Bitcoin (BTC) dropped listed below $86,000 on Monday, continuing to broaden on a liquidity imbalance as smaller sized individuals continued to purchase dips. Nevertheless, big holders are utilizing the need to leave positions, keeping disadvantage pressure strongly in location.

Secret takeaways:

-

Retail and mid-sized Bitcoin wallets acquired $474 million in cumulative buy-side volume, while whales offered $2.78 billion throughout the very same duration.

-

Short-term BTC holders continued to cost a loss, an indication of capitulation, however a turnaround has actually not been verified.

-

Bitcoin might re-test quarterly lows at $80,600 after revoking its short-term bull pattern.

Whales control the sell-side as retail bets on a bottom

Order circulation information from Hyblock Capital highlighted a sharp divergence in habits throughout individual classes. Retail traders or wallets ($ 0–$ 10,000) have actually collected a cumulative volume delta of $169 million, regularly bidding into the sag. Mid-sized individuals ($ 1,000–$ 100,000) likewise constructed a $305 million net area position as they tried to front-run a healing.

Nevertheless, whale wallets ($ 100,000–$ 10 million) stay the dominant force, with an unfavorable $2.78 billion in cumulative volume delta. The integrated purchasing power of retail and mid-sized traders is inadequate to take in institutional-scale circulation.

This leads to a liquidity inequality where smaller sized gamers analyze sub-$ 100,000 rates as a discount rate, while big holders deal with the very same zone as a chance to lower direct exposure.

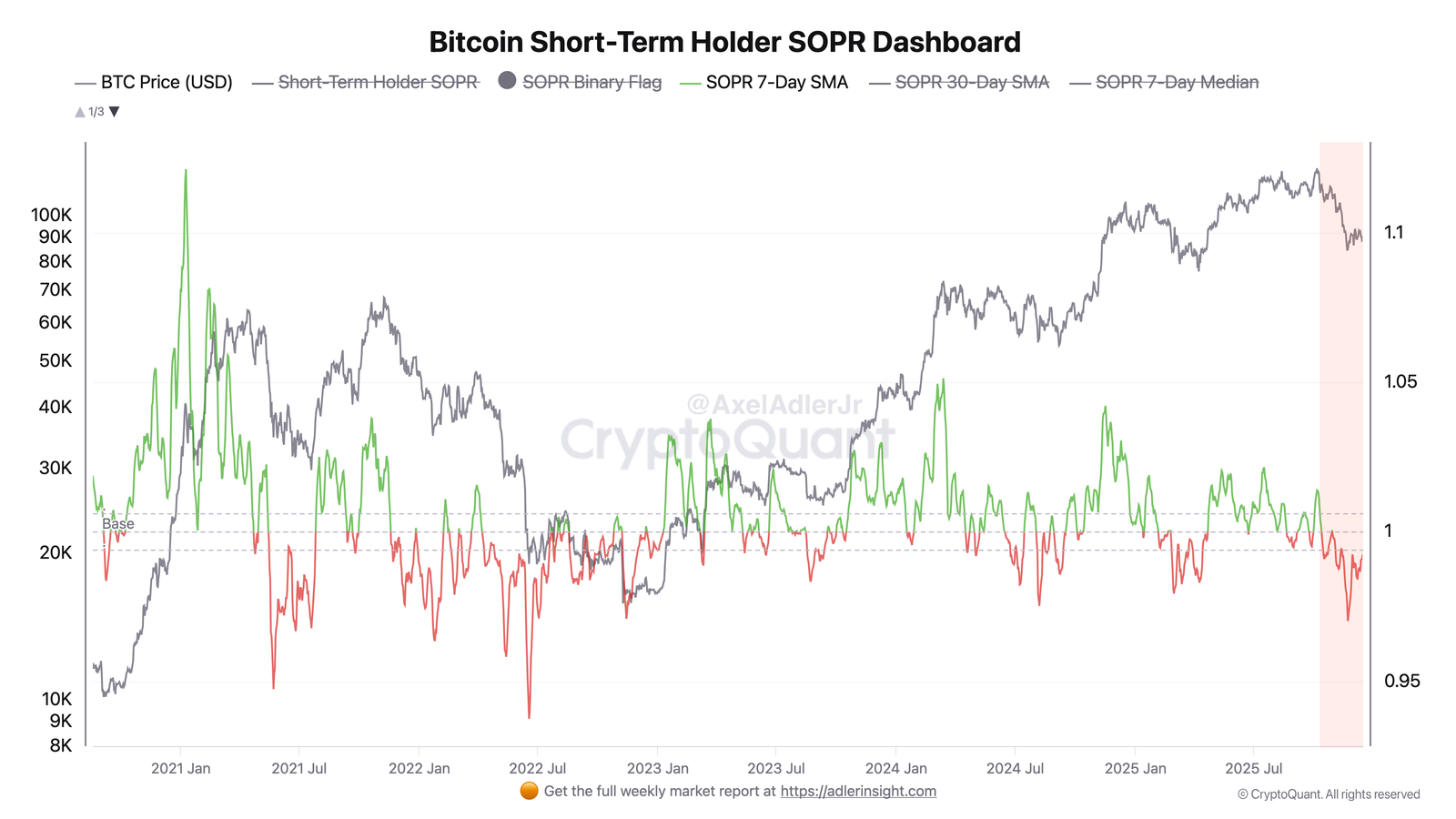

On the other hand, onchain expert Axel Adler Jr indicated the short-term holder invested output profit-ratio (seven-day SMA) slipping listed below 1, presently hovering near 0.99. This showed that coins held for less than 155 days are, usually, being cost a loss.

Historically, such conditions have actually lined up with regional capitulation stages, when offering pressure peaks. Nevertheless, Adler stressed that tension alone is not a turnaround signal. A continual healing can start after SOPR recovers and holds above 1, validating that need has actually begun to take in supply.

Related: Bitcoin sees ‘pure control’ as United States sell-off liquidates $200M in an hour

Bitcoin open up to review lower liquidity targets

From a technical perspective, Bitcoin’s structure has actually deteriorated even more. BTC’s rate has actually broken down from an increasing wedge pattern, sweeping the month-to-month VWAP (volume-weighted typical rate) before printing a bearish break of structure (BOS) listed below $87,600.

With the short-term bullish pattern revoked, BTC now deals with disadvantage targets near previous liquidity swimming pools or external liquidity.

The instant targets stay the $83,800 swing low, with a much deeper retracement towards the $80,600 quarterly lows possible if sell pressure continues. In the meantime, both order circulation and onchain signals recommend that perseverance is needed before stating a resilient bottom.

Related: Bitcoin parabola breakdown raises possibility for 80% correction: Veteran trader

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we aim to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might include positive declarations that go through threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this info.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we aim to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might include positive declarations that go through threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this info.