Bitcoin might be on the brink of recovering its all-time high of $111,970, however crypto experts state there’s little basic assistance for the possession to meaningfully break above the level.

” The danger of a short-term correction continues to construct– specifically in the lack of a strong driver to press Bitcoin decisively above the existing all-time high,” Bitfinex experts stated in a report on Monday.

Bitcoiners are confronted with a difficult call as Bitcoin approaches ATH

” Without a strong macro or structural benefit driver, Bitcoin is susceptible to short-term corrections, especially as long-lasting holders disperse into strength,” they stated.

The experts stated that Bitcoin (BTC) holders are now confronted with an important choice whether to sell or not.

” Market individuals still holding coins from Q1 2025, and who held through the sharp drawdown listed below $80,000, are now being checked as the rate churns sideways near ATH levels,” they stated.

Throughout the very first quarter of 2025, Bitcoin struck a low of $78,513. It is trading at $109,519 at the time of publication, simply 3 months later on, according to CoinMarketCap information, putting financiers who purchased that low point up by 39%.

The experts stated whatever the long-lasting holders choose to do “will assist specify the next leg of the marketplace structure.” They cautioned that an abrupt sell-off by Bitcoin long-lasting holders might result in an extended debt consolidation stage.

It isn’t uncommon for Bitcoin to get in a combination stage after reaching brand-new all-time highs. In March 2024, Bitcoin reached an all-time high of $73,679 before getting in a combination stage, swinging within a series of around $20,000 up until Donald Trump was chosen as United States president in November.

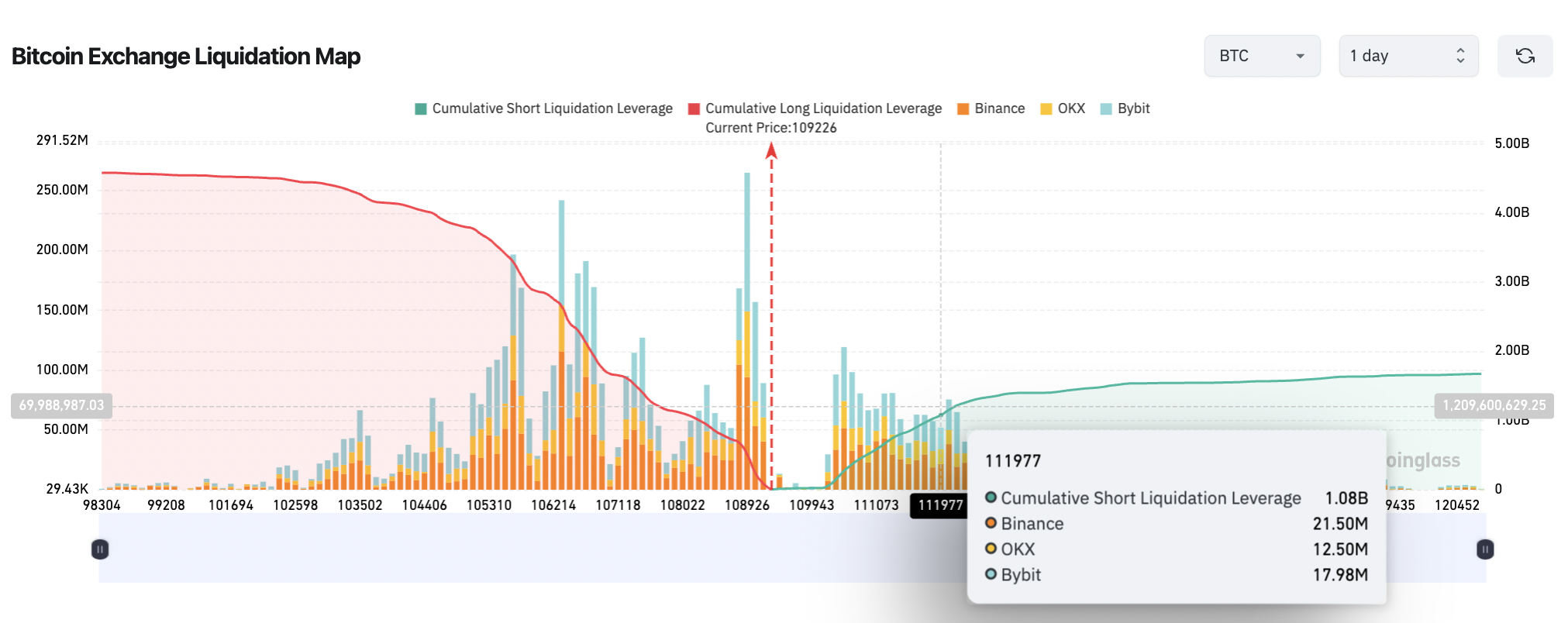

$ 1B in other words positions at danger if Bitcoin recovers ATHs

In Spite Of being 2.2% off Bitcoin’s all-time high of $111,970, not all traders are persuaded, with around $1.08 billion in other words positions set to be liquidated if it strikes the rate point, per CoinGlass information.

Experts are presently considering macro occasions such as the United States Federal Reserve’s approaching rates of interest choice and advancements associated with United States President Donald Trump’s tariff policies.

Experts are considering the next Fed choice

The Federal Reserve is set to reveal its next rates of interest choice on June 18, an essential occasion that numerous market individuals look for macroeconomic signals.

Rates of interest cuts are thought about a bullish sign for risk-on possessions like Bitcoin and other cryptocurrencies.

Related: Bitcoin rate will see ‘short-term correction’ before $140K: Experts

On the other hand, Swyftx lead expert Pav Hundal just recently informed Cointelegraph that the continuous loop of tariff unpredictability from United States President Donald Trump is the most considerable danger for those wagering huge on Bitcoin over the next 2 months.

” The most significant hazard to bulls today is that absolutely nothing modifications over the next 2 months, and we simply remain caught in this cycle of limitless tariff final notices,” Hundal stated.

Publication: Child boomers worth $79T are lastly getting on board with Bitcoin

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.