Bottom line:

-

Bitcoin wanders towards $115,000 into the weekly close ahead of a crucial macro week.

-

BTC requires a weekly close above $114,000 to remain “bullish,” analysis states.

-

Markets are persuaded that the Federal Reserve will cut rate of interest next week.

Bitcoin (BTC) circled around weekend lows into Sunday’s weekly close ahead of a significant week for crypto and threat possessions.

” Time to take note” to Bitcoin cost

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD dropping towards $115,000.

The set prevented significant volatility after the week’s last Wall Street trading session, throughout which it struck $116,800– its greatest because Aug. 23.

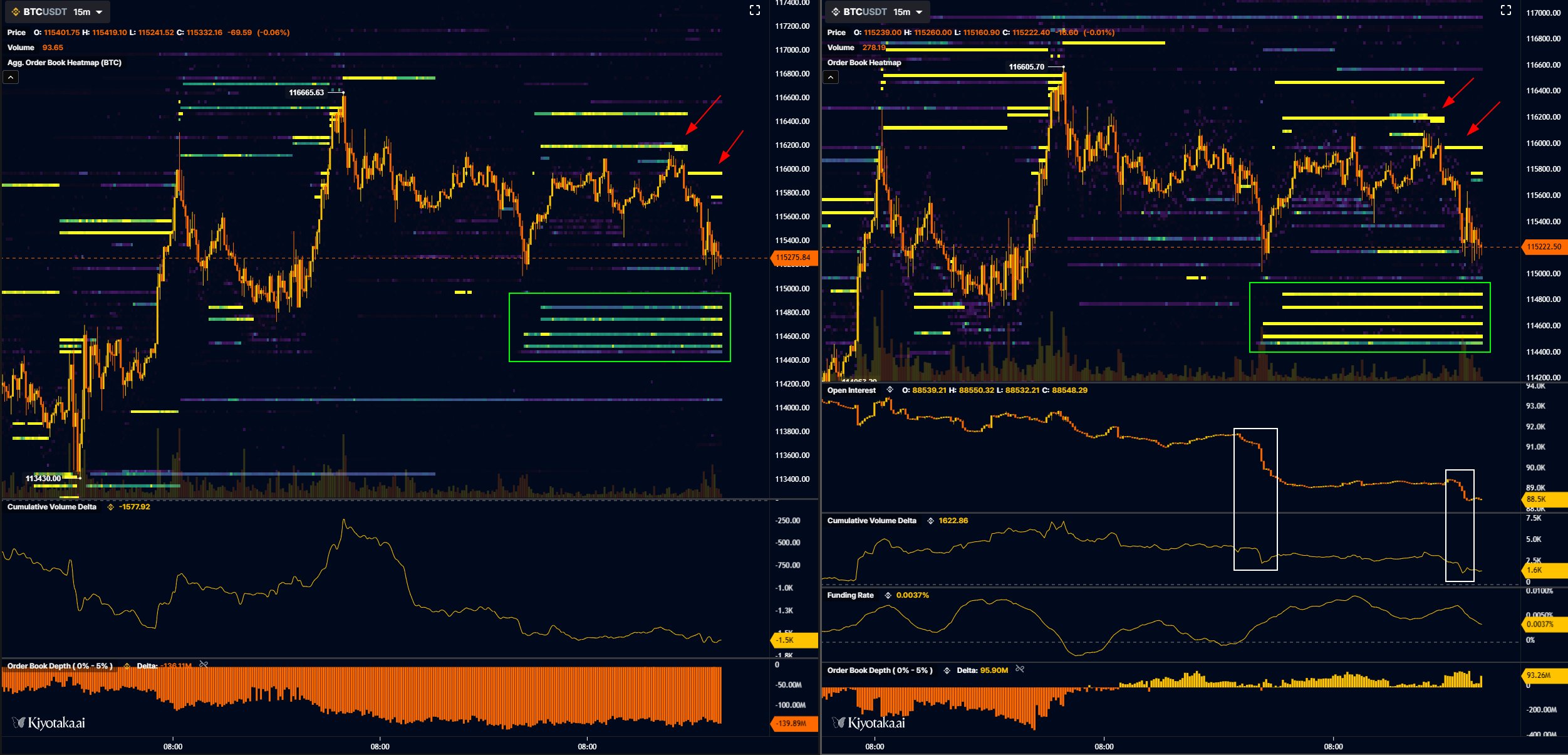

” Pretty clear cost is being strolled down here yet once again entering into a brand-new week,” popular trader Alter summed up about the most recent BTC cost action in part of a post on X.

