Bitcoin (BTC) saw flash volatility around Wednesday’s Wall Street open as United States tasks information was available in well above expectations.

Bottom line:

-

Bitcoin tries to save the day’s losses on the back of more powerful United States nonfarm payrolls information.

-

Blended signals lead to threat possessions diverging in their responses to the numbers.

-

Bitcoin traders remain careful of a much deeper BTC rate dip to come.

Analysis: Fed interest-rate time out to “continue”

Information from TradingView tracked a BTC rate spike to almost $69,000 which rapidly backtracked, extending day-to-day losses past 4% at the time of composing.

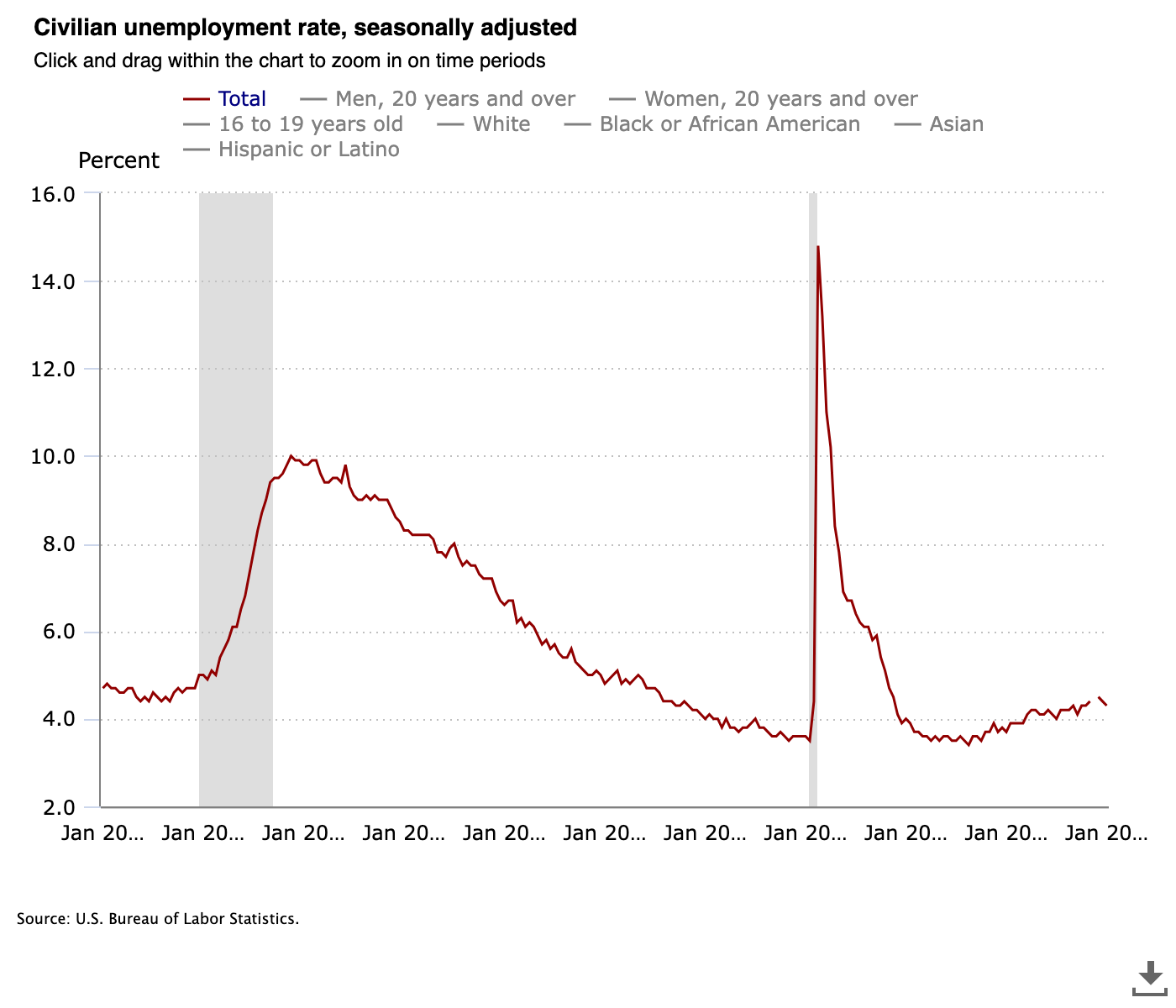

United States nonfarm payrolls outshined significantly on the day, with 130,000 tasks included January versus the expected 55,000.

Strong labor-market numbers tend to indicate less requirement to lower rates of interest– normally a headwind for crypto and threat possessions. At the very same time, the decreased possibility of economic downturn produces a nuanced photo for risk-asset efficiency.

