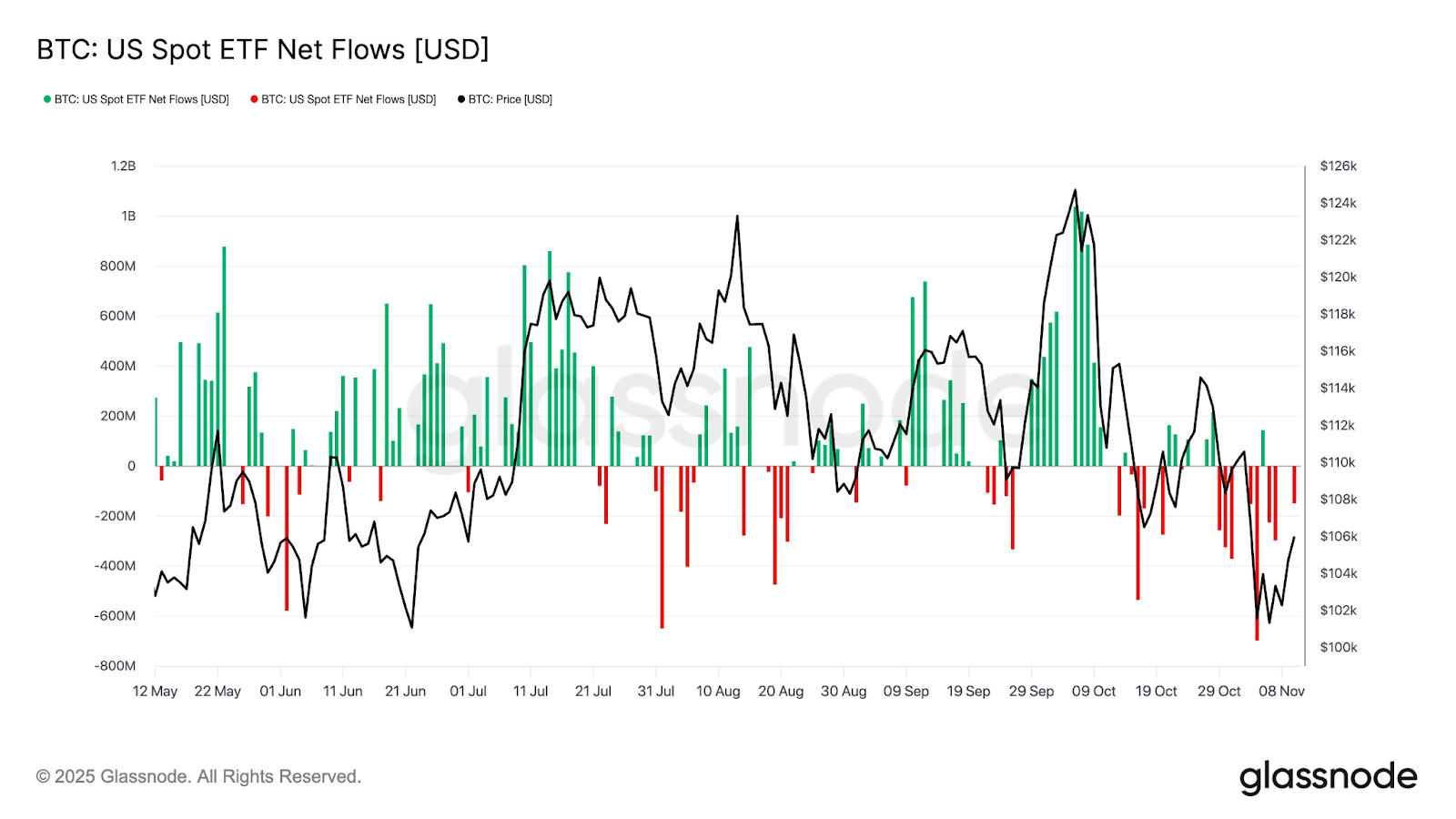

Bitcoin exchange-traded fund (ETF) financial investments are revealing indications of healing, signifying a return of danger hunger following a record crypto market crash in early October.

United States area Bitcoin ETFs saw $524 million worth of cumulative net inflows on Tuesday, marking the greatest everyday quantity because Oct. 7, according to information from Farside Investors.

The $524 million inflows mark the greatest cumulative inflows because the crypto market crash on Oct. 10, which provided a considerable blow to crypto financier hunger.

