Bottom line:

-

Bitcoin liquidity video games continue as pressure installs on $100,000 assistance.

-

Indications of rate forming a greater low integrate with RSI strength gradually increasing.

-

A Bitcoin “bottoming stage” is now in development, states brand-new research study.

Bitcoin (BTC) threatened $100,000 assistance once again Friday as bulls expected a greater low.

BTC rate comes down with “liquidity herding video game”

Information from Cointelegraph Markets Pro and TradingView revealed BTC rate action pulling away to near $99,000 around the Wall Street open.

After stopping working to protect a significant relief bounce from multimonth lows, BTC/USD continued to put pressure on bulls and late long positions.

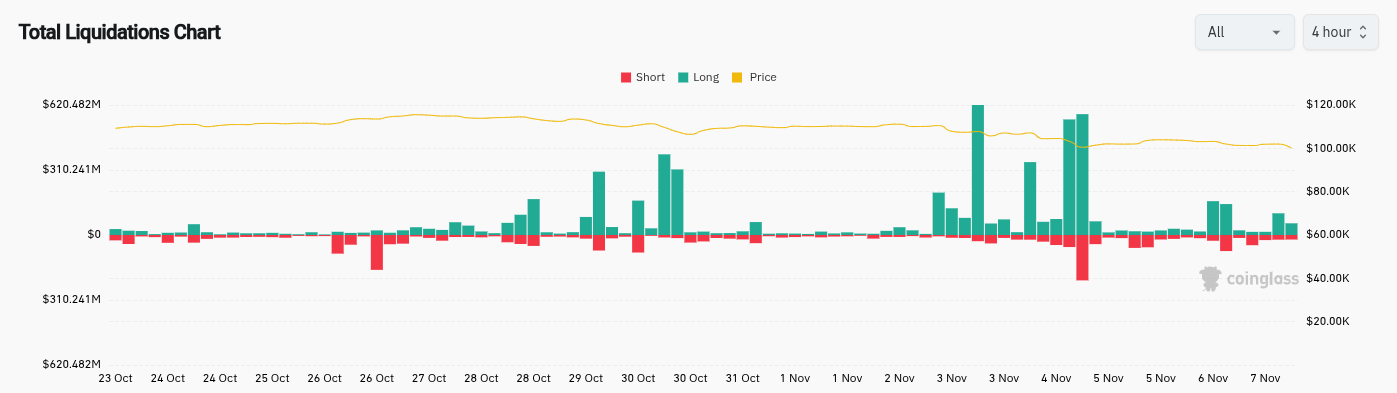

Information from keeping track of resource CoinGlass put 24-hour crypto long liquidations at over $700 million at the time of composing.

Liquidity continued to form both above and listed below the rate, with large-volume traders possibly trying to affect short-term motions.