As such, the S&P 500 at first got 0.5%, while the Nasdaq Composite Index fell 0.6% before both backtracked their relocations.

Rare-earth elements likewise saw unsure rate action, with gold striking brand-new February highs before returning gains to target $5,000 assistance.

Responding, trading resource The Kobeissi Letter in addition referenced cooling joblessness in anticipating that the Federal Reserve would hold rates consistent at its March conference.

” The joblessness rate was up to 4.3%, listed below expectations of 4.4%. This was a much more powerful than anticipated tasks report, all around the board,” it composed in a post on X.

” The Fed time out will continue.”

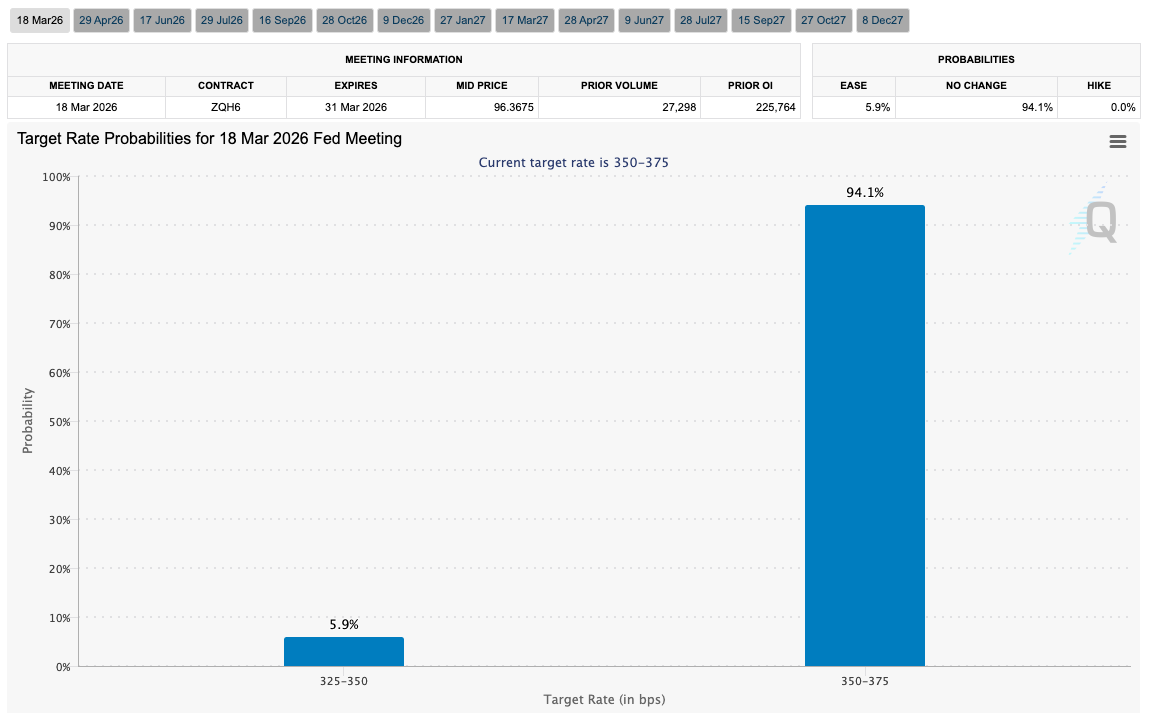

The most recent information from CME Group’s FedWatch Tool put the chances of a March rate time out at over 90%.

Attention now concentrated on Friday’s Customer Cost Index (CPI) print for more hints regarding the course of inflation.

Trader eyes BTC rate “sluggish bleed” towards $50,000

Talking about current BTC rate action, traders stayed not impressed and manipulated towards fresh drawback.

Related: BTC traders await $50K bottom: 5 things to understand in Bitcoin today

Daan Crypto Trades generated Fibonacci retracement levels at $64,569, $62,474 and $59,805 while considering the capacity for a much deeper retracement.

” Pretty weak revealing total after the preliminary bounce. Bulls stopped working to press greater past that $72K+ mark and rather saw rate break down once again,” he summed up.

” Unless ~$ 68k is retaken, the fib retracement levels are the ones to view in the short-term.”

Previously, Cointelegraph reported on $69,000 having essential long-lasting significance, with the threat of a prolonged rangebound environment establishing around that level now greater.

$ 50,000 BTC rate bottom targets likewise continued, with trader Jelle arguing that BTC/USD was copying 2022 bearish market trajectory “carefully.”

” Would see a reasonably sluggish bleed towards the low $50ks from here – before recuperating up; if it keeps playing out the very same,” he informed X fans.

” Great deals of individuals discuss purchasing there. I question if they will if rate arrives.”

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we aim to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might consist of positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this info.