Bitcoin looks set for a bearish open up to mark the last trading day of March and potentially the weakest Q1 efficiency considering that 2018.

Crypto and stock traders’ stress and anxiety over United States President Donald Trump’s fresh wave of 25% tariffs on vehicles imported to the United States, the risk of tariffs on the pharmaceutical market is plainly shown in BTC’s present disadvantage. Trump’s regular recommendations to April 2 being “Freedom Day” (the day when an obvious number for “mutual tariffs” will be appointed to numerous nations) likewise has actually shaken traders’ self-confidence.

At the time of publishing, stock futures have actually currently slipped into the red, with the DOW futures shedding 206 points and the S&P 500 futures down 0.56%. As anticipated, Bitcoin’s (BTC) rate relocated tandem with equities markets, slipping to $81,656 on March 30 and securing a 7th successive day of lower lows.

United States futures markets efficiency on March 30. Source: X/ Spencer Hakimian

After a turbulent quarter, equities markets look set to shut down for the month, with the S&P 500 down 6.3% and the Nasdaq and DOW each signing up 8.1% and 5.2% particular losses.

Bitcoin’s consistent decrease is a mix of weak need in area markets and clear derisking from traders who hesitate to open fresh positions in BTC’s futures markets.

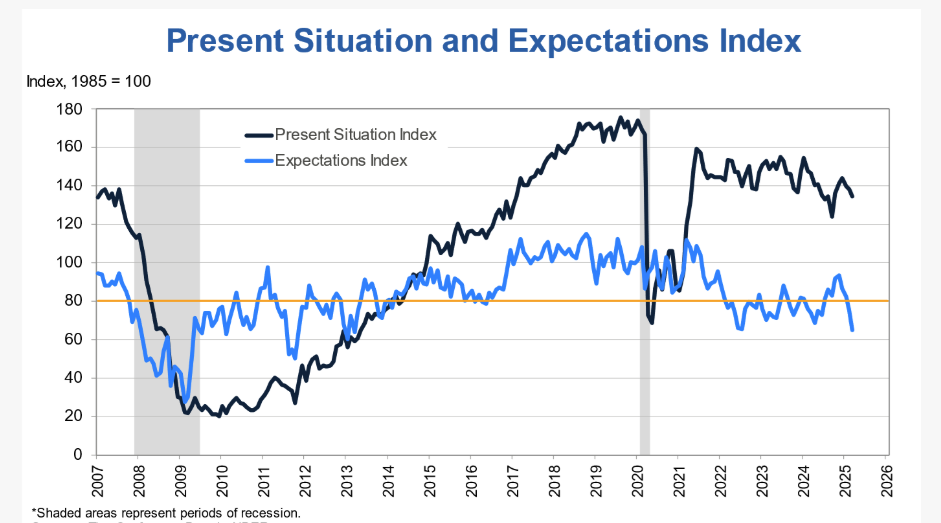

Recently’s core Personal Intake Expenses (PCE) information revealed a higher-than-anticipated uptick in inflation, and March customer self-confidence information from the Conference Board revealed the regular monthly self-confidence index– a metric that shows participants’ expectation for earnings, company and task potential customers– at a 12-year low.

Customer self-confidence present circumstance and future expectations information. Source: The Conference Board

Related: Bitcoin bottom ‘most likely’ at $80K, opening door for heap, CRO, MNT and RENDER to rally

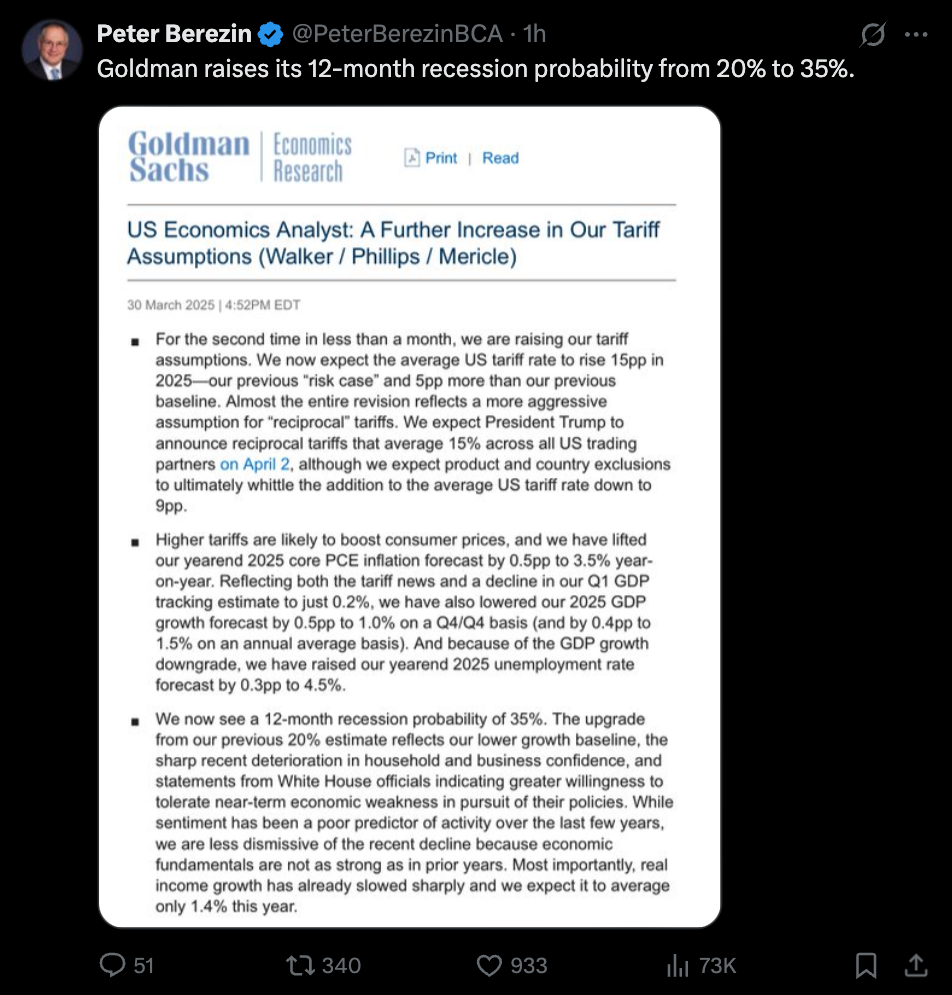

Economic crisis chances likewise continue to increase, with a current report from Goldman Sachs raising the 12-month economic crisis likelihood from their previous 20% to 35%. In the report, Goldman Sachs’ experts stated,

