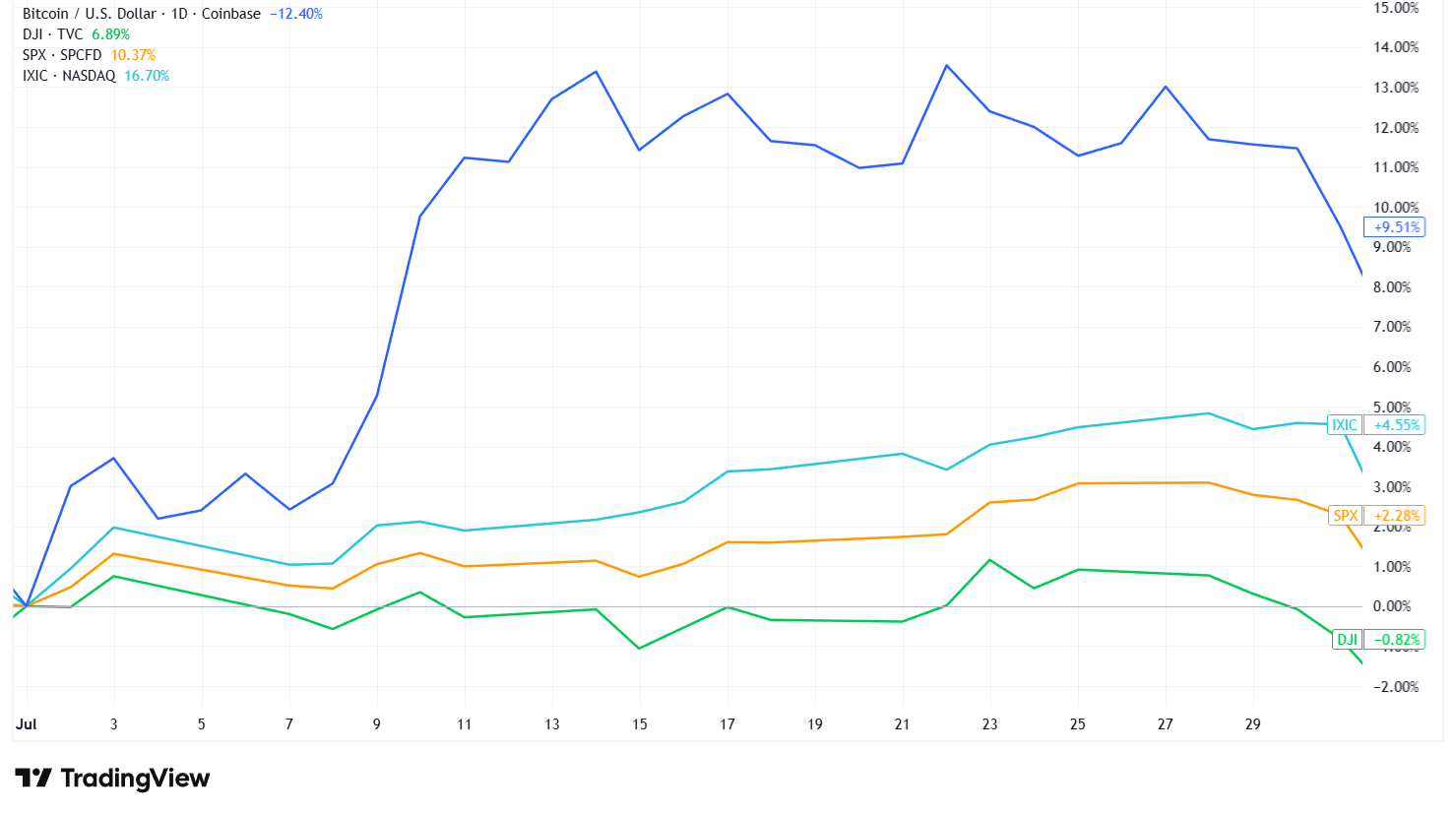

Over the previous 6 months, Bitcoin has actually fallen practically 18%. On the other hand, the 3 significant United States stock indexes published strong and constant gains, with the Nasdaq Composite up 21%, the S&P 500 increasing 14.35% and the Dow Jones Industrial Average climbing up 12.11%.

Bitcoin has actually still tape-recorded noteworthy turning points this year, consisting of setting brand-new all-time highs and preventing the normal “red September” for the 3rd year in a row.

