Bitcoin cost forecasts are coming thick and quickly after Monday’s all-time high, and one expert is tipping Bitcoin to reach $135,000 before a substantial market correction.

Before this breakout, there were practically 2 months of combination, which now seems like “ancient history,” Fairlead Techniques creator and handling partner Katie Stockton informed CNBC on Monday.

She stated that the company produces “determined relocation forecasts” from the breakouts and presuming the previous uptrend continues ahead of any restorative stage:

” That puts Bitcoin at around $135,000 as an intermediate-term goal.”

Stockton stated stocks that track Bitcoin (BTC) markets, such as Coinbase or Method, are likewise most likely to carry out well. “There is favorable action throughout deep space of cryptocurrencies,” she stated, mentioning Ether (ETH) and XRP (XRP) motions.

Experts echo BTC cost forecast

Bitcoin broke out from its multi-week sideways channel on Monday to reach an all-time high of $122,871 on Coinbase before pulling away back listed below $120,000 throughout early trading on Tuesday early morning.

Stockton’s forecast carefully mirrors other experts’ current projections.

” Based Upon the July 10 breakout signal, which has actually traditionally caused a typical 20% rally over the following 2 months, we predict Bitcoin might reach $133,000,” 10x Research study head of research study Markus Thielen informed Cointelegraph on Tuesday.

” We anticipate some near-term combination, followed by a push towards $133,000, with our $160,000 year-end target still securely in sight.”

” Financiers are still taking a look at $150,000 as the next significant cost level to reach throughout this cycle,” LVRG Research study director Nick Ruck informed Cointelegraph, including:

” We stay positive that Bitcoin can continue, pending no unexpected black swan occasions.”

Related: Bitcoin is rallying on United States deficit issues, not buzz: Expert

Cointelegraph technical experts tagged $132,000 to $138,000 as a “sensible short-term target” before momentum slows.

Bitcoin’s breakout of what seems a “bull flag” pattern mean a $130,000 target, analysis recommended.

Retail is still missing from crypto

Bitcoin smashed past the $120,000, breaking above a seven-year trendline that has actually functioned as a strong resistance level because 2018.

” This is an exceptionally bullish signal, particularly provided the environment this is taking place in,” Nic Puckrin, financier and creator of The Coin Bureau, stated in a note shown Cointelegraph.

” However, most notably, retail purchasers are no place to be seen yet. This rally is still driven by institutional capital, while the common indications of retail participation– skyrocketing search traffic and crypto app rankings– are missing,” he included before specifying that retail is not likely to get included “up until we get to around $150,000 and the FOMO begins.”

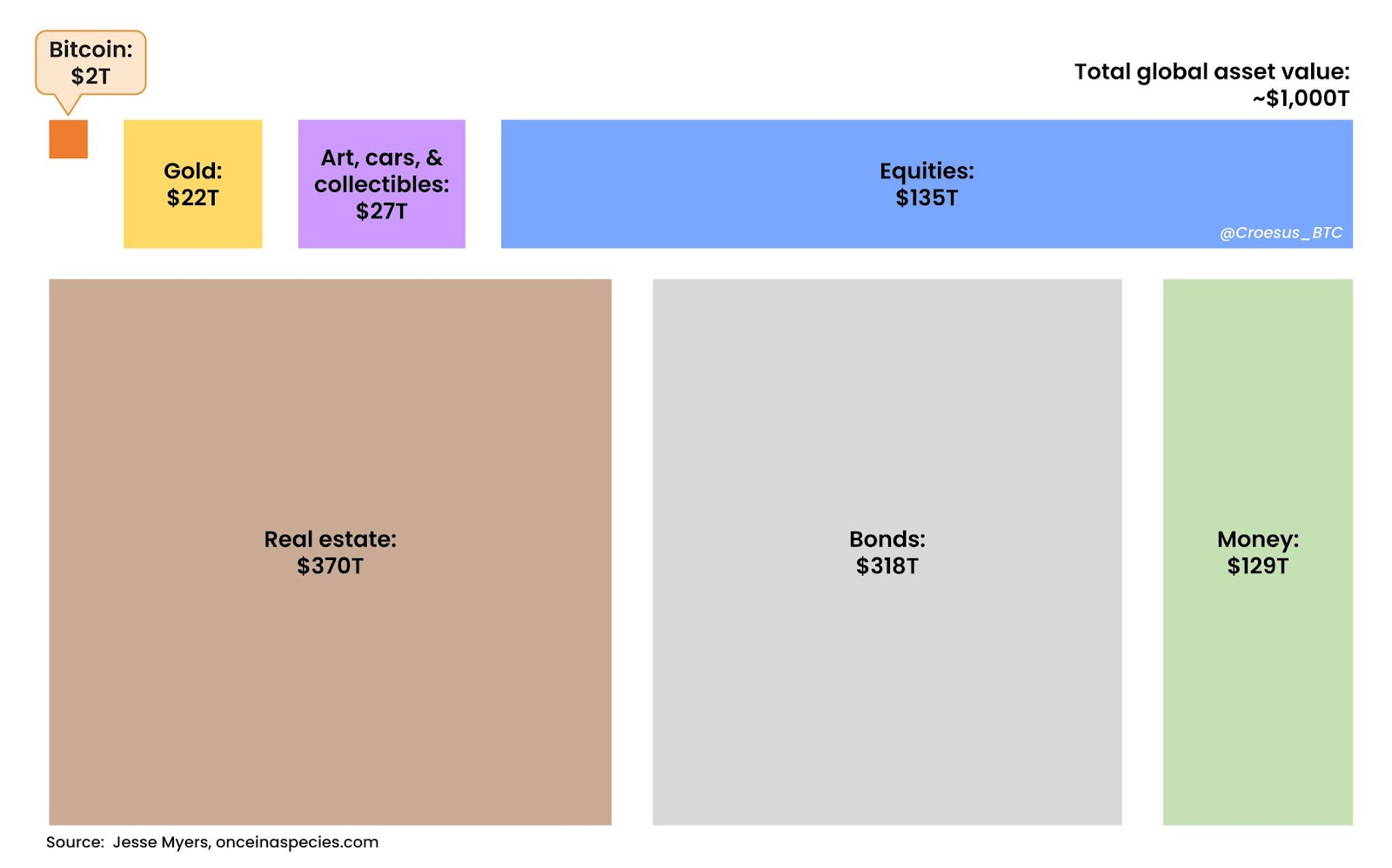

Bitcoin is still a small possession class

The huge relocation increased Bitcoin’s market capitalization to $2.4 trillion, which allowed BTC to turn Amazon and end up being the world’s fifth-largest worldwide possession.

Nevertheless, in regards to possession classes such as gold, equities, property and bonds, it is still a minnow, Bitcoin Chance Fund co-founder James Luxurious observed on Monday.

Publication: Bitcoin vs stablecoins face-off looms as GENIUS Act nears