” The upgrade from our previous 20% quote shows our lower development beeline, the sharp current degeneration in home and company self-confidence and declarations from White Home authorities showing higher determination to endure near-term financial weak point in pursuit of their policies.”

United States economic crisis chances raised by Goldman Sachs. Source: X/ Peter Berezin

Does Bitcoin’s disadvantage have a silver lining?

While lots of crypto experts have actually openly modified their bullish six-figure-plus BTC rate quotes and now anticipate a review to Bitcoin’s swing lows in the mid $70,000 variety, institutional financiers continue to purchase, and net inflows to the area ETFs stay favorable.

On March 30, Technique CEO Michael Saylor required to X and published his popular orange dots Bitcoin chart, stating,

” Requirements a lot more Orange.”

Technique Bitcoin purchases. Source: X/ Michael Saylor

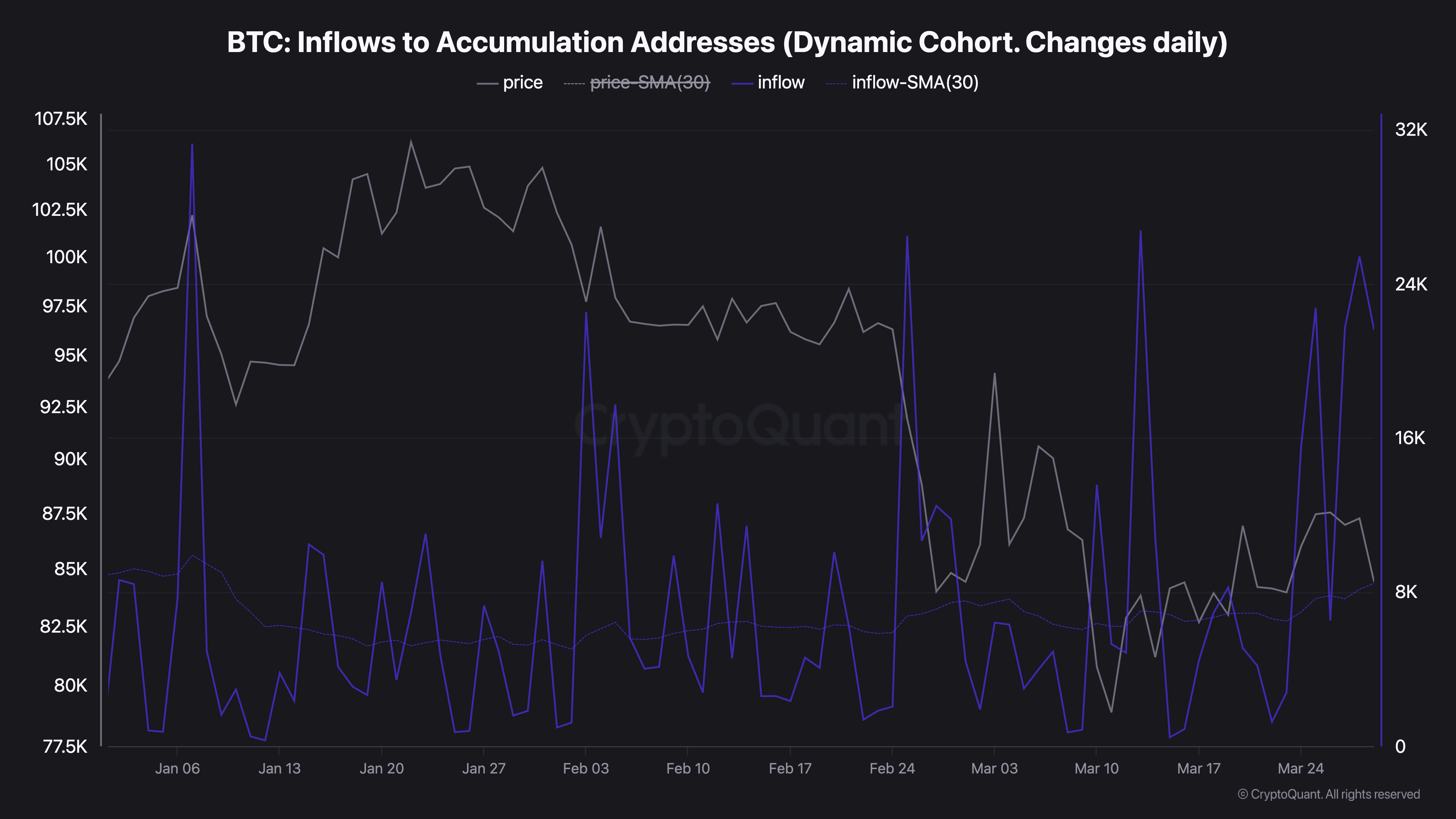

Information from CryptoQuant likewise reveals Bitcoin inflows to build-up addresses continuing to increase throughout the month.

BTC: Inflows to build-up addresses. Source: CryptoQuant

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.