Here’s how Bitcoin’s divergence from stocks has actually expanded through the 2nd half of the year.

July: GENIUS Act raises crypto

July 2025 was specified by strong equity efficiency and a durable danger cravings that continued in spite of substantial tariff statements.

Early-July trade rhetoric triggered quick turbulence, however markets rapidly moved their focus back to business revenues and underlying development principles.

Related: DATs bring crypto’s expert trading issue to TradFi: Shane Molidor

On July 9, AI chip giant Nvidia ended up being the very first business to reach a $4-trillion appraisal. On the exact same day, equities brushed off trade-related shocks as the S&P 500 and Nasdaq published fresh record highs even after the United States revealed 50% tariffs on copper.

Bitcoin ended July up 8.13%, marking its greatest regular monthly efficiency in the 2nd half of the year to date, consisting of December. Crypto markets enhanced after United States President Donald Trump signed the GENIUS Act into law, injecting fresh optimism into the sector, especially for stablecoin-related services.

Business adoption likewise stayed a crucial style, with business continuing to include Bitcoin to their balance sheets as part of digital property treasury techniques. By July, interest in other significant cryptocurrencies, consisting of Ether (ETH) and Solana (SOL), likewise started to get.

August: Powell’s speech powers Ether’s ATH

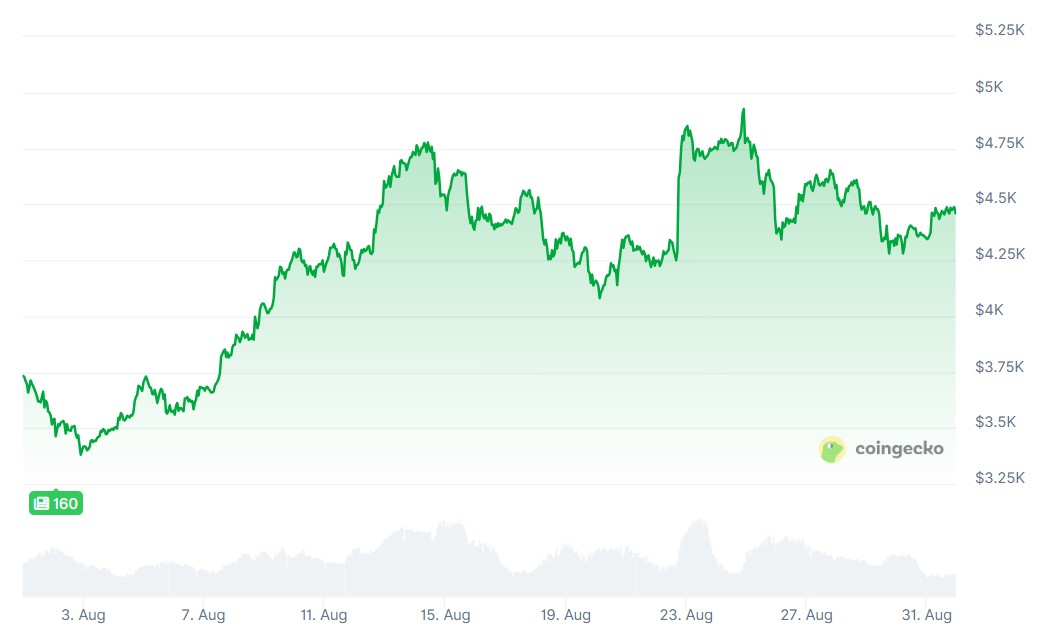

August was driven by increasing expectations that the Federal Reserve would quickly cut rate of interest. Those hopes sustained a broad rally throughout standard markets, while crypto moved even quicker. Bitcoin rose to a brand-new all-time high of around $124,000 on Aug. 14 as the United States dollar deteriorated in the middle of increasing trade stress.

The Jackson Hole Economic Seminar then brought markets’ attention back to financial policy. On Aug. 22, Fed Chair Jerome Powell provided a dovish signal, recommending that rate cuts were still possible later on in the year, pressing Ether to a brand-new all-time high.

Equities reacted favorably, however Bitcoin stopped working to sustain its momentum. The property saw a sharp however quick uptick right away after Powell’s speech before resuming its decrease. By month’s end, Bitcoin’s post-ATH correction had actually plainly diverged from standard markets. Bitcoin closed August down 6.49%.

