Bottom line:

-

Bitcoin has actually seen its biggest 30-day illiquid supply boost of the present booming market.

-

Illiquid supply now stands at 14 million BTC, more than ever in the past.

-

Whales are still building up as the cost go back to 6 figures.

Bitcoin (BTC) financiers are turning the BTC supply more illiquid than at any point in its history

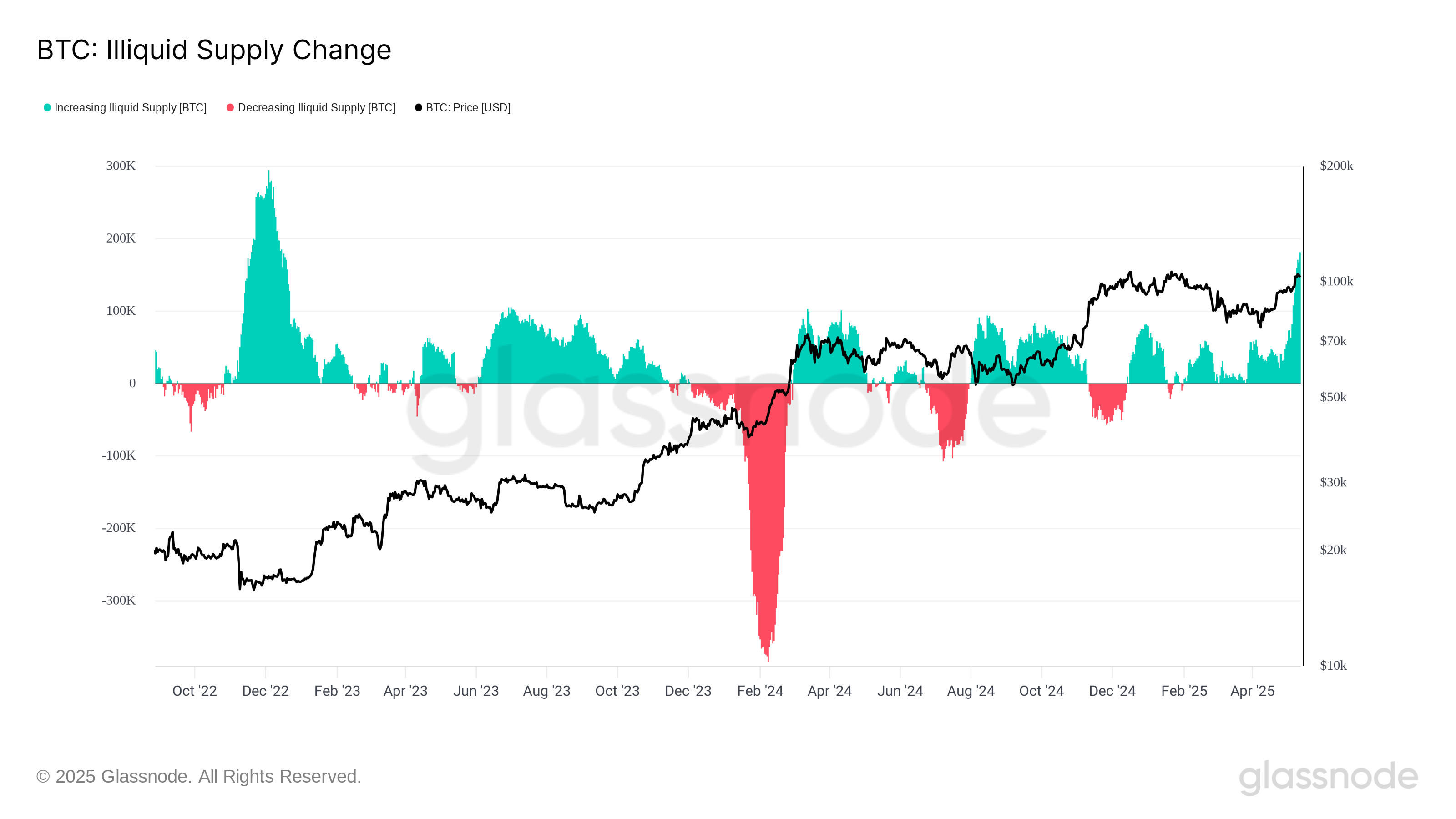

Information from onchain analytics platform Glassnode reveals that Bitcoin’s “illiquid supply” has actually reached a record 14 million BTC.

Bitcoin illiquid supply go back to all-time highs

Bitcoin is progressively discovering its method into the hands of entities that do not offer what they obtain.

Glassnode, which charts the part of the BTC supply owned by so-called “illiquid entities,” exposes that this has actually reached levels not seen throughout the present booming market.

An entity is thought about illiquid if the ratio in between its cumulative BTC inflows and outflows is listed below a particular worth.

” This ratio yields a number L in between no and one, with bigger worths suggesting greater liquidity,” it discussed in a devoted guide.

” Liquidity is for that reason the degree to which an entity invests the possessions it gets. Illiquid entities are those that hoard coins in anticipation of a long-lasting BTC cost gratitude.”