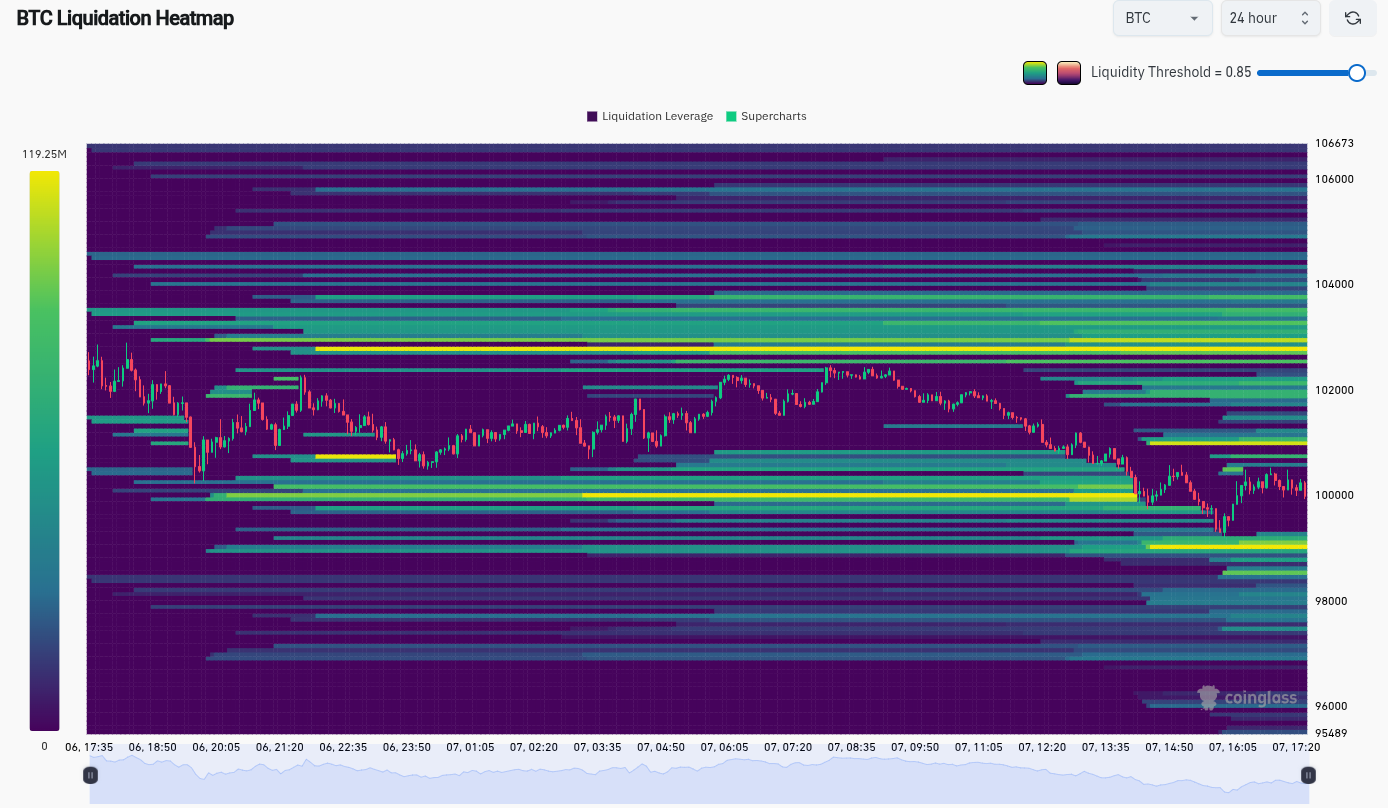

” FireCharts reveals $57M in $BTC quote liquidity appearing as plunge security at $99k,” trading resource Product Indicators composed on X, along with information from among its exclusive trading tools.

” Not encouraged they wish to get filled. This seems like another round of the liquidity herding video game. Seeing to see if it goes up with rate, or carpets if rate goes back.”

Analyst Exitpump on the other hand considered open interest (OI) for indications of a low-time frame healing.

$BTC Another round of huge OI boost, shorts remained in control, however not for longer, rate is recuperating from big quotes, some indications of strength that can result in correct brief capture, NYO will be necessary. pic.twitter.com/rowlJKvsbA

— exitpump (@exitpumpBTC) November 7, 2025

On the per hour chart, the rate tried to form a greater low, while the relative strength index (RSI) information likewise revealed a rebound forming from the “oversold” 30/100 limit.

” It’s either taking a greater low here or we got another stab lower delegated tidy up the lows + get the staying longs,” trading account CRG continued, alerting that BTC/USD had yet to show any strength.

Little required to begin “next rally” on Bitcoin

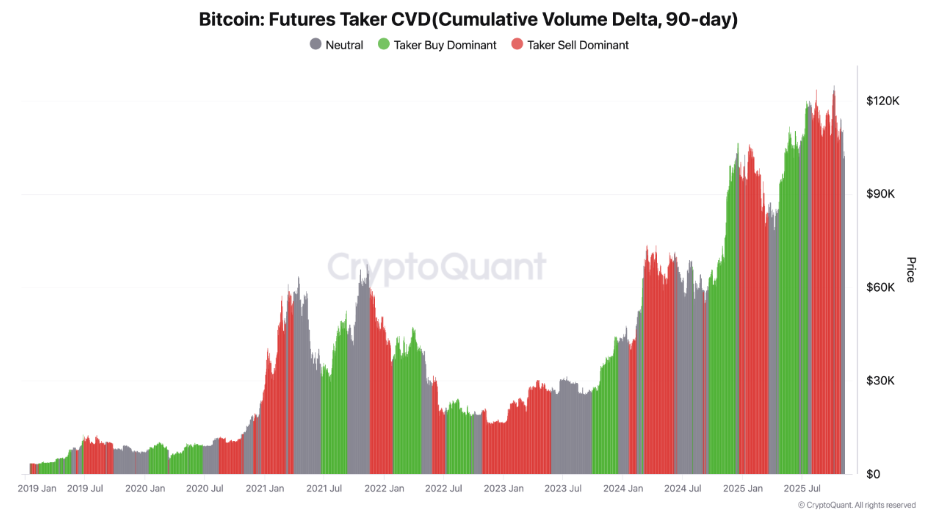

Summing up the present market, onchain analytics platform CryptoQuant concluded that Bitcoin remained in a “bottoming stage.”

Related: Bitcoin rate 21% dip ‘regular’ as accumulator wallets purchase 50K BTC in day

Numerous charts supported its thesis, consisting of cumulative volume delta (CVD) on Bitcoin futures.

” Speculative selling pressure is fading,” factor Sunny Mommy composed in among its “Quicktake” article on the day.

While area CVD was still “a little bearish,” an absence of mass required selling amongst traders pointed the method to market relief, Mommy stated.

” Simply put: this still appears like a bottoming stage. A little excellent news might be all it requires to trigger the next rally,” the post included.

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.