United States area Bitcoin exchange-traded funds (ETFs) closed a 3rd straight week at a loss, deepening issues that a person of Bitcoin’s greatest institutional need engines is stalling.

Area Bitcoin (BTC) ETFs saw $1.1 billion in net unfavorable outflows throughout the previous trading week, marking their fourth-largest week of outflows on record, according to Farside Investors information.

The ETF outflows happened throughout a substantial correction, as Bitcoin’s cost fell by over 9.9% throughout the previous week, to trade at $95,740 at the time of composing, Cointelegraph information programs.

Related: Metaplanet’s Bitcoin gains fall 39% as October crash pressures business treasuries

The current correction marked the very first pattern of an emerging “mini” bearish market, according to crypto insights platform Matrixport.

” Our information revealed a market losing momentum and doing not have the drivers required for a continual rally,” composed Matrixport in a Friday X post, including:

” With ETF streams weakening, OG financiers minimizing direct exposure, and macro conditions providing no instant driver, the course forward stays extremely depending on upcoming policy choices from the Federal Reserve.”

The crypto market stays in a “critical point,” as crucial cost levels and macro triggers will figure out the next considerable relocation, according to Matrixport.

United States area Bitcoin ETF inflows and financial investments from Michael Saylor’s Technique were the primary need motorists for Bitcoin in 2025.

Related: Bitcoin ETFs bleed $866M in second-worst day on record, however some experts still bullish

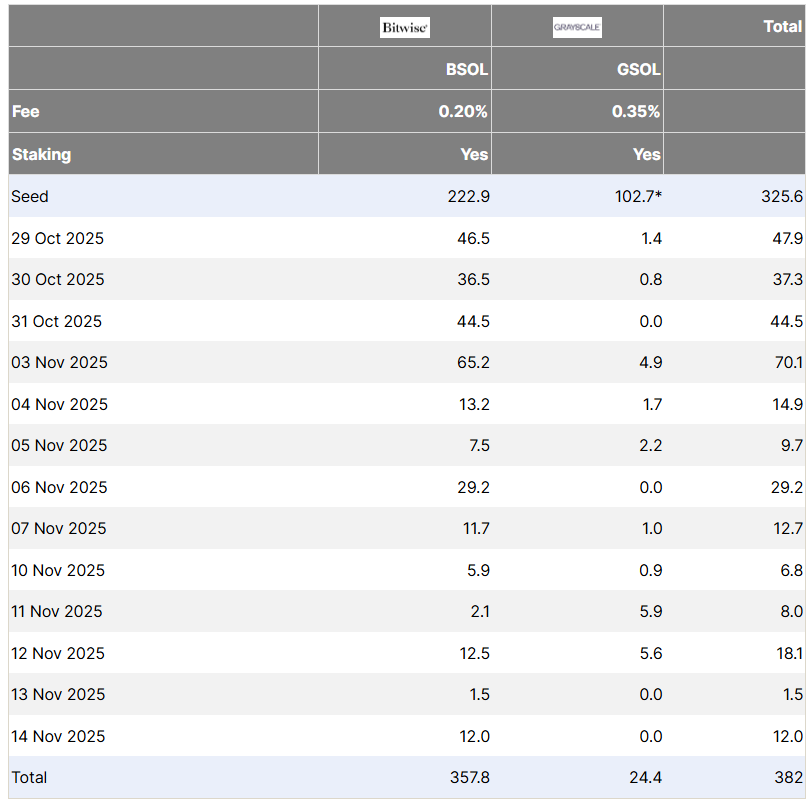

Solana ETF inflows defy market gravity

Area Solana (SOL) ETFs continue to defy the gravity of the cryptocurrency market, creating favorable inflows regardless of the more comprehensive decline.

Solana ETFs ended recently with $12 million in inflows on Friday, logging 13 days of successive inflows because their launch on Oct. 29.

Area Ether (ETH) ETFs logged $177 million in outflows on Friday, marking the 4th successive day at a loss, according to Farside Investors.

In spite of the favorable ETF inflows, Solana’s cost fell 15% on the weekly chart, while Ether’s cost fell 11% throughout the exact same duration.

Publication: Bitcoin to see ‘another huge thrust’ to $150K, ETH pressure constructs