On Friday, the Japanese federal government authorized a $135-billion (21.3 trillion Japanese yen) stimulus bundle, primarily targeted at cost relief and supporting gas and home electrical power expenses.

Prime Minister Sanae Takaichi and her cabinet think the strategy will moisten inflation by 0.7 portion points usually from February to April. However markets, consisting of crypto markets, are worried.

The yen has actually considerably compromised versus the United States dollar, striking 10-month lows; Japanese federal government 10-year bond yields reached 1.84% on Thursday, the greatest level given that the 2008 monetary crisis. Significant federal government costs like this stimulus bundle is most likely to cause the issuance of more bonds, even more damaging the yen, which would trigger the Bank of Japan to step in with rate walkings. That might activate mass sell-offs in the United States.

It might take place quickly. Financing Minister Satsuki Katayama stated on Friday, “We are alarmed by current one-sided, sharp relocations in the currency market.” In tandem, Bank of Japan guv Kazuo Ueda stated that the bank will talk about the “expediency and timing” of a rate trek in subsequent conferences.

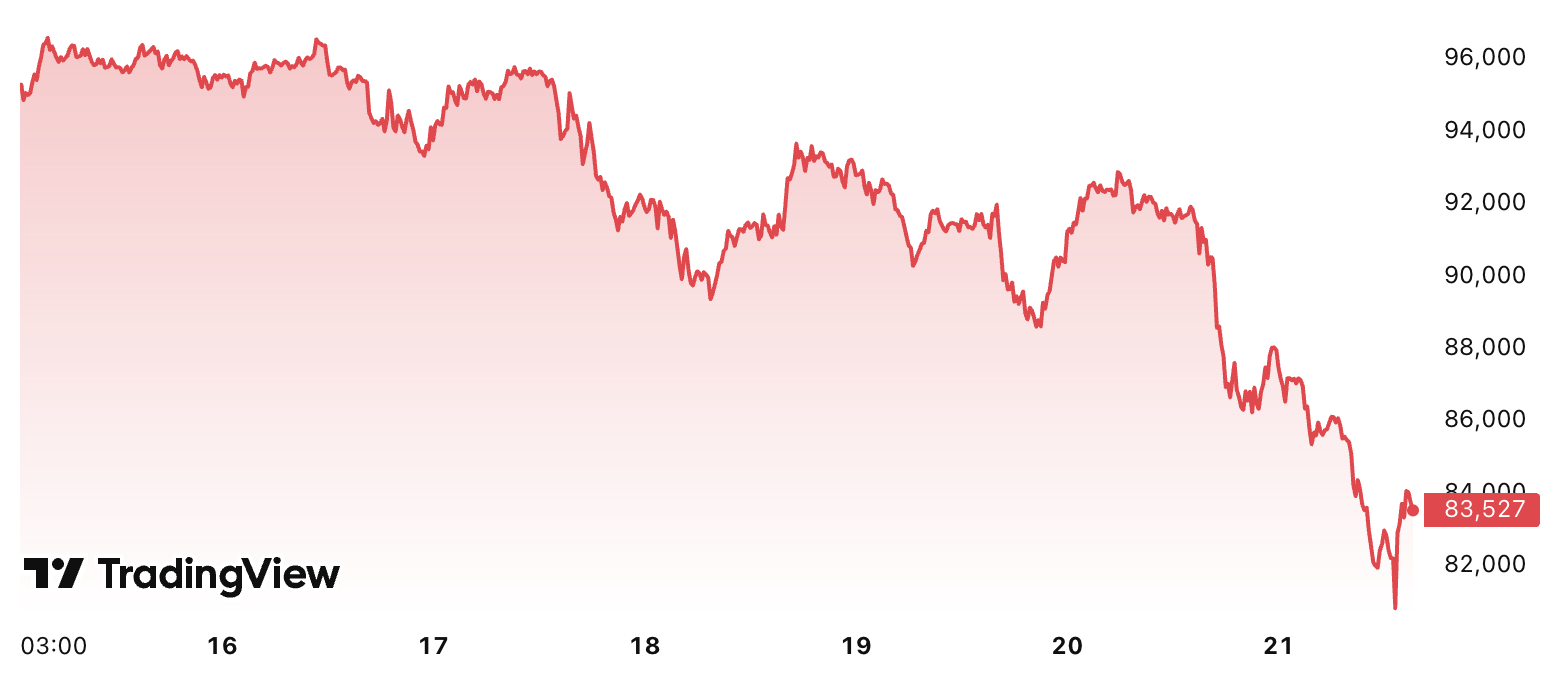

Bitcoin (BTC) has actually continued to drop in the middle of this news. Historically, a weakened yen has actually worked as a successful sanctuary for Bitcoin traders. They might obtain yen at low-interest rates, transform it into United States dollars and buy high-yield possessions. Nevertheless, Japan’s record financial obligation levels and a prospective rate walking have actually triggered traders to reevaluate the yen’s stability.

PubKey opens in Washington, DC

It hasn’t all been doom and gloom for Bitcoin today. Market hopes increased on Thursday when Bitcoin-themed bar PubKey opened its doors in Washington, DC for the very first time.

A surprise look by pro-crypto Treasury Secretary Scott Bessent made the rounds on X. Some saw it as a bullish indication: “Having the Secretary of the Treasury at the Pubkey DC launch looks like a minute I might quickly review and state ‘wow, it was all so apparent’,” treasury business Strive’s Ben Werkman stated in an X post.

PubKey very first released in New york city City in late 2022. The principle is basic: Integrate a regional watering hole with a love for crypto. It’s seen significant success, especially after United States President Donald Trump made a look throughout his 2024 project run. He purchased 50 hamburgers and 50 Diet plan Cokes– and spent for them with Bitcoin on the Lightning Network.

