Secret Takeaways:

-

The Bitcoin long-lasting holder friend saw a $26 billion worth boost as BTC rate rose to $94,900.

-

Short-term holders cost a loss in early April.

-

Bitcoin’s 30% correction lines up with historic cycles, and BTC might discover assistance in the $88,750 and $91,000 zone.

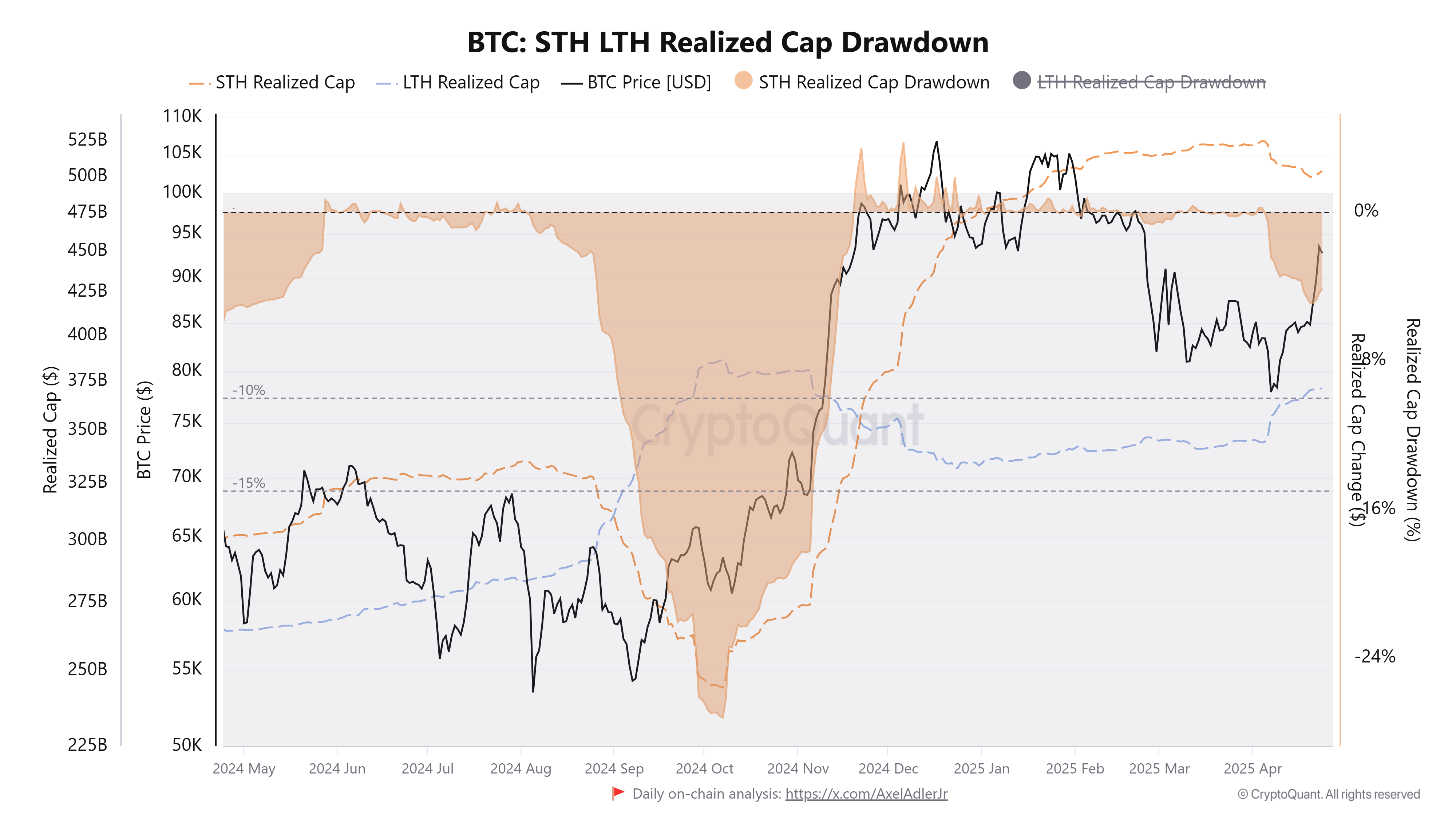

Bitcoin (BTC) long-lasting holders (LTHs) substantially increased their cumulative wealth in April as BTC rate rose from $74,450 to $94,900. According to information from CryptoQuant, the long-lasting holders (LTHs) recognized market cap increased from $345 billion to $371 billion in between April 1 and April 23, marking a $26 billion gain.

This sharp boost in LTH recognized cap signals that long-lasting holders are rewarded for strength through current drawdowns. Bitcoin experienced a 30%+ correction in between January and early April, a pattern constant with historic market cycles. Information from previous cycles in 2013, 2017, and 2021 programs that such drawdowns are regular after Bitcoin touches brand-new all-time highs, frequently cleaning weaker hands before resuming its upward pattern.

Other elements likewise highlighted LTH’s conviction throughout the correction duration. Bitcoin’s growing decoupling from conventional markets, especially as United States equities dealt with pressure from the trade wars, enhanced its financial investment appeal. While stocks toppled, gold costs rose to brand-new highs at $3,500, showing financier need for non-correlated properties– a pattern most likely improved LTHs self-confidence in Bitcoin’s store-of-value story.

On the other hand, Cointelegraph reported that short-term holders (STHs) went back to benefit today. Still, numerous cost a loss throughout the April drawdown, showing their propensity to turn positions under market tension. This habits echoes a repeating pattern in 2024, where STHs regularly offered to LTHs throughout corrections.

