Bottom line:

-

Bitcoin traders wait on signals of United States financial policy loosening as information forces the Federal Reserve into a corner.

-

Economic downturn is most likely than not, sources state, amidst increasing joblessness and resurgent inflation.

-

Bitcoin and threat possessions need to eventually acquire from an economic crisis shock.

Bitcoin (BTC) stands to acquire as a United States economic crisis ends up being the “base case circumstance.”

Fresh analysis from sources consisting of trading resource The Kobeissi Letter makes grim forecasts for the United States economy and Federal Reserve.

Fed’s “worst headache” gets genuine

United States financial health is because of take a hit on the back of trade tariffs and the resurgent inflation, which might accompany them.

The most recent macroeconomic information, that includes Q1 GDP and the Fed’s “chosen” inflation gauge, puts authorities in a tight area, Kobeissi states.

GDP can be found in noticeably listed below expectations, turning unfavorable versus a projection 0.3% gain.

” Efficiently, the Fed should choose in between consisting of either inflation or joblessness,” it summed up, calling the scenario the Fed’s “worst headache.”

A crucial concern is the level and timing of any rate of interest cuts– something that crypto and risk-asset traders are acutely considering thanks to the favorable ripple effect for markets.

” Not decreasing rates of interest will even more deteriorate United States GDP and most likely boost joblessness. Nevertheless, if rates of interest are cut right away, we would anticipate to see another rebound in inflation,” Kobeissi continued.

Therefore in a “lose-lose” scenario, the Fed deals with the risk of both stagflation– increasing inflation with increasing joblessness– and a full-on economic crisis.

” An economic crisis in the United States has actually become our base case circumstance,” Kobeissi included, connecting to increasing chances on forecast service Kalshi.

Bitcoin expert sees economic crisis silver lining

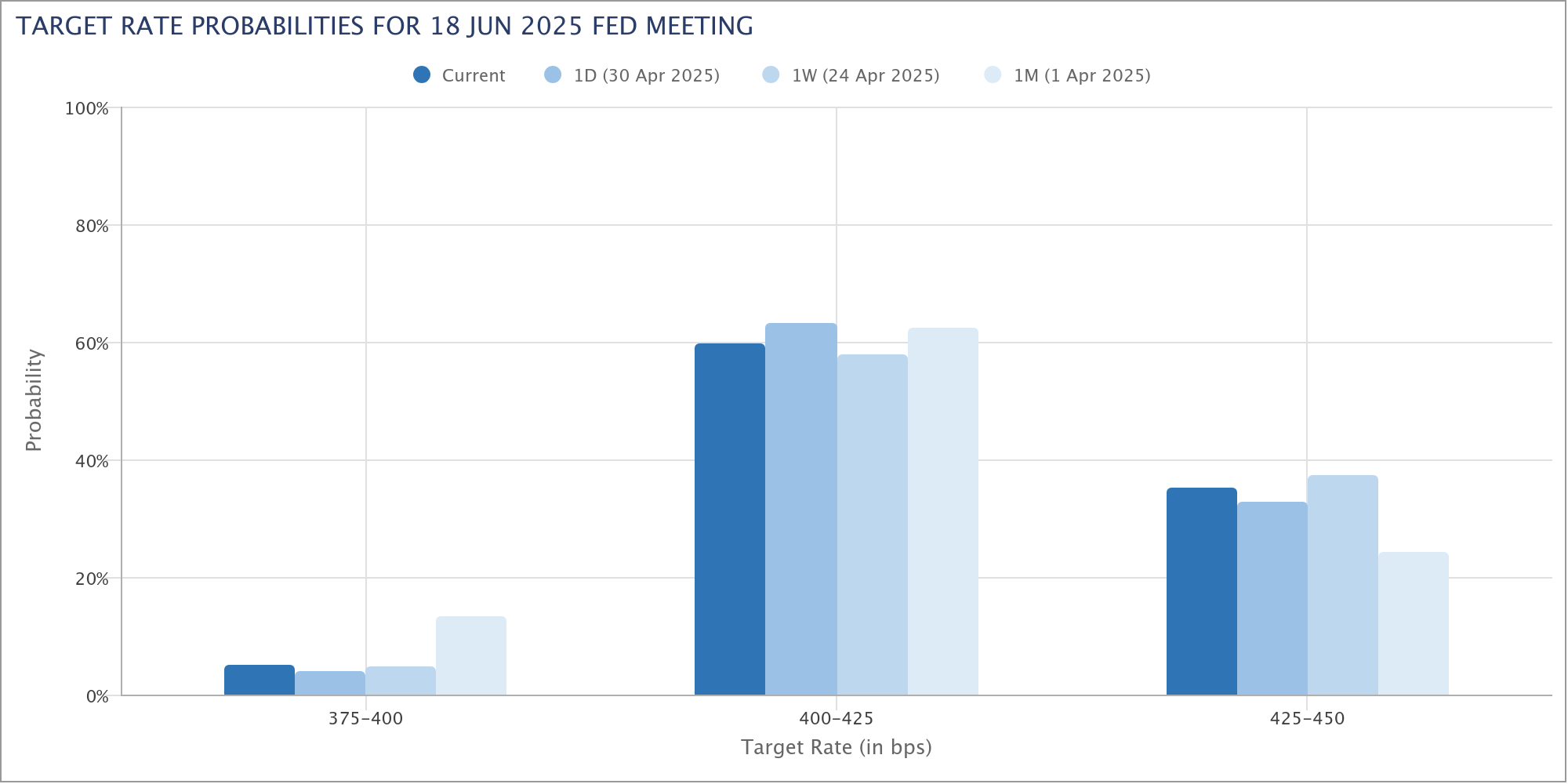

The most recent information from CME Group’s FedWatch Tool highlights market expectations for Fed policy, which has actually stayed conservative through 2025 in spite of the persistence of United States President Donald Trump that rates head lower.

Related: Bitcoin ‘hot supply’ nears $40B as brand-new financiers flood in at $95K

The June conference of the Federal Free Market Committee (FOMC) is presently the occasion that must trigger the next 0.25% cut, agreement recommends. The Might conference, nevertheless, now has simply 3% chances of such a result.

On the other hand, crypto market individuals are weighing the possible Fed course as conditions end up being significantly tough to browse.

” The other day, the marketplace was pricing 57% likelihood of 25bps cut for June 18th FOMC. Today it’s 63%,” popular trader Alter discussed the FedWatch information.

” Press pertaining to push in regards to financial information & & rate cuts. Fed will still be worried about rate pressures however more so about weak point within the economy, particularly if policy isn’t remedied in time.”

Crypto trader, expert and business owner Michaël van de Poppe forecasted that economic crisis alone would trigger the Fed to reassess its position.

” The rumours for a prospective economic crisis is increasing, which need to reinforce the thesis for the FED to relax the policy,” he composed in part of an X response to Q1 GDP information.

” That will likely be a short on the marketplaces, liquidity to be included and risk-on to prosper.”

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.