September: First rate cut of 2025

September has actually traditionally been Bitcoin’s weakest month. In addition to June, it is among just 2 months that publishes an unfavorable typical regular monthly return, making it the label “red September.”

In 2025, nevertheless, Bitcoin defied that pattern, taping its 3rd successive favorable September. The gain came as the Fed provided its very first rate cut of the year, a 25-basis-point decrease validated by indications of a cooling labor market. Bitcoin ended the month up 5.16%.

Related: Bitcoin set to beat ‘red September’ dip for 3rd straight year

Equities likewise reacted favorably, extending their third-quarter rally as market value in the possibility of extra financial alleviating in October.

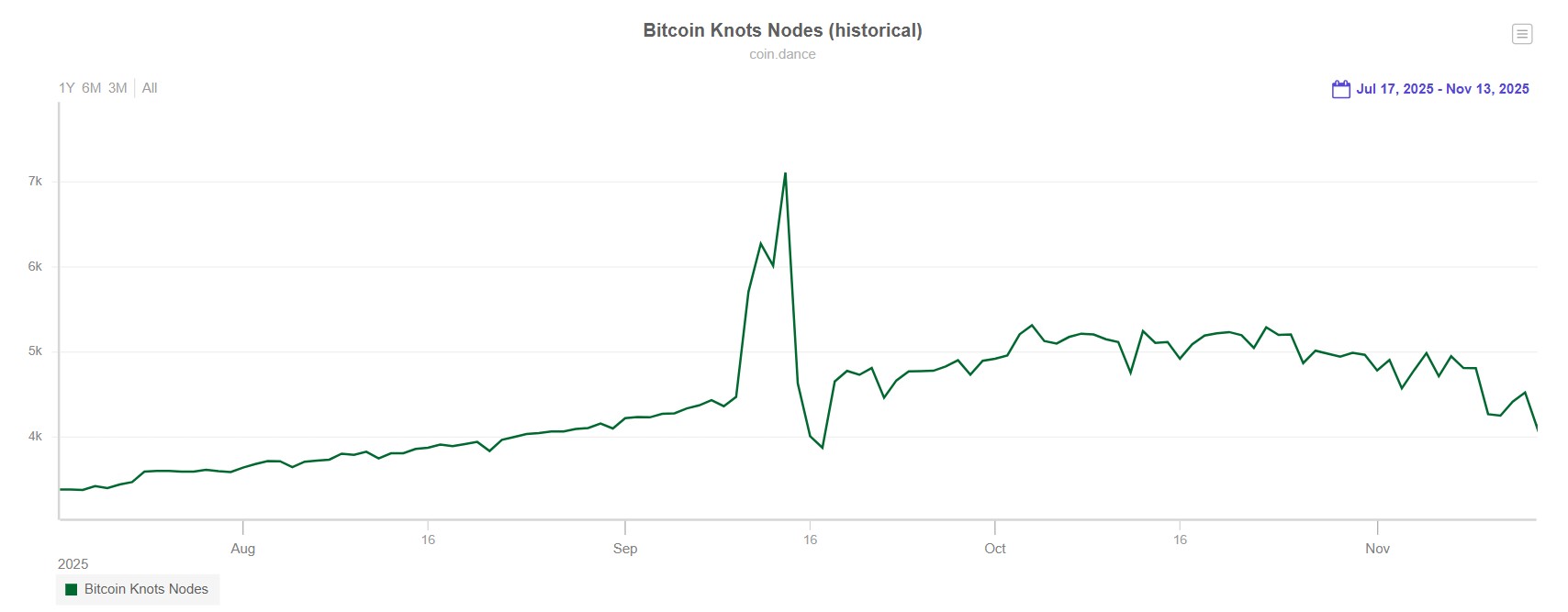

Bitcoin, nevertheless, dealt with a brand-new internal obstacle. The neighborhood ended up being divided over a significant network upgrade that would eliminate limitations on just how much approximate information can be embedded on the blockchain.

Bitcoin Core, the software application execution most extensively utilized by miners and node operators, supported raising the limitation. Those who see non-financial information on Bitcoin as spam pressed back versus the modification, adding to increased adoption of Bitcoin Knots as an alternative execution.

