Bottom line:

-

Business Bitcoin treasuries such as Method’s are anticipated to drain pipes OTC desks and after that exchanges.

-

The resulting supply imbalance will “uncork” BTC cost action.

-

In the meantime, profit-taking is still a significant top priority for existing hodlers.

Bitcoin (BTC) need from non-prescription (OTC) desks and exchanges will “uncork” BTC cost development, a brand-new projection stated.

In brand-new X material Wednesday, swing trader Chaos Capital Pres bank on a fresh Bitcoin supply shock.

OTC desk BTC balances indicate price “uncork”

Bitcoin is set to be “uncorked” as decreasing reserves on exchanges and OTC desks produce a supply imbalance.

Chaos Capital Pres, which champs Bitcoin treasury business Method (MSTR) as the “most uneven sell the marketplace,” sees need just increasing from there.

“$ MSTR purchases the majority of its BTC from OTC trade desks. MSTR purchased 182,391 BTC YTD,” it kept in mind, mentioning a Cointelegraph report.

” OTC trade desks’ cumulative balances are down to around 155,000 BTC. As the OTC desks run low, the need on the general public exchanges will increase, which is what will uncork BTC’s cost.”

As Cointelegraph reported, business Bitcoin treasuries’ BTC direct exposure increased by 630 BTC on Monday alone, even as BTC cost action wobbled around three-week lows.

Method, which has the most significant Bitcoin treasury of any public business, has actually acquired BTC nearly weekly in 2025, despite cost.

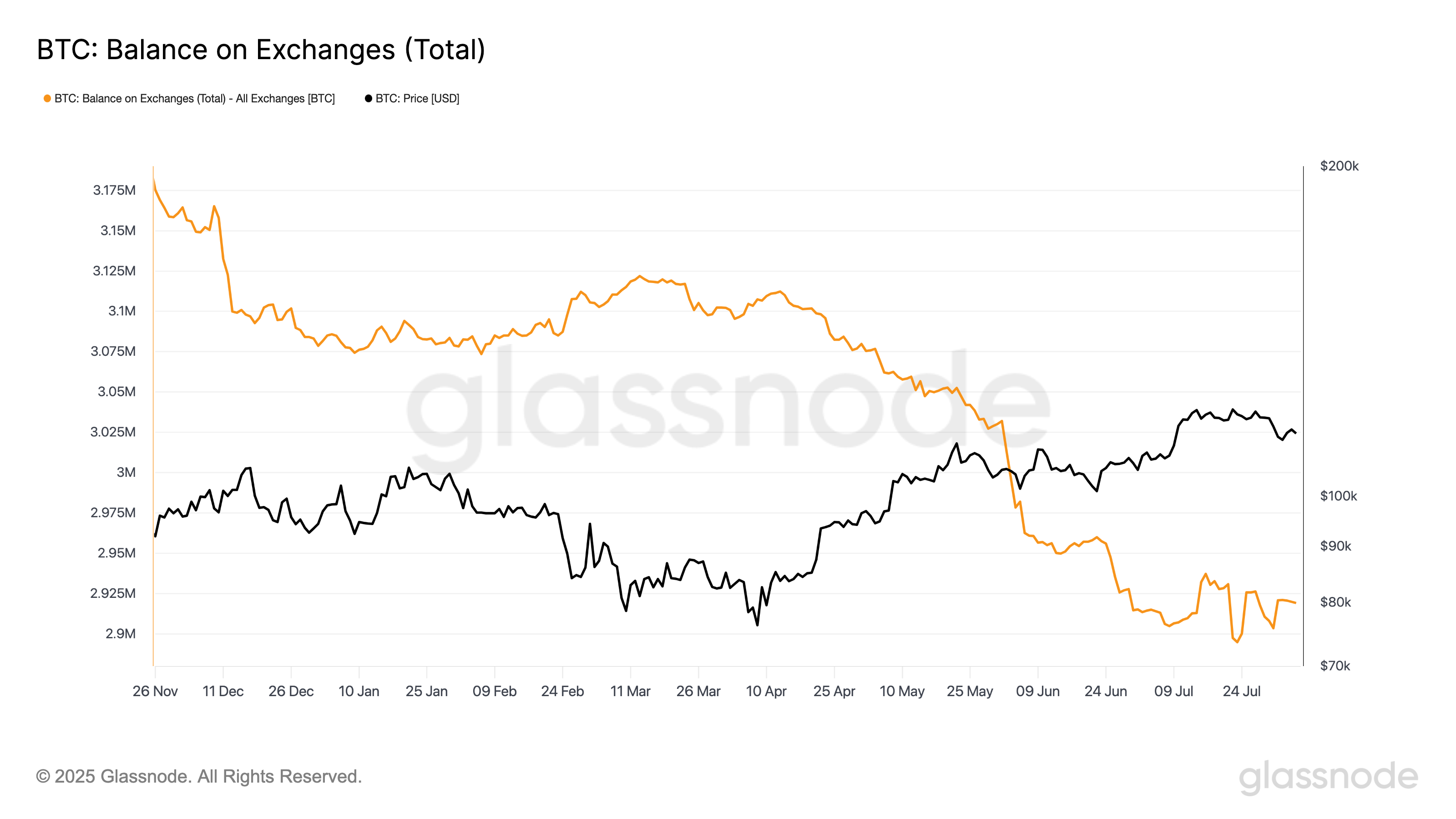

Exchanges have actually seen their BTC reserves begin to bottom out over the previous month as long time hodlers earnings.

