Bitcoin (BTC) market belief has actually started to recuperate as exchange traders reassess selling.

Bottom line:

-

Bitcoin taker circulation lastly sees favorable worths after a month of seller supremacy.

-

” Aggressive” sell pressure is fading at existing rate levels, analysis states.

-

The Crypto Worry & & Greed Index strikes record lows in spite of BTC rate stabilization.

Bitcoin exchanges eye “early indications of stabilization”

New findings from onchain analytics platform CryptoQuant launched on Thursday reveal net taker circulation turning favorable for the very first time in a month.

” Bitcoin market belief is revealing early indications of stabilization, and Binance’s 7-day Net Taker Circulation shows that shift when seen in correct macro context,” factor Crazzyblockk summed up in among its “Quicktake” post.

The metric, revealed as the distinction in between market buy and market offer orders, has actually been deep in unfavorable area considering that mid-January.

” After reaching almost -$ 4.9 B in cumulative net selling in early February, Binance’s 7-day taker circulation has actually progressively recuperated and turned favorable to around +$ 0.32 B,” Crazzyblockk continued.

” The belief ratio has actually moved from approximately -3% back into favorable area, signifying a clear decrease in sell-side aggressiveness.”

The post included that the phenomenon showed up throughout significant exchanges, with Binance however revealing a “more powerful shift in net purchasing pressure than peers.”

The modification comes as BTC rate action tries to support around 20% above current 15-month lows near $59,000.

As Cointelegraph reported, nevertheless, market individuals see a danger of stagnancy listed below $69,000– a crucial resistance level since the top of the 2021 Bitcoin booming market.

Crypto sees more “severe greed” than ever

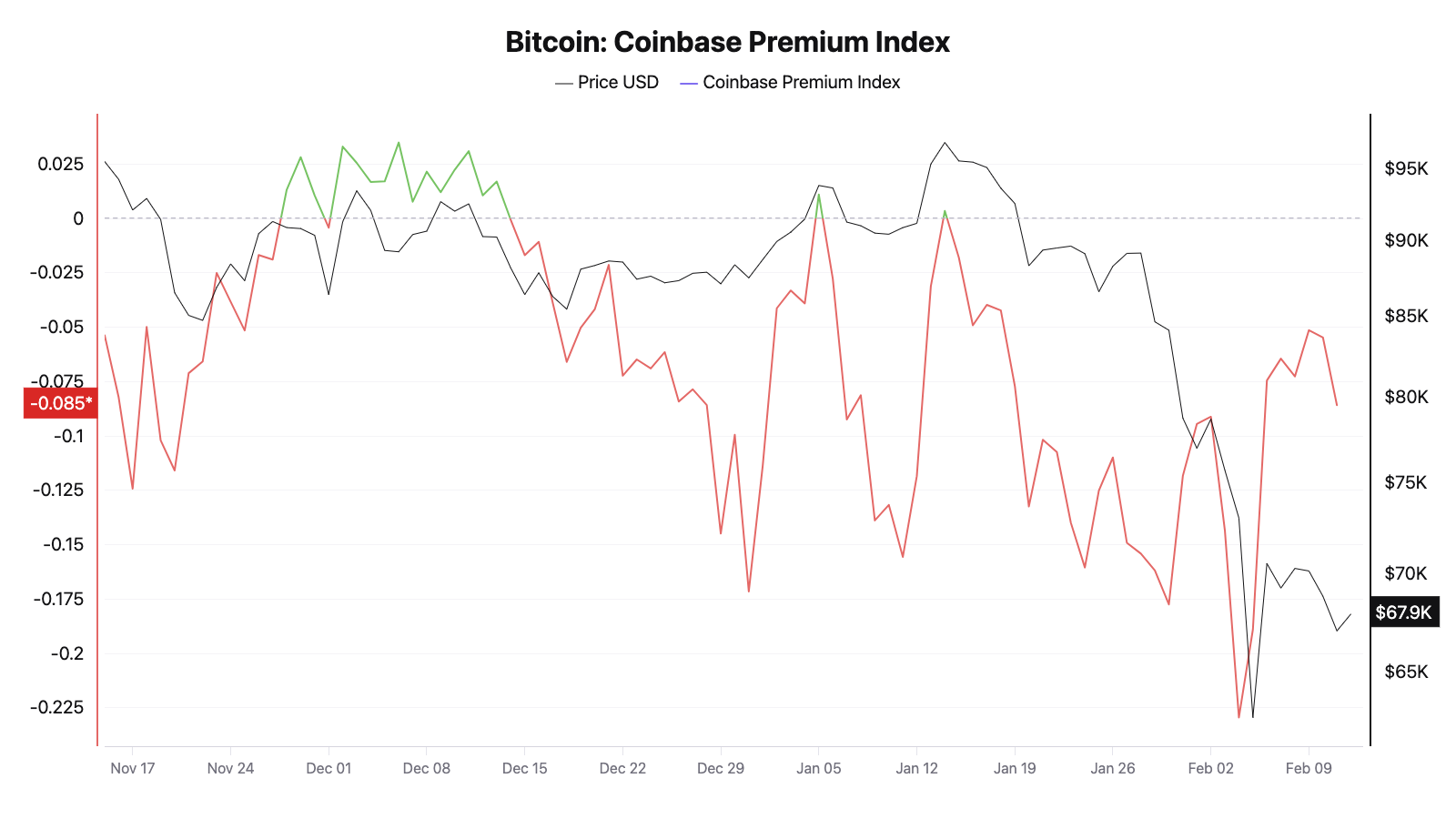

The split in between exchanges, on the other hand, continues to show up through the Coinbase Premium Index.

Related: BTC traders wait on $50K bottom: 5 things to understand in Bitcoin today

This sign determines the distinction in rate in between Coinbase’s BTC/USD and Binance’s BTC/USDT sets, and has actually likewise been nearly completely “red” considering that the middle of last month.

An unfavorable Premium suggests lower United States area need compared to Asia, and the current CryptoQuant information verifies that the status quo stays in spite of the modest BTC rate bounce.

Commenting, trading business QCP Capital explained the Premium decrease, indicating a “small amounts in U.S.-led area selling pressure.”

QCP tempered interest as it referenced “severe worry” signals from crypto market belief gauge, the Crypto Worry & & Greed Index.

” That stated, belief stays vulnerable, with the Crypto Worry & & Greed Index still deep in severe worry area at 9, which is less ‘all clear’ and more ‘thin ice that takes place to be holding,’ it composed in its newest “Asia Color” market upgrade on Wednesday.

The Index has actually considering that dropped to simply 5/100, a rating which ranks amongst its most affordable ever taped.

TODAY: Crypto Worry & & Greed Index plunges to 5 Extreme Worry, the most affordable level on record. pic.twitter.com/30srOiR5Ak

— Cointelegraph (@Cointelegraph) February 12, 2026

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding. While we aim to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this post. This post might include positive declarations that go through threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage emerging from your dependence on this details.