Secret takeaways:

-

Bitcoin rate preserves its bullish momentum, however a belief sign recommends the marketplace might be overheating.

-

Information highlights Bitcoin traders taking earnings and an uneven market angled towards longs.

-

Experts caution of a prospective short-term correction, specifically if gold deteriorates or seasonal patterns play out.

Optimism has actually gone back to the crypto markets, and numerous traders think Bitcoin (BTC) rate is on the course to brand-new all-time highs. In simply one month, Bitcoin rose 39%, briefly crossing the $105,000 mark. According to Glassnode experts, “there are indications of restored market strength, and the marketplace is trading within a profit-dominated program.”

Still, not everybody is persuaded the rally will continue unattended. Some financiers are currently taking earnings, pressing Bitcoin’s understood cap to an all-time high of $889 billion. A lot more profit-taking is anticipated at the $106,000 level.

Historically, blissful market belief has actually typically caused durations of debt consolidation– and even sharp corrections. That danger might be growing, especially as gold, whose rate action Bitcoin has actually carefully mirrored in current months, is revealing indications of tiredness and might be heading for a correction itself.

A lot of financiers are back in revenue

The current Bitcoin rally has actually returned over 3 million BTC to a successful state, according to Glassnode. This shift has actually reignited capital inflows, which surpassed $1 billion each day, recommending strong demand-side interest and a market ready to soak up selling pressure. Even most short-term holders who were undersea considering that the December 2024 peak have actually seen their portfolios turn green.

This relief, both monetary and mental, is currently equating into costs habits. The net distinction in between short-term holders’ transfer volume in revenue versus at a loss has actually swung dramatically to +20%– a significant turnaround from the -20% seen throughout the capitulation stage at the end of April.

Institutional financier self-confidence is likewise rebounding. Over the previous 3 weeks, more than $5.7 billion has actually streamed into Bitcoin ETFs, according to CoinGlass. The overall properties under management held within the United States area ETFs have actually now reached over 1.26 million BTC, a brand-new all-time high.

Are crypto traders too blissful today?

With a lot momentum, it’s simple to think of a moonshot. However that very same momentum might be trigger for care. BTC’s open interest has actually reached $68 billion, near all-time highs, suggesting a greatly located market. In such conditions, even a little driver might trigger an outsized relocation– up or down.

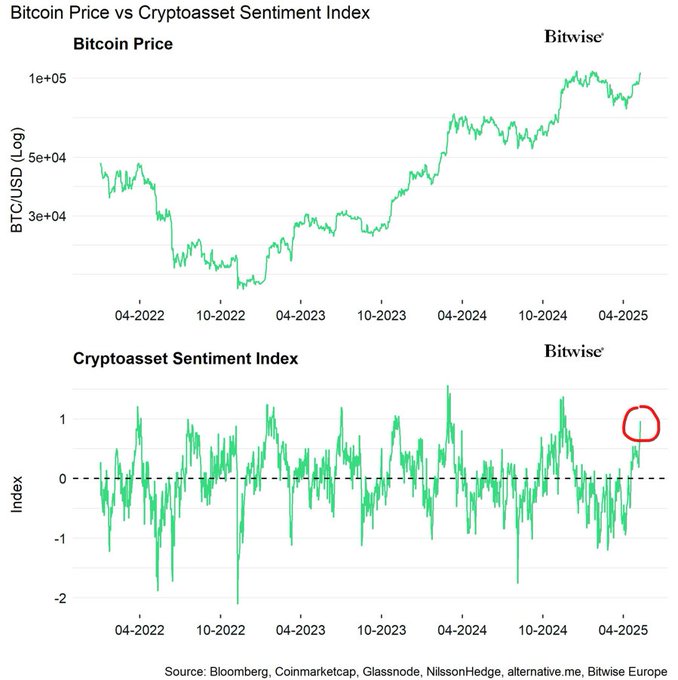

André Dragosch, head of research study at Bitwise Property Management, cautioned that Bitcoin may be getting a bit ahead of itself. He published Bitwise’s internal Cryptoasset Belief Index, which has actually reached its greatest level considering that November 2024. The index, that includes 15 sub-indicators covering belief, streams, onchain information, and derivatives (such as the continuous financing rate and put-call volume ratio), now reveals an overheated market.

In remarks to Cointelegraph, Dragosch stated,

” The current readings indicate that market belief has actually ended up being overheated which placing seems one-sided on the long side. It tends to indicate an increased danger for a momentary pull-back in the rate of Bitcoin, which the present rally might take a break.”

Yet, Dragosch stays “structurally positive” up until completion of 2025, pointing out the continued BTC build-up by corporations and ETPs, which continues to diminish Bitcoin on-exchange balances.

Related: Arizona guv eliminates 2 crypto costs, punish Bitcoin ATMs

P otential crypto market headwinds

A number of dangers might challenge Bitcoin in the short-term.

For Bitwise primary financial investment officer Matt Hougan, restored regulative unpredictability is a leading issue, especially after the Senate stalled stablecoin legislation recently.

Wider shifts in market habits might likewise be at play. Because March 2025, Bitcoin has actually revealed a more powerful connection with gold than with equities. That shift followed significant modifications in United States policy, which appeared to guide capital towards politically neutral properties: both Bitcoin and gold increased 22% (the latter considering that remedied to a 13% gain). At the very same time, the S&P 500 and Nasdaq-100 simply clawed back previously losses.

This divergence advances much shorter amount of time. Because Might 12, significant United States indexes got 3% to 4% on favorable advancements in US-China trade relations, however Bitcoin hardly budged. On the other hand, gold has actually begun printing lower highs– a prospective early signal of a drop, as kept in mind by expert Michael Van de Poppe. If gold gets in a restorative stage, Bitcoin may do the same.

Seasonality might likewise contribute. The expression “Offer in Might and disappear” has some historic support. As expert Daan Crypto Trades kept in mind, May has actually normally been a green month for Bitcoin (balancing over 8%), while June and September are typically the worst-performing months. As he put it,

” Seasonality is never ever something to entirely base your choices on, however it can exercise well. Numerous financiers are viewing the very same thing after all.”

Whether this rally has more space to run– or is due for a breather– might quickly be tested.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.