Bottom line:

-

Bitcoin’s speculative financier base now has an aggregate buy-in cost of above $100,000.

-

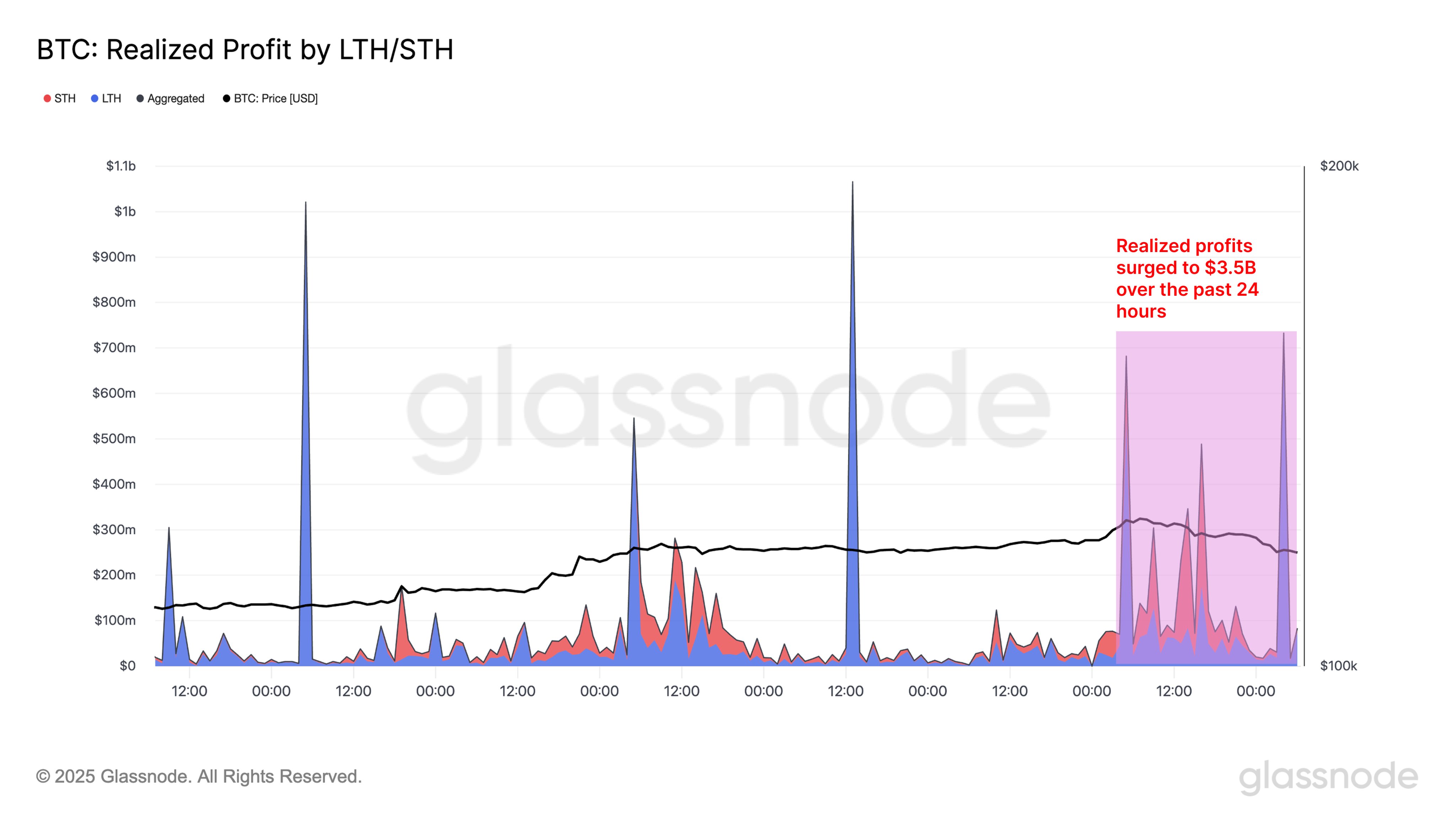

Profit-taking increases as $3.5 billion is understood in simply 24 hr.

-

The secret owner of a 14-year-old BTC wallet sends out 40,000 BTC to Galaxy Digital.

Bitcoin (BTC) speculators have actually struck a brand-new turning point as their aggregate buy-in cost passes $100,000 for the very first time.

The current information from onchain analytics firm Glassnode validates that since July 15, the expense basis of Bitcoin short-term holders (STHs) has actually reached 6 figures.

Bitcoin short-term holder expense basis now $100,000

Bitcoin’s more speculative financier associates are now typically six-figure purchasers.

Breaking down the expense basis for numerous classes of BTC hodler, Glassnode validates that those getting in the marketplace within the last 6 months on aggregate paid over $100,000 per coin.

STH entities are generally believed to be more conscious low-timeframe BTC cost action, feeling more pressure to offer based upon unexpected patterns. Their expense basis, referred to as understood cost, can form trusted assistance throughout Bitcoin booming market.

The expense basis passing $100,000 hence strengthens that level’s significance need to BTC/USD start a much deeper slump.

On The Other Hand, neither STHs nor their more established equivalents, long-lasting holders (LTHs), have actually lost time taking revenues around all-time highs.

Glassnode validates that in the 24 hr to 4 am Eastern Time Tuesday, STH and LTH combined profit-taking was around $3.5 billion.

” Among the biggest $BTC earnings awareness days this year – driven mainly by long-lasting holders,” it stated on X.

BTC hodlers take revenues off the table

Previous to the profit-taking occasion, Glassnode cautioned that the degree of current gains might show too appealing for hodlers, no matter for how long their existence in the market.

Related: ‘ Do not get caught!’– Bitcoin cost analysis sees dip with $118.8 K in focus

” Capital rotation metrics indicate a minor boost in short-term holder activity, yet the supremacy of long-lasting holders stays undamaged, supporting market stability,” it reported in the most recent edition of “Market Pulse,” its routine research study series.

” On the other hand, profit/loss signs signal care, with understood profit-taking increasing and almost 99% of the supply in earnings, recommending raised ecstasy and possible threat of corrections.”

As Cointelegraph reported, whales likewise seized the day to secure gains today.

They consist of the secret owner of 80,000 BTC, which just recently ended up being active onchain for the very first time in a years. 40,000 BTC relocated to a wallet at exchange Galaxy Digital on July 15, per information from Arkham.

UPDATE: The Bitcoin OG with 80,009 $BTC($ 9.46 B) has actually moved 40,009 $BTC($ 4.68 B) to #GalaxyDigital.

And #GalaxyDigital has actually straight transferred 6,000 $BTC($ 706M) into #Binance and#Bybit https://t.co/8Z4m7CAQ0i https://t.co/4fpZhBM5uY pic.twitter.com/gdl6f8wSZw

— Lookonchain (@lookonchain) July 15, 2025

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.