Secret takeaways:

-

Bitcoin’s decrease mirrors Nasdaq weak point however does not have an essential validation.

-

Area BTC ETF inflows have actually cooled however stay net favorable, revealing resistant financier need.

-

Stablecoin liquidity and onchain build-up recommend conditions for a rebound.

Bitcoin (BTC) extended its decrease to $102,000 on Tuesday, dropping 7% today and matching the Nasdaq 100 futures’ 1.67% drop as danger possessions came under pressure. Historically, when the Nasdaq falls by more than 1.5% in a single day, Bitcoin has a 75% possibility of publishing an unfavorable return, balancing a decrease of– 2.4%, according to information from EcoinBitcoin-Nasdaq itcoin Nasdaq connection by Ecoinometrics. Source: X

Regardless of the macroeconomic drag, the expert argued that Bitcoin’s rate weak point isn’t totally validated by basics. Monetary conditions stay loose, and equity markets just recently struck record highs.

” Bitcoin has actually been underpriced relative to the macro background,” Ecoinometrics kept in mind, highlighting that the present dip appears more sentiment-driven than structural.

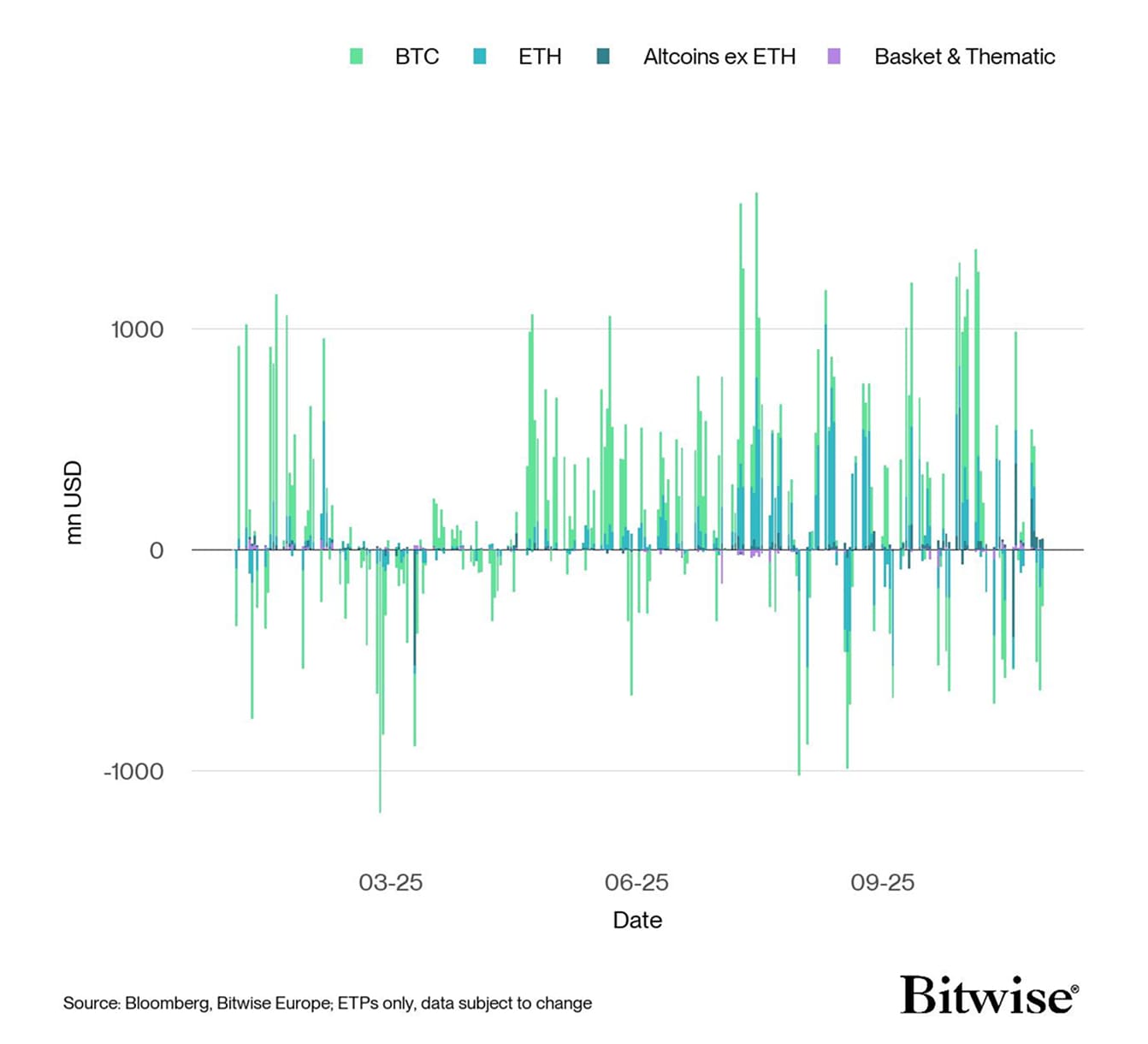

Nevertheless, area Bitcoin ETF inflows have actually slowed significantly considering that early October. The very first 2 weeks of Q4 created over $5 billion in net inflows, while the previous 4 weeks have actually seen cumulative outflows of around $1.5 billion. Although this shift recommended some cooling of need, the general net inflow balance stays favorable, an indication that long-lasting financier hunger for BTC direct exposure stays resistant.

Worldwide, the downturn has actually been echoed throughout crypto exchange-traded items (ETPs). Recently saw $246.6 million in net outflows from all crypto ETPs, mainly driven by $752 million in Bitcoin outflows. Especially, the iShares Bitcoin Trust (IBIT) led with $403 million in outflows, while Grayscale’s GBTC saw $68 million exit.

Onchain metrics include subtlety to the image. Sell-side pressure has actually relieved from $835 million to $469 million week-over-week, while long-lasting build-up stays strong. Bitcoin whales sent out modest inflows of around 4,900 BTC to exchanges; an indication of careful repositioning instead of panic.

Exchange-held reserves was up to 2.85 million BTC, enhancing the wider build-up pattern even as BTC trades listed below its 200-day moving average ($ 108,000) and short-term holder expense basis of $113,000.

Related: Bitcoin long-lasting holders unload 400K BTC: How low can BTC rate go?

Bitcoin liquidity signals turning point

Information from CryptoQuant recommended that the Stablecoin Supply Ratio (SSR) has actually hung back to the 13– 14 variety, the exact same zone seen before Bitcoin’s rebound previously this year. Historically, this level has actually marked liquidity turning points, where increasing stablecoin balances signal increasing “purchasing power” on the sidelines.

Presently, with Bitcoin trading at $102,200, the low SSR recommends that stablecoin liquidity is silently constructing once again, possibly setting the phase for a relief rally or the last bullish leg of this cycle.

Nevertheless, each succeeding SSR rebound has actually grown weaker, recommending that while another upside stage might still be possible, the marketplace’s underlying liquidity momentum might be fading.

Related: Bitcoin rate gets $92K target as brand-new purchasers go into ‘capitulation’ mode

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.