Alter flagged “some quite good quote depth & & liquidity simply listed below $115K” on exchange order books.

” Time to take note,” he concluded.

Continuing, market individuals stayed cool on the short-term outlook, with popular trader and expert Rekt Capital taking a detailed method.

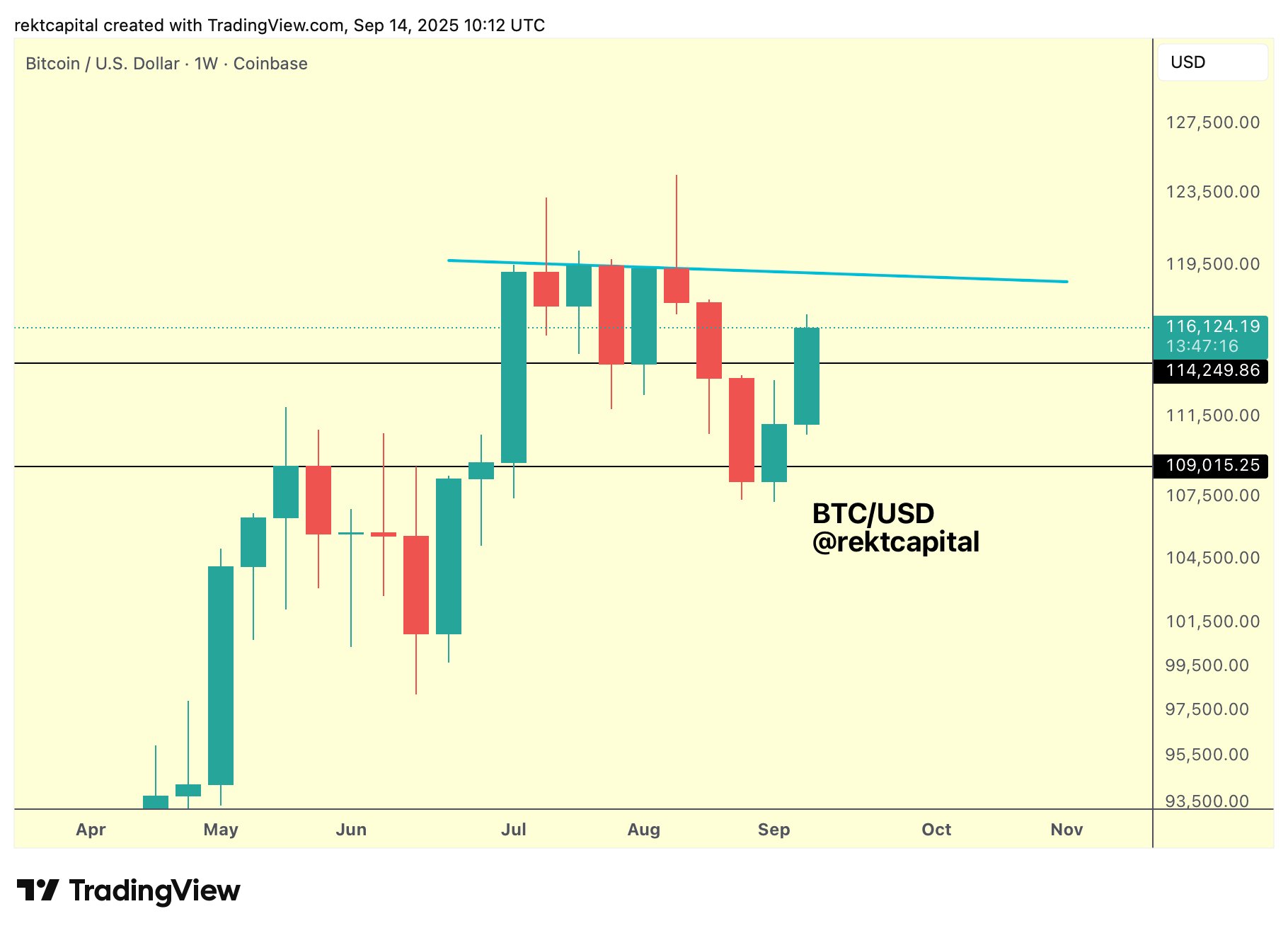

” The objective isn’t for Bitcoin to break $117k in the short-term,” he discussed in his newest X post.