His look brought PubKey onto the nationwide phase. “We had individuals taking a trip from the tri-state location entering PubKey,” owner Thomas Pacchia just recently informed Cointelegraph Publication. “After that, some individuals took a trip throughout the United States or perhaps internationally.”

The bar does not back a political celebration. However PubKey’s growth to the country’s political center is no error. “Bitcoin definitely should have an embassy in Washington, DC,” he stated.

Related: Organizations lean into crypto regardless of Bitcoin cost depression

Canada authorizes spending plan advancing stablecoin policy

Up north, Canadian Prime Minister Mark Carney has actually had his 2025 spending plan authorized by parliament. Stashed in the file’s 600-page depths is an area describing the governance of stablecoins.

Under the spending plan, stablecoin providers will require to hold enough reserves, set clear redemption policies and carry out robust threat management structures. Managed by the Bank of Canada, $10 million will be assigned over a two-year duration to guarantee smooth operations.

It’s a leap forward for the Canadian stablecoin market. Though the expense is designed on the United States’ GENIUS Act, there are some distinctions. For instance, Canada’s expense does not prohibit unlicensed providing. Rather, it curbs this issue by needing registration. Anybody can end up being an authorized stablecoin provider with the Bank of Canada– if they leap through the correct hoops.

Related: Canada’s spending plan assures laws to manage stablecoins, following United States lead

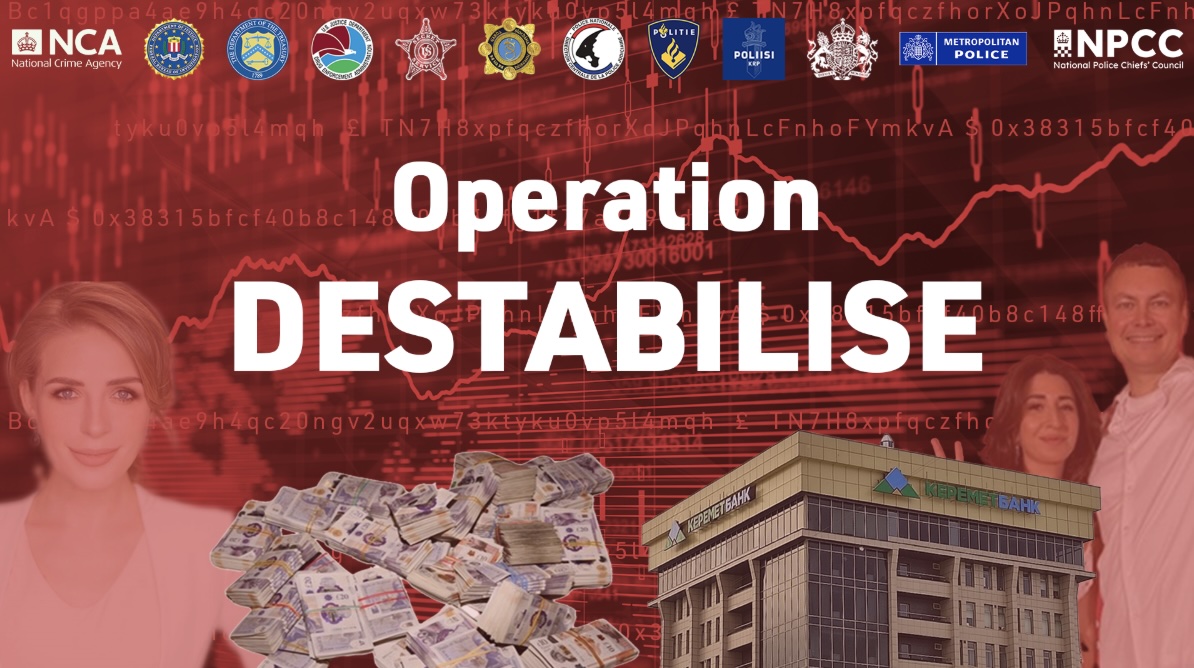

UK’s NCA determines billion-dollar crypto laundering ring

There is a little bank in Bishkek, the capital of Kyrgyzstan, that might appear like any other. Keremet Bank uses home loans and loans and even commemorates International Women’s Day.

However according to the UK’s National Criminal activity Firm (NCA), it’s owned by cash launderers, and they’re utilizing it to clean Britain’s drug cash with cryptocurrency.

In 2015, on Christmas Day, a business called Altair Holding obtained a 75% stake in Keremet Bank. The NCA has actually connected the business to George Rossi, a US-sanctioned Ukrainian nationwide and the head of the cash laundering network TGR. This network is among 2 that the firm has actually exposed for laundering funds for cybercriminals, drug dealerships and gun traffickers throughout a minimum of 28 cities and towns in the UK. It has likewise apparently assisted approved Russians bypass monetary constraints.

” For a cost, the launderers gather ‘filthy’ money created from the drugs trade, guns supply, and arranged migration criminal offense, and transform it to ‘tidy’ cryptocurrency,” the NCA stated in a report launched on Friday.

Given that TGR purchased a managing stake in Keremet Bank in 2015, it has actually helped with “cross-border payments on behalf of Promsvyazbank, a Russian state-owned bank, which supported business associated with the Russian military commercial base.”

Basically, the NCA stated it has actually exposed a successful avenue utilized by Russia to prevent sanctions and unlawfully money its war in Ukraine. To date, more than 25 million pounds ($ 33 million) has actually been taken in money and cryptocurrency, the firm stated, and 128 arrests have actually been made worldwide.

Publication: Bitcoin whale Metaplanet ‘undersea’ however considering more BTC: Asia Express