Onchain analytics firm Glassnode put combined exchange balances at 2.919 million BTC since Tuesday.

” In amount, the marketplace has actually moved from ecstasy to reassessment, with oversold conditions and seller fatigue meaning prospective for a bounce,” onchain analytics firm Glassnode summed up in the current edition of its routine newsletter, Market Pulse.

” Nevertheless, fragility is growing, and the structure stays susceptible to external unfavorable drivers or postponed need revival.”

Spotlight on “noteworthy” understood earnings

Profit-taking continues to include high up on the radar for market individuals amidst worries of a much deeper BTC cost correction.

Related: Bitcoin analysis cautions BTC cost ‘going lower’ initially as $113K slips

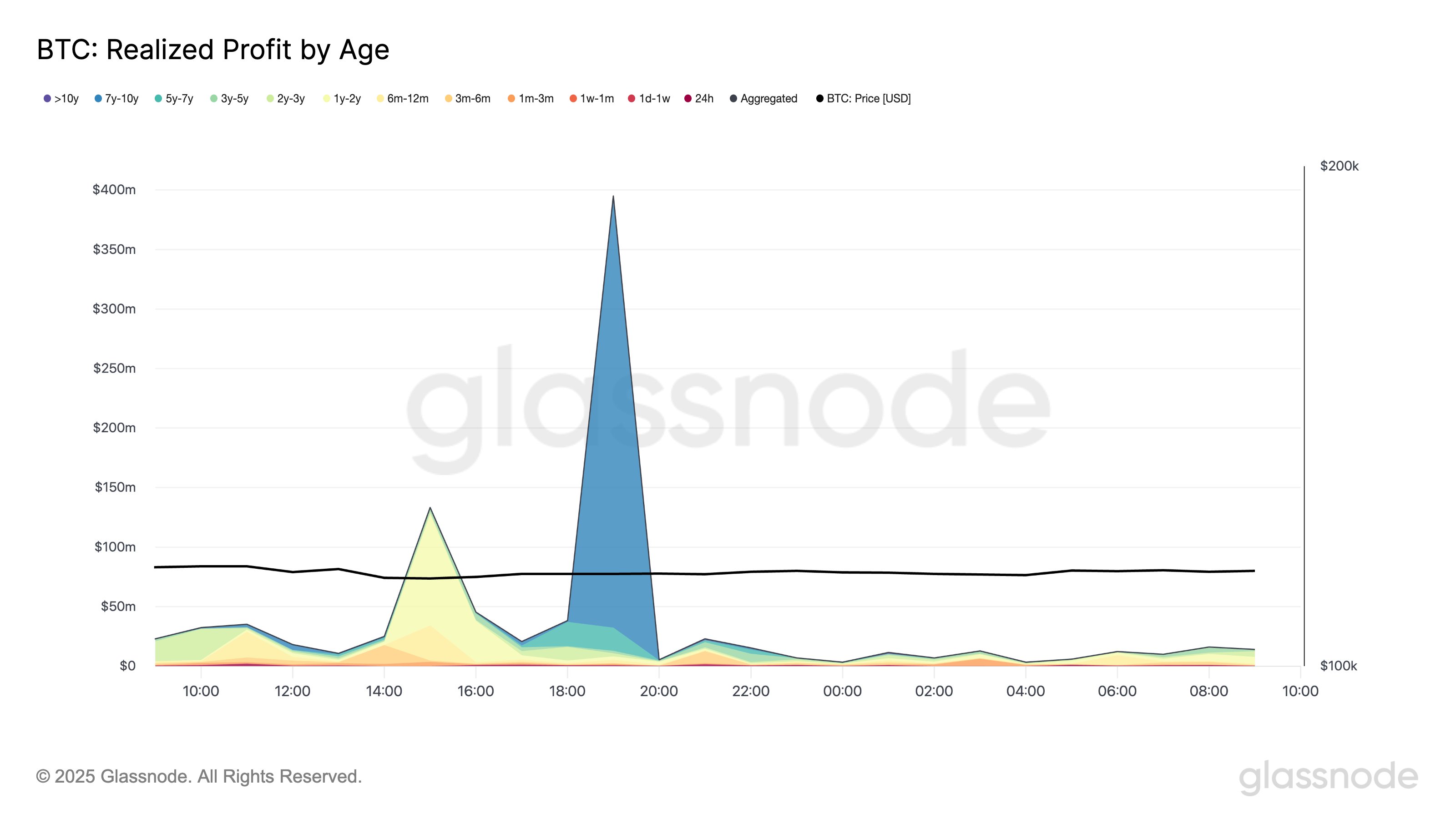

Glassnode determined 24-hour understood earnings through Wednesday at over $1 billion.

“$ 362M (≈ 35.8%) originated from ancient coins held for 7– ten years – an uncommon occasion that might show internal transfers or real exits,” it informed X fans.

” Another $93M originated from 1– 2 year holders, likewise marking noteworthy earnings awareness.”

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.