Bottom line:

-

Bitcoin diverges from stocks and gold to see everyday losses of 2% to begin the week.

-

Analysis hopes that the upcoming Federal Reserve interest-rate choice will supply a BTC cost increase.

-

Concealed bullish divergences reinforce the case for BTC cost gains.

Bitcoin (BTC) had a hard time at $115,000 into Monday’s Wall Street open as analysis saw more BTC cost disadvantage.

BTC cost sees “traditional” disadvantage into FOMC

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD dropping as much as 2% versus the day’s highs.

Bitcoin diverged from both gold and United States stocks, with the S&P 500 and Nasdaq Composite Index both acquiring at the open. Gold cost passed $3,655, now under $20 from all-time highs.

Commenting, crypto trader, expert and business owner Michaël van de Poppe connected BTC cost weak point to the week’s crucial macroeconomic occasion.

Bitcoin, he argued, typically trades down into United States Federal Reserve interest-rate choices.

” Really traditional cost action prior to the FOMC conference,” he composed in part of a post on X.

” Most likely we’ll continue to remedy on $BTC & & Altcoins up until the FOMC conference has actually passed.”

Van de Poppe described the Federal Free Market Committee, or FOMC, tipped by markets to provide a 0.25% rate cut on Wednesday.

While some crypto market individuals revealed discouragement at Bitcoin’s failure to sign up with threat properties in rallying at the start of the week, others considered bullish chart hints.

Looks bullish … for Nasdaq pic.twitter.com/IsLUKXz8J8

— WhalePanda (@WhalePanda) September 15, 2025

Amongst these was a covert bullish divergence for the relative strength index (RSI) on weekly timeframes.

” Bitcoin weekly covert bullish divergence is now validated,” popular trader BitBull reported.

” Considering that 2023, every bullish or covert bullish divergence has actually played out for $BTC and led to huge gains.”

Fellow trader Merlijn argued that the RSI divergence suggested that the macro image was “shrieking extension” greater, calling BTC cost benefit “inescapable.”

Bitcoin belief neutral as stocks climb up “wall of concern”

One resemblance in between Bitcoin and stocks was available in the type of market belief as the week started.

Related: BTC ‘prices in’ what’s coming: 5 things to understand in Bitcoin today

Regardless Of the S&P 500 reaching brand-new highs and Bitcoin being not far listed below cost discovery, belief was “leaning bearish.”

” If anything, numerous procedures of belief reveals that worry is the dominating feeling,” trading company Mosaic Property Business composed in the most recent edition of its routine newsletter, “The marketplace Mosaic.”

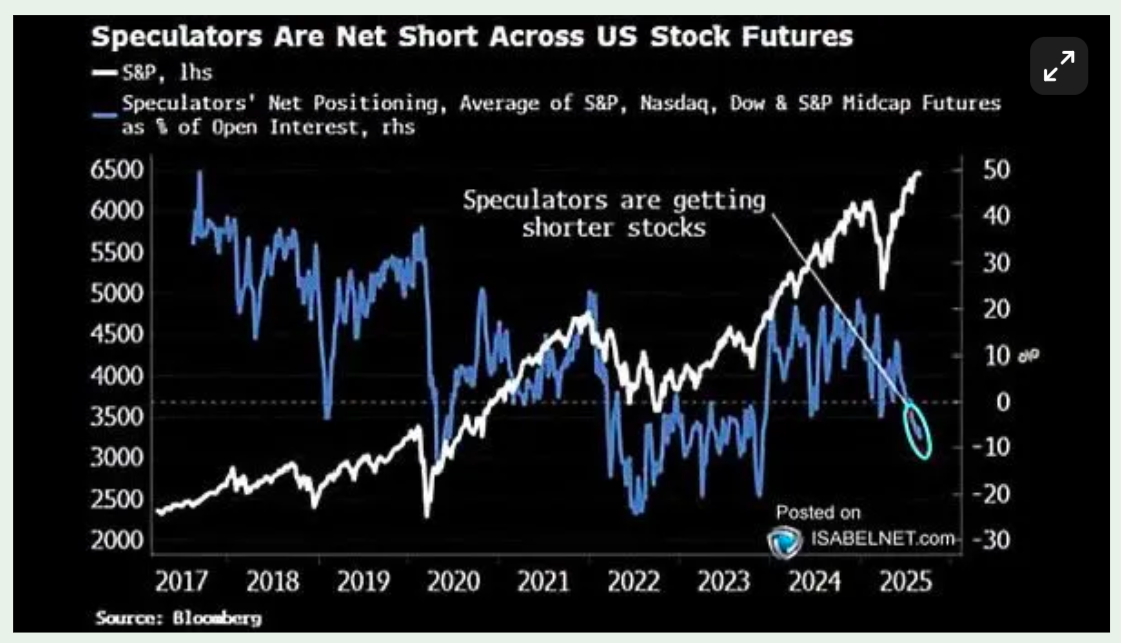

Mosaic observed that big financiers were net brief throughout numerous stocks futures, “where placing in the group is viewed as a contrarian signal.”

” Numerous procedures of belief are a tailwind for stock costs as the marketplace climbs up a wall of concern,” it included.

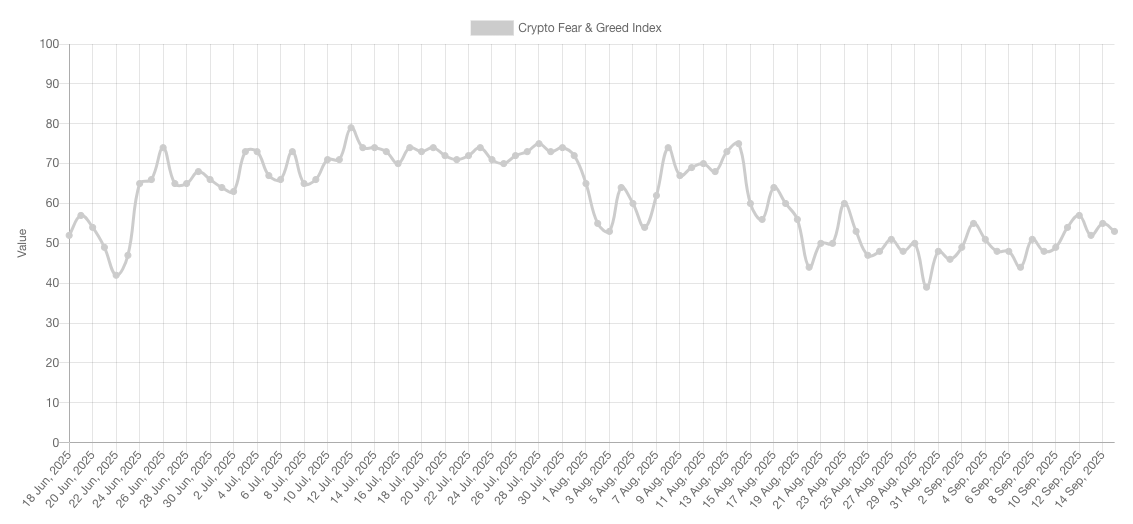

The Crypto Worry & & Greed Index stayed in neutral area at 53/100 on the day, far from overheated levels above 95 which typically accompany cost action near all-time highs.

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.