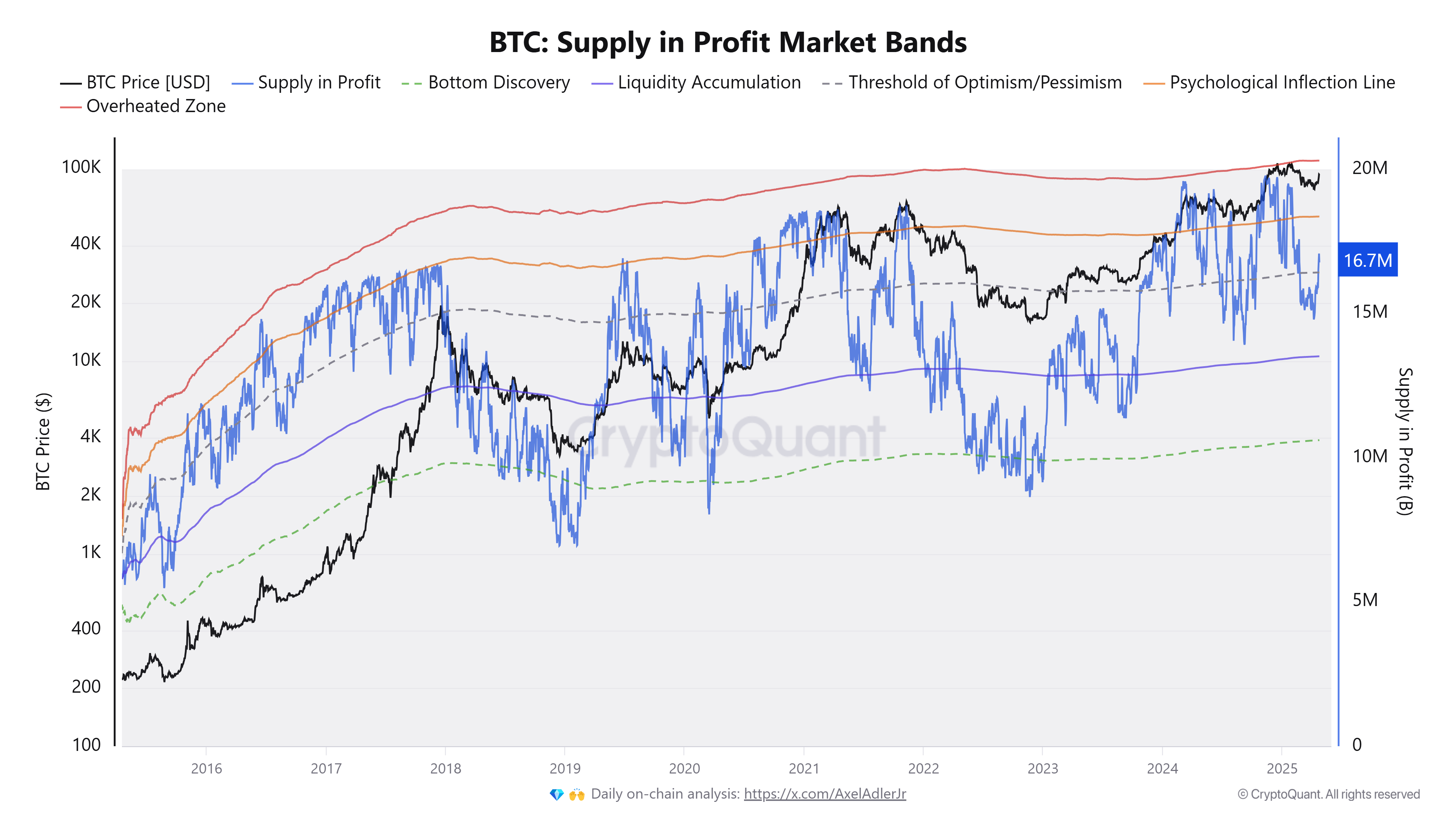

Bitcoin supply in revenue market bands indicates a bullish outlook, after the overall supply in revenue increased above the “limit of optimism”. Presently, 16.7 million BTC in numerous Bitcoin addresses remain in revenue.

Historic information from 2016, 2020, and 2024 reveal that when Bitcoin regularly holds above this crucial bullish zone, it regularly stimulates substantial bull runs, driving costs to brand-new highs within months.

Related: Bitcoin exchange outflows simulate 2023 as whales purchase retail ‘panic’

Bitcoin might develop a brand-new variety in between $95K-$ 90K

Following its increase to $94,900, experts anticipate Bitcoin to possibly go through a cooldown duration. MNCapital creator, Michael van de Poppe, pointed out that after an enormous breakout, it is “relatively regular to have a small correction”.

Also, confidential crypto trader Jelle mentioned that Bitcoin has actually evaluated its weekly resistance in the meantime, and BTC might drop as low as $91,000.

From a technical viewpoint, Bitcoin might combine in between $94,900 and $88,750 in the coming days. Current rate action recommended an extended cooldown following its breakout rally. On the 4-hour chart, the crucial assistance zone lies in between $90,500 and $88,750, representing a reasonable worth space.

A breach listed below this variety might revoke the lower timespan (LTF) bullish structure, possibly driving costs towards the next assistance location in between $84,000 and $86,300, where Bitcoin formerly combined for a week before its strong favorable breakout.

Related: Bitcoin’s next huge resistance is $95K– What will activate the breakout?

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.