Secret takeaways:

-

Long-lasting Bitcoin holders offered 241,000 BTC over the previous 1 month.

-

BTC cost bear flag targets $95,500.

Bitcoin (BTC) long-lasting holders have actually offered more than 241,000 BTC over the previous month. Continued selling might send out the cost towards $95,000 or lower, according to experts.

Bitcoin long-lasting holders offer $26 billion worth of BTC

Bitcoin long-lasting holders (LTHs)– entities holding coins for a minimum of 6 months– have actually begun to unload coins as BTC cost struck brand-new all-time highs above $124,500 in August.

Related: Bitcoin taps $111.3 K as projection states 10% dip ‘worst case situation’

Evaluating the LTH supply modification, CryptoQuant expert Maartunn stated that on a rolling 30-day basis, the supply had actually reduced by a net 241,000 BTC, worth around $26.8 billion at present market value since Monday. He included:

” That is among the biggest drawdowns considering that early 2025.”

This might continue to push Bitcoin’s cost in the coming weeks, especially when combined with whales, who have actually unloaded more than 115,000 BTC over the exact same duration.