Illiquid supply stood at simply over 14 million BTC today, with the 30-day rolling boost being available in at 180,000 BTC, its biggest dive given that December 2022.

At the time, the previous bearishness was concerning an end, with BTC/USD decreasing 77% to strike long-lasting lows of simply above $15,000 at the same time.

Whale BTC build-up “considerable”

As Cointelegraph continues to report, this bull cycle stands apart in regards to financial investment patterns thanks to increasing institutional involvement.

Related: BTC bulls get ‘most significant signal’– 5 things to understand in Bitcoin today

Business treasuries, such as that of service intelligence company Technique, have actually integrated with the United States area Bitcoin exchange-traded funds (ETFs) to make Bitcoin a mainstream financial investment target.

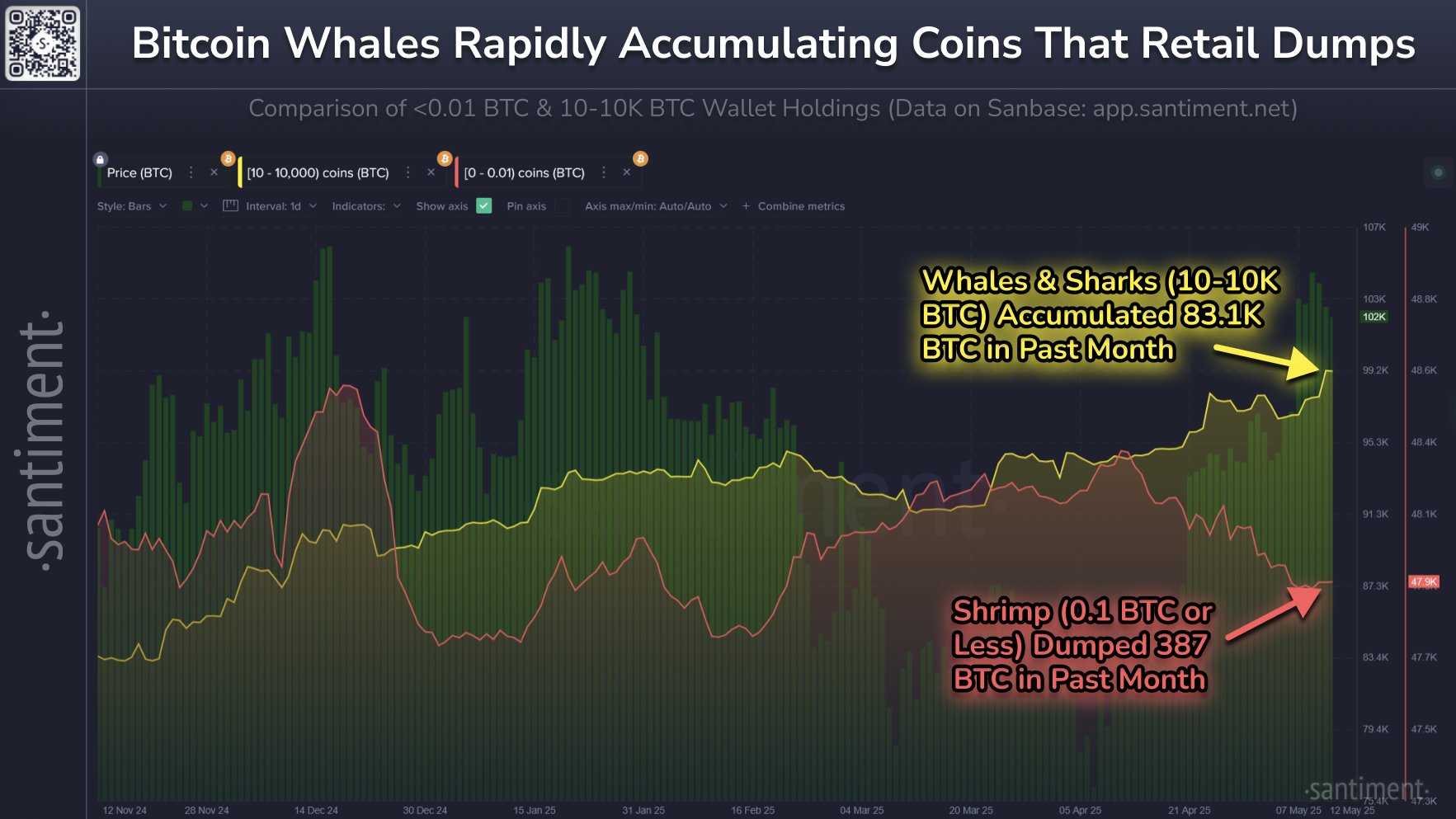

Onchain information similarly reveals that Bitcoin whales have actually collected throughout the current BTC cost rebound. Just retail financiers seem panicking.

” Bitcoin’s essential whale & & shark tier (holding 10-10K BTC) have actually now collected 83,105 more BTC in the previous one month,” research study company Santiment reported in an X post today.

” On the other hand, the tiniest retail holders (holding

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.