United States area Bitcoin exchange-traded funds (ETFs) published $104.9 million in net outflows on Tuesday in the very first trading session today.

Overall trading volume in area Bitcoin (BTC) ETFs was up to simply over $3 billion, down almost 80% from a record $14.7 billion on Feb. 5, showing an ongoing downturn in trading activity, according to SoSoValue information.

The outflows came as another round of organizations reported their Bitcoin ETF holdings for the 4th quarter of 2025, with Jane Street ranking as the second-largest purchaser of BlackRock’s iShares Bitcoin ETF (IBIT) in Q4, purchasing $276 million.

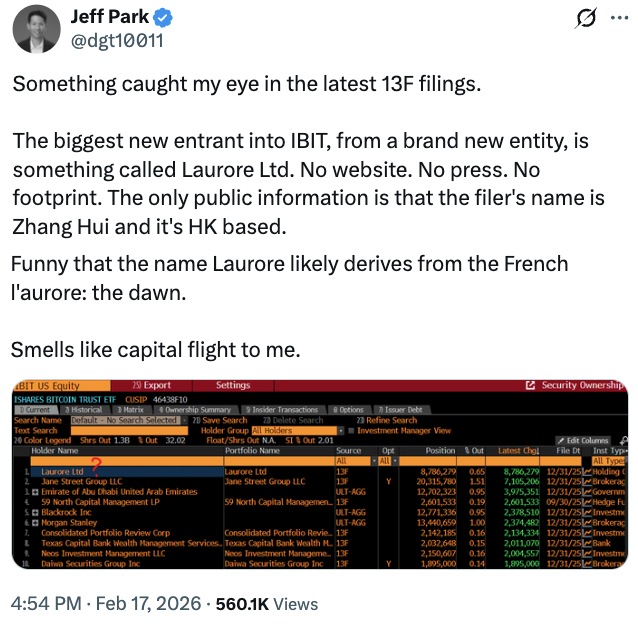

Q4 likewise saw a brand-new IBIT entrant, an odd Hong Kong-based business called Laurore, which got $436.2 countless the ETF in a single purchase reported to the United States Securities and Exchange Commission.

A prospective indication of Chinese organizations moving into Bitcoin?

According to Bitwise Investments consultant Jeff Park, Laurore’s freshly revealed position in IBIT might be an early indicator of institutional Chinese capital going into Bitcoin.

Park stated Laurore has no public footprint– no site or press– and the only offered info is that the filer’s name is Zhang Hui, the Chinese equivalent of “John Smith.”

While Park hypothesized that the financial investment might be connected to capital flight, some analysts questioned why the business would select to purchase Bitcoin through an ETF instead of straight.

Brevan Howard slashes IBIT holdings by 85%

Beyond Laurore and Jane Street, a number of organizations made considerable relocations with IBIT in Q4 2025. Weiss Property Management apparently included approximately 2.8 million shares ($ 107.5 million), while 59 North Capital increased its position by 2.6 million shares ($ 99.8 million).

Abu Dhabi’s state-owned financial investment company Mubadala Financial investment likewise improved its IBIT holdings by 45%, increasing from 8.7 million shares in Q3 to 12.7 million in Q4, valued at $630.7 million.

On the other hand, some business cut their Bitcoin ETF direct exposure in Q4 2025. Brevan Howard lowered its IBIT holdings, dropping approximately 85% from 37 million shares ($ 2.4 billion) in Q3 2025 to about 5.5 million shares ($ 273.5 million) in Q4.

Goldman Sachs likewise cut its IBIT holdings by approximately 40%, leaving around $1 billion in properties.

Publication: Is China hoarding gold so yuan ends up being international reserve rather of USD?