The favorable everyday inflows are a welcome signal for Bitcoin (BTC) holders, as financial investments from ETFs and Michael Saylor’s Technique were the 2 primary automobiles driving need for Bitcoin’s cost this year, according to Ki Young Ju, creator and CEO of crypto analytics platform CryptoQuant.

The growing need from ETF purchasers came a day after the senate authorized a financing plan that brought Congress one action more detailed to ending the federal government shutdown. The legislation is now headed for a complete vote in your home of Representatives, which might happen later on today, according to a Tuesday report by CBS News.

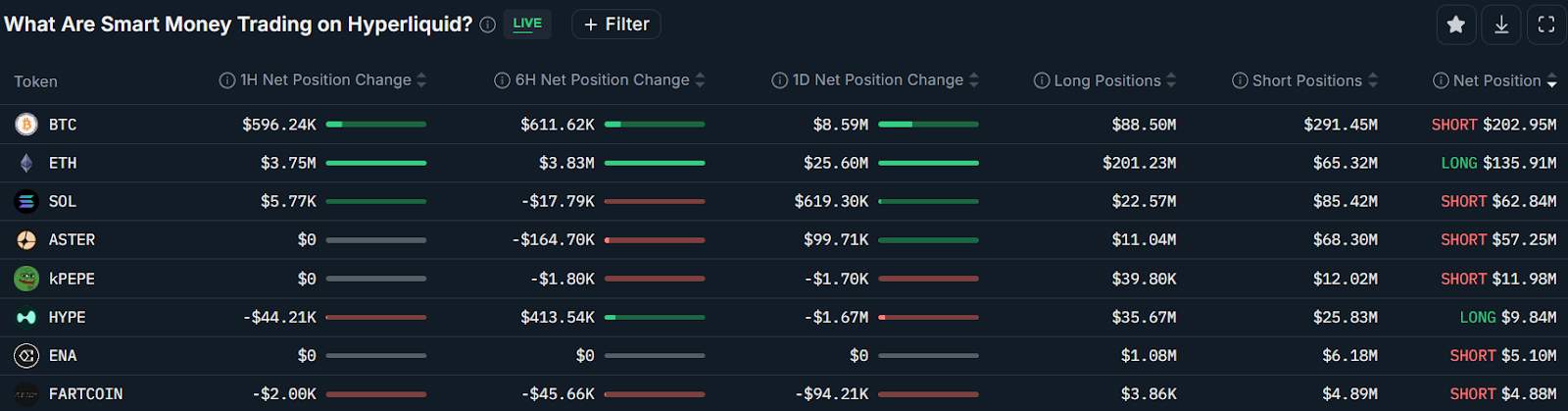

The advancement motivated a rearranging for more advantage amongst the market’s most effective traders, tracked as “wise cash” traders on Nansen’s blockchain intelligence platform.

Smart cash traders have actually included over $8.5 million worth of net long Bitcoin positions over the previous 24 hr, signifying a growing optimism. Nevertheless, wise traders were still net brief by $202 million on decentralized exchange Hyperliquid, according to Nansen.

Related: CleanSpark prepares $1.15 B raise to broaden Bitcoin mining, AI facilities

Experts call correction healthy in spite of retail concerns

In spite of retail issues over completion of the bull cycle, Bitcoin’s existing correction stays in a “healthy” variety, assisting reset utilize and “leading the way for restored institutional entry,” Lacie Zhang, research study expert at Bitget Wallet, informed Cointelegraph.

” Looking ahead, all eyes turn to the Nov. 13 CPI print, though a continued information hold-up from the federal government shutdown includes unpredictability.”

Cooling inflation information might alleviate geopolitical issues and result in a “liquidity-driven rebound” for the world’s biggest cryptocurrency, the expert included.

Related: 61% of organizations prepare to increase crypto direct exposure in spite of October crash: Sygnum

On the other hand, continual inflows from Bitcoin ETFs might signify that the “de-risking stage” of ETF holders is concerning an end, as financier need for digital properties is returning after the crash.

Bitcoin ETFs have actually been mainly at a loss because the October crash, with everyday outflows rising to $700 million, which indicated a “more comprehensive de-risking stage amongst ETF financiers,” composed crypto information platform Glassnode, in a Tuesday X post.

When It Comes To the other crypto ETFs, Ether (ETH) ETFs saw $107 million worth of outflows on Tuesday, while the Solana (SOL) ETFs extended their 11-day winning streak with $8 million worth of net favorable inflows, according to Farside Investors.

Publication: Bitcoin to see ‘another huge thrust’ to $150K, ETH pressure constructs