Bitcoin (BTC) rebounding is now “extremely likely” as BTC cost action sets another bearish record.

Bottom line:

-

Bitcoin has actually never ever traded up until now listed below its 200-day moving average, information programs.

-

BTC cost action is due “suggest reversion” as an outcome.

-

Analysis explains a “macro-driven” Bitcoin bearish market now in development.

Bitcoin sees among its fastest cost drawdowns

Brand-new analysis from Martin Leinweber, director of digital property research study and method at European index company MarketVector Indexes, states Bitcoin’s long-lasting financial investment thesis is “undamaged.”

BTC cost action has actually never ever wandered off up until now from its 200-day easy moving average (SMA), and Leinweber stated the dip listed below $60,000 was anything however “typical.”

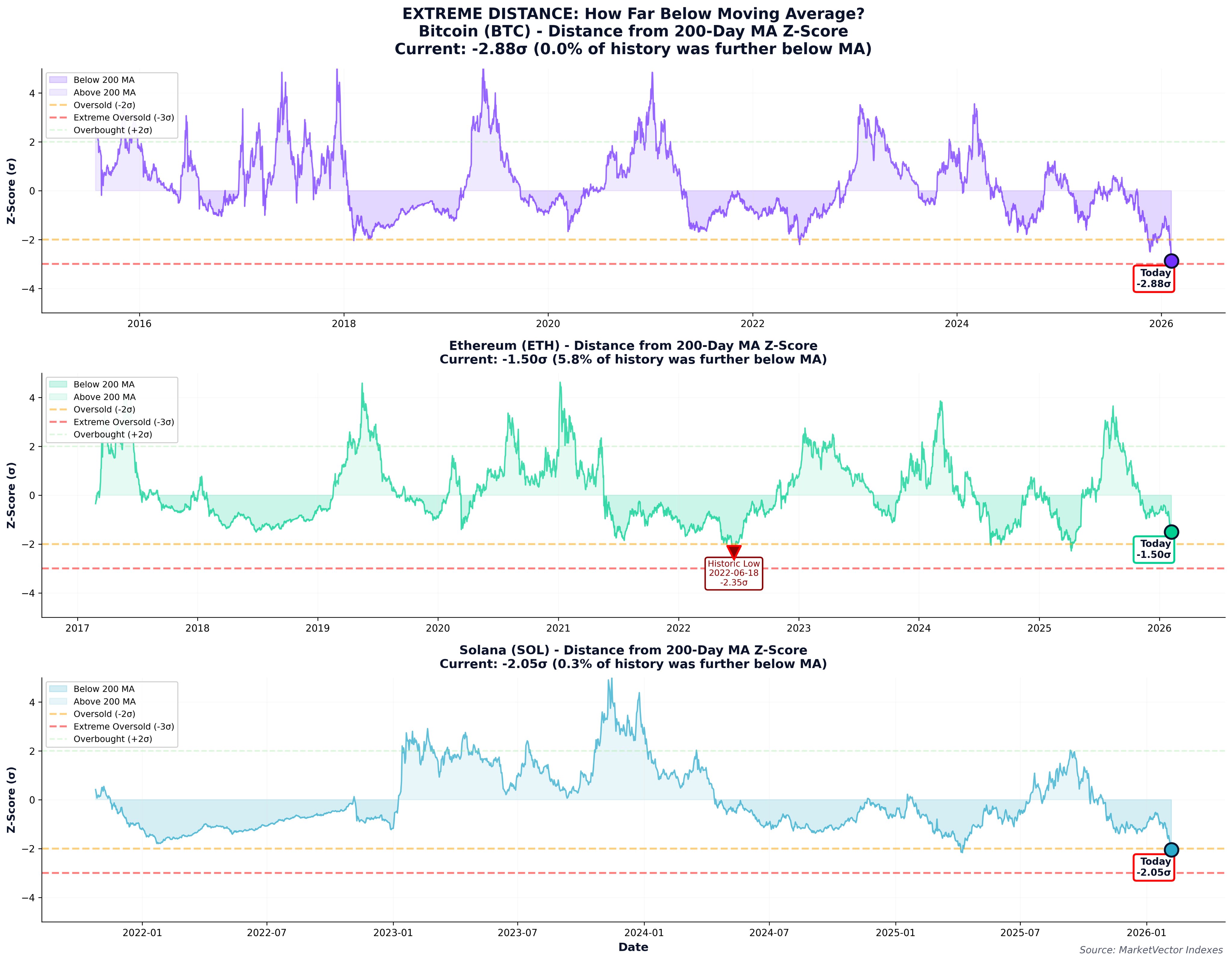

” Bitcoin is -2.88 σ listed below its 200-day moving average. In ten years of information, this has actually never ever took place previously. Not throughout COVID. Not throughout FTX. Never ever,” he composed in an X thread on Friday.

