Secret takeaways:

-

Bitcoin’s weekly close above $115,000 signals bullish strength.

-

BTC’s bull flag breakout might activate a rally to $120,000.

Bitcoin (BTC) might see more upside over the next couple of days after BTC/USD ended the 2nd week in the green above $115,000, according to experts.

Why Bitcoin is bullish above $115,000

Bitcoin cost finished its 2nd successive week of gains on Sunday, 8% above its Aug. 30 low of $107,270, per information from Cointelegraph Markets Pro and TradingView.

Bitcoin recovered the important level of $115,000, which has actually topped the cost considering that Aug. 24.

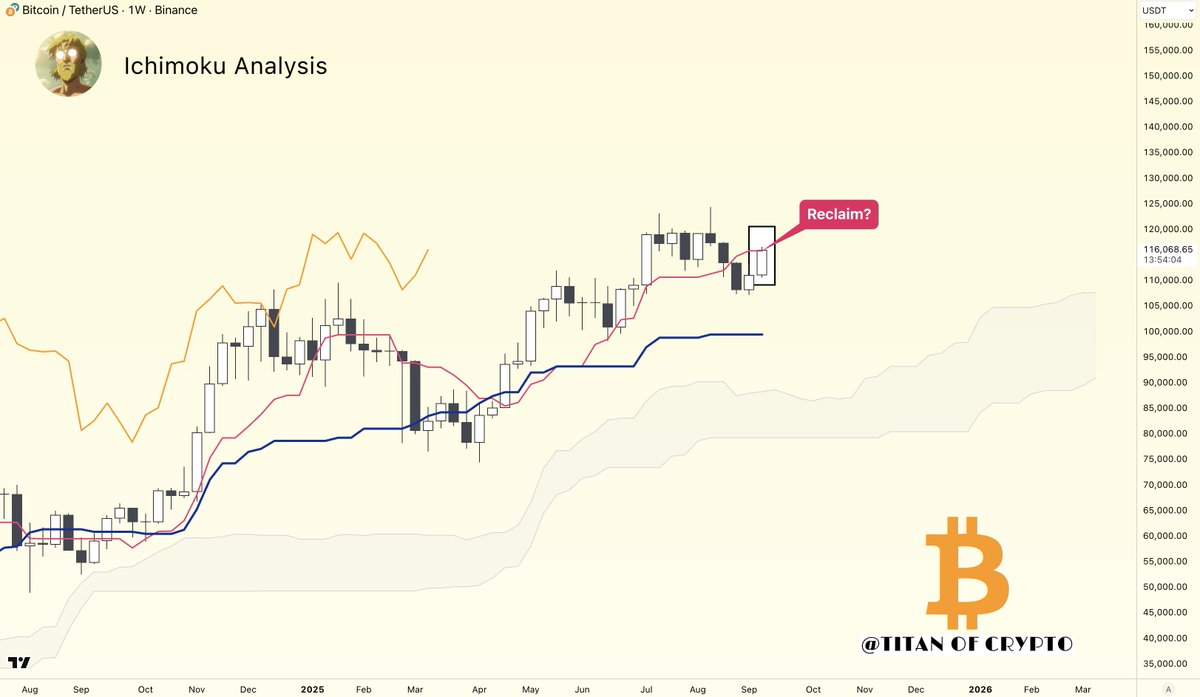

Trader Titan of Crypto kept in mind that $115,000 was the crucial level to view on the weekly timespan.

Related: Bitcoin whale is disposing once again as BTC flatlines at $116K

An accompanying chart exposed that this level lined up with the Tenkan, a line in the Ichimoku Cloud indication that determines short-term momentum and prospective pattern modifications.

” A validated weekly close above it would highly enhance the bullish case for #BTC.”

Historically, the cost breaking above the Tekan frequently indicates a short-term uptrend, specifically when the Cloud itself remains in the bullish area and the cost trades above it.

Most just recently, the BTC/USD set rallied 44% to the present all-time highs above $124,500 after the cost crossed above the Tenkan in late April.

Expert AlphaBTC stated BTC/USD should hold above $115,000, especially with volatility anticipated ahead of FOMC today.

” A tap of $118K is most likely at the start of the week.”

#Bitcoin LTF strategy

With the #FOMC Rate choice looming, I wish to see #Bitcoin keep the channel and stay above 115K, with a tap of 118K most likely at the start of the week.

The Secret will be if the marketplaces offer the news as a 25bp cut is revealed and costs are … https://t.co/PjcVKnXmGf pic.twitter.com/eVocYnVYAQ

— AlphaBTC (@mark_cullen) September 15, 2025

As Cointelegraph reported, Bitcoin ought to pay very close attention to the $115,000 mental level entering into a crucial macro week.

BTC cost to $120,000 next?

The upcoming FOMC choice on Wednesday, with a 94% opportunity of a 25 bps rate cut, is a crucial motorist of prospective gains for Bitcoin. Decreasing rate of interest has actually traditionally enhanced threat possessions like BTC, and a dovish tone from Fed Chair Jerome Powell’s speech after the conference might move Bitcoin’s cost towards $120,000.

From a technical point of view, the BTC/USD set traded inside a bull flag on the four-hour chart, as revealed listed below.

A four-hour candlestick close above the flag at $115,800 would validate a bullish breakout, leading the way for a run-up to the technical target of the dominating chart pattern at $122,000. Such a relocation would bring the overall gains to 6% from the present levels.

The 50-period and 200-period easy moving averages verified a “golden gross” on Sunday, more strengthening BTC’s upside capacity.

A number of experts job Bitcoin’s short-term rally to $120,000 based upon bullish futures information and a possible breakout from an inverted head-and-shoulders pattern.

Experts like Jelle job a 35% rally to $155,000, pointing out a bullish signal from the weekly Stochastic RSI.

#Bitcoin secured a significant bullish signal

The weekly stochastic RSI has actually crossed bullish.

This signal printed 9 times in this cycle alone, resulting in a typical gain of 35%.

35% from here would imply $155k/ BTC.

Send it. pic.twitter.com/gCSkb6E3ha

— Jelle (@CryptoJelleNL) September 15, 2025

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.