October: Trump threatens 100% tariffs on China

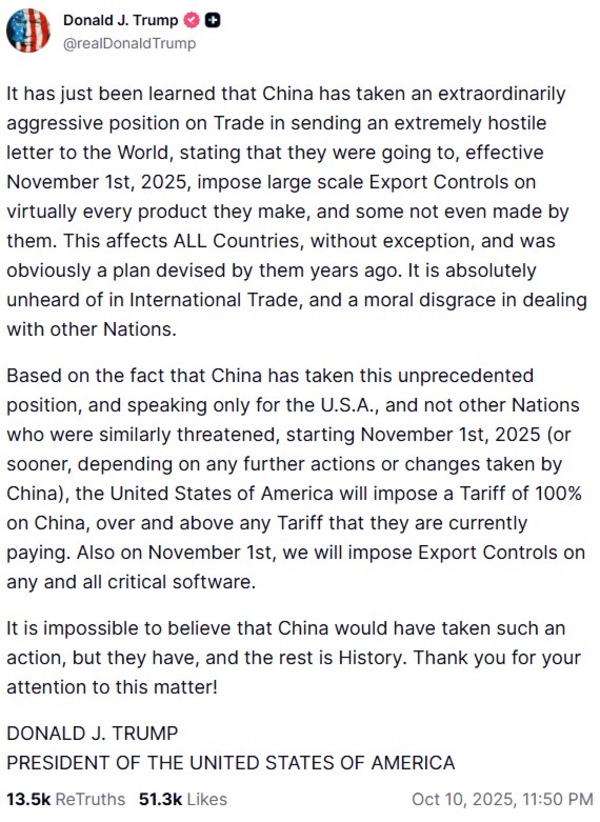

Bitcoin struck another all-time high up on Oct. 6, however the month was eventually specified by the biggest liquidation occasion in Bitcoin’s history, with approximately $19 billion in positions erased.

Numerous elements were recognized as factors to the liquidation waterfall that sent out Bitcoin plunging listed below $110,000. These consisted of a rate problem on Binance and the market’s heavy dependence on futures-based trading, which enhanced required liquidations as rates fell.

The instant driver, nevertheless, was a social networks post by President Trump threatening 100% tariffs on Chinese imports. The remark activated a sharp sell-off throughout both crypto and equity markets.

Although October is typically described as Uptober in the crypto neighborhood due to its traditionally strong efficiency, 2025 showed to be an exception. Bitcoin snapped a five-year streak of favorable Octobers and ended the month down 3.69% even as significant stock indexes recuperated from the trade-related shock.

By the end of the month, the Fed provided its 2nd successive rate cut, decreasing the federal funds rate by another 25 basis points. On the other hand, the United States federal government stayed shut throughout October, extending what ended up being the longest federal government shutdown in history.

November: End of the United States federal government shutdown

October might bring the label Uptober, however November has actually traditionally been Bitcoin’s greatest month, publishing a typical gain of 41.12%– more than double October’s typical return of about 20%.

In 2025, November showed to be Bitcoin’s worst-performing month of the year, with the property falling 17.67%. Offering pressure magnified throughout the month, pressing Bitcoin listed below the $100,000 mark by mid-November.

The divergence from equities was noticable. Stock exchange traded mostly sideways as the United States federal government shutdown pertained to an end. Financiers stayed mindful in the middle of issues over a possible AI-driven bubble. A few of those worries were alleviated later on in the month after Nvidia reported record revenues for the 3rd quarter, assisting support belief throughout innovation stocks.

Bitcoin’s year-end target slashed

Up until now, Bitcoin is up about 2% in December, with significant equity indexes likewise publishing moderate gains. Bitcoin’s typical December return presently stands at 4.54% at the time of composing.

While the holiday has actually been reasonably peaceful for Bitcoin over the last few years, history recommends the crypto market does not always decrease throughout the celebrations.

In December 2020, for instance, Bitcoin rose almost 47%, even as market-shaking news emerged from the United States Securities and Exchange Commission: the launch of a years-long suit versus Ripple Labs and its executives.

This year, much of the optimism surrounding Bitcoin’s prospective year-end rally has actually faded. Numerous market watchers have actually reduced their cost targets for the cryptocurrency, consisting of Requirement Chartered.

The bank had actually formerly anticipated a year-end cost of $200,000 for Bitcoin, however on Monday, it modified that target to $100,000. Requirement Chartered has actually likewise postponed its longer-term projection for Bitcoin reaching $500,000, pressing the target from 2028 to 2030.

Publication: Huge concerns: Would Bitcoin endure a 10-year power failure?