Bitcoin (BTC) has a brand-new gold-inspired $155,000 target, as analysis explains both properties as “extremely excellent.”

In a post on X on April 16, popular trading and analytics account Cryptollica forecasted BTC/USD copying gold to strike brand-new all-time highs next.

Analysis sees essential BTC cost resemblances to gold

Bitcoin has actually made the headings for its failure to follow in gold’s record-breaking steps in 2025.

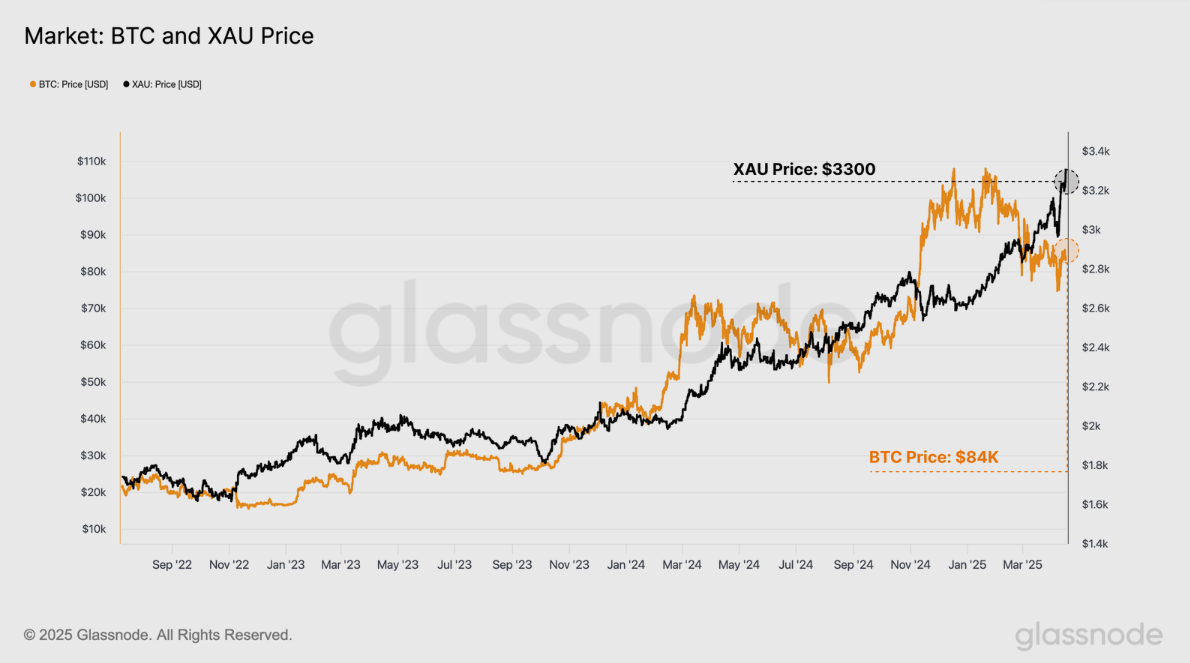

While XAU/USD continues to see repetitive record highs, BTC/USD is down 9.3% year-to-date, information from Cointelegraph Markets Pro and TradingView programs.

In spite of require an impending “blow-off top” for gold, Bitcoin bulls hope that after a hold-up of a number of months, its “digital” equivalent will do the same.

For Cryptollica, this implies BTC/USD breaking out of a consolidatory wedge structure to quickly recover 6 figures– and more.

” Bitcoin midterm target: 155K $,” it informed X fans.

BTC cost efficiency currently has different possible tailwinds at its disposal, all of which have actually sustained bull runs in the past.

As Cointelegraph reported, these consist of a decreasing United States dollar index (DXY) and all-time highs in the international M2 cash supply.

Bitcoin “extremely excellent” throughout trade war

Continuing, onchain analytics firm Glassnode argued that in spite of the cost efficiency variation, Bitcoin and gold have actually weathered the existing macroeconomic storm extremely well.

Related: Can 3-month Bitcoin RSI highs counter bearish BTC cost ‘seasonality?’

” In the middle of this chaos, the efficiency of difficult properties stays extremely excellent,” it summed up in the current edition of its routine newsletter, “The Week Onchain,” released on April 16.

” Gold continues to rise greater, having actually reached a brand-new ATH of $3,300, as financiers leave to the standard safe house possession. Bitcoin sold to $75k at first along with threat properties, however has actually considering that recuperated the weeks gains, trading back up to $85k, now flat considering that this burst of volatility.”

Glassnode stated that gold and BTC are “progressively getting in the centre phase as international neutral reserve properties.”

In regards to the BTC cost drawdown, experts worried the reality that by historic requirements, the dip versus all-time highs stays modest at around 30%.

” In prior macroeconomic occasions like recently, Bitcoin has generally knowledgeable higher than -50% sell-offs in such occasions, which highlights a degree of toughness of modern-day financier belief towards the possession throughout damaging conditions,” it composed, describing the continuous US-China trade war.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.