” The objective is for Bitcoin to recover $114k into assistance initially. Since that’s what would make it possible for the premium-buying essential to get cost above $117k later.”

Rekt Capital was amongst those eventually seeing brand-new all-time highs throughout the existing booming market, arguing that Bitcoin might not have actually peaked at $124,500.

A weekly close above $114,000 would be “bullish,” he included on the day.

Markets remain dead set on Fed rate cut

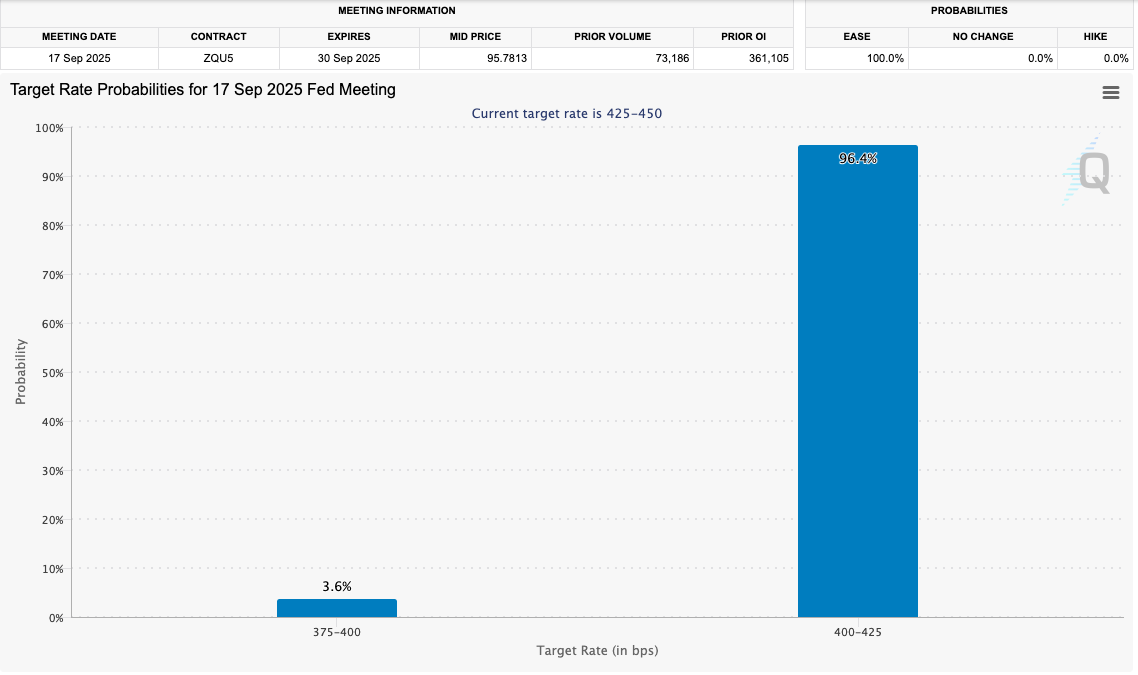

The coming week’s primary focus was the United States Federal Reserve’s choice on rate of interest.

Related: Bitcoin ‘sharks’ include 65K BTC in a week in crucial need rebound

As Cointelegraph reported, markets all saw policymakers cutting rates by a minimum of 0.25%. Broadly encouraging United States macro information prints sealed that conviction.

In its newest market upgrade on Sept. 11, trading company Mosaic Possession Business was positive about the outlook for threat possessions in Q4 and beyond.

” The mix of enhancing leading indications, continuous loose monetary conditions, and strong market breadth that consists of involvement by cyclical markets prefers a continuous financial growth in my viewpoint,” its author composed.

” That supports the revenues outlook which is eventually great for stock rates at the very same time the Fed is set to resume rate cuts. That might produce an exceptional trading environment into next year.”

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.