The analysis positions today’s crash amongst Bitcoin’s 15 fastest, with BTC/USD coming by more than 22% in a single week, an even worse rate than in 98.9% of its history.

” When you remain in the 99th percentile of bad results, suggest reversion ends up being extremely likely,” Leinweber continued.

2.88 basic variances listed below the 200-day SMA, nevertheless, has actually never ever occurred before, and sees Bitcoin beat the drawdowns for significant altcoins Ether (ETH) and Solana (SOL).

” We’re not at generational lows yet. However we ARE at analytical extremes throughout several signs,” the analysis stated.

Regardless Of that, Leinweber is not in a rush to anticipate a long-lasting BTC cost bottom, arguing that the present flooring might just be a “regional” one.

Zooming out, on the other hand, there stays factor to think in the Bitcoin bull case.

” Bearishness = macro driven, not tech failure. Long-lasting thesis undamaged,” the X thread concluded.

Bitcoin dip-buying requirements “persistence”

Previously, Cointelegraph reported on the record-breaking nature of current BTC cost losses.

Related: BTC cost heads back to 2021: 5 things to understand in Bitcoin today

Thursday saw Bitcoin’s first-ever $10,000 red everyday candle light, with liquidations beating considerable bearish occasions in the past, consisting of the COVID-19 crash and implosion of exchange FTX.

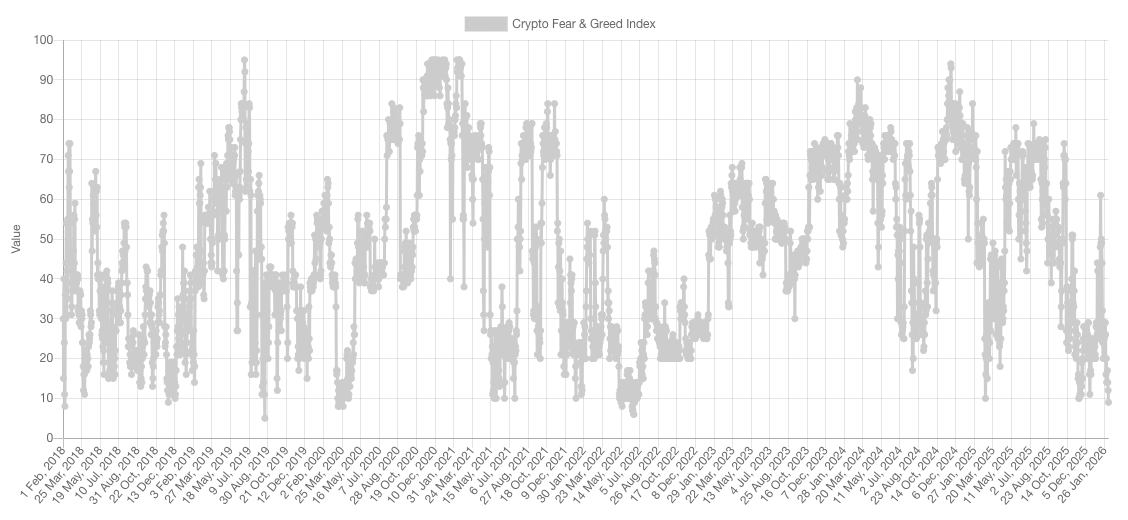

Belief dropped to severe lows, as determined through the Crypto Worry & & Greed Index’s 9/100 rating.

At the exact same time, indications that large-volume financiers were purchasing the dip rapidly emerged, with the concentrate on hedge funds and Binance.

Examining the wave of liquidations in current weeks, trader Daan Crypto Trades was amongst those considering a possibly rewarding purchasing chance.

“$ BTC Bouncing from the middle of the 2024 variety. Rate sold -38% in simply a couple of weeks and a great deal of big leveraged positions have actually been erased,” he informed X fans.

” Good time if you are more money heavy and have the persistence to collect or make money from the volatility.”

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we make every effort to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might consist of positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage emerging from your dependence on this info.