The Bitcoin Worry & & Greed Index has actually lastly clawed its escape of the “worry” zone on Sunday, dealing with to neutral for the very first time in more than 2 weeks as the rate of Bitcoin rose back to around $115,000 over the weekend.

The Bitcoin Worry & & Greed Index, which determines general market belief, is presently being in the “neutral” zone with a rating of 51 out of 100.

It’s up 11 points from the afraid rating of 40 on Saturday, and likewise up over 20 points considering that recently, marking a sharp modification in tune over the previous couple of days.

Trump’s China tariff statement on Oct. 10 had actually plunged the index from a “greed” rating of 71 to an annual low of 24 as $19 billion of crypto leveraged positions were liquidated.

” Aggressive” BTC selling is subsiding

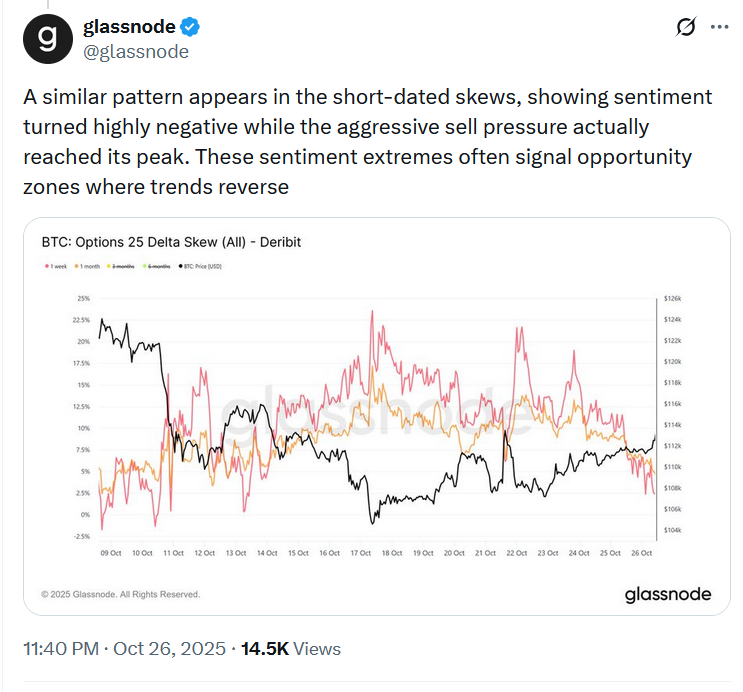

The shift in belief comes in the middle of a current decrease in Bitcoin (BTC) selling pressure, according to Bitcoin analytics platform Glassnode.

In an X post on Sunday, Glassnode recommended a pattern turnaround remains in the works, as offering pressure and unfavorable belief appear to have currently peaked to their extremes.

Related: Bitcoin is no inflation hedge however prospers when the dollar wobbles: NYDIG

” For the very first time considering that the October 10th flush, area and futures CVD [Cumulative Volume Delta] have actually flattened, showing that aggressive selling pressure has actually gone away over the last a number of days,” the post checks out, including:

” Financing rates stay listed below the neutral level of 0.01%, showing no extreme long positioning or froth. In truth, we can see that financing turned really unfavorable a number of times over the last 2 weeks revealing that individuals lean towards care.”

Looking ahead at other possibly bullish indications, the marketplace is relatively expecting another rates of interest cut by the United States Federal Reserve at its Oct. 29 conference.

At the time of composing, information from CME Group’s FedWatch suggestions a 96.7% possibility that the Fed will cut rates by 0.25% today.

Publication: Bitcoin flashing ‘uncommon’ leading signal, Hayes suggestions $1M BTC: Hodler’s Digest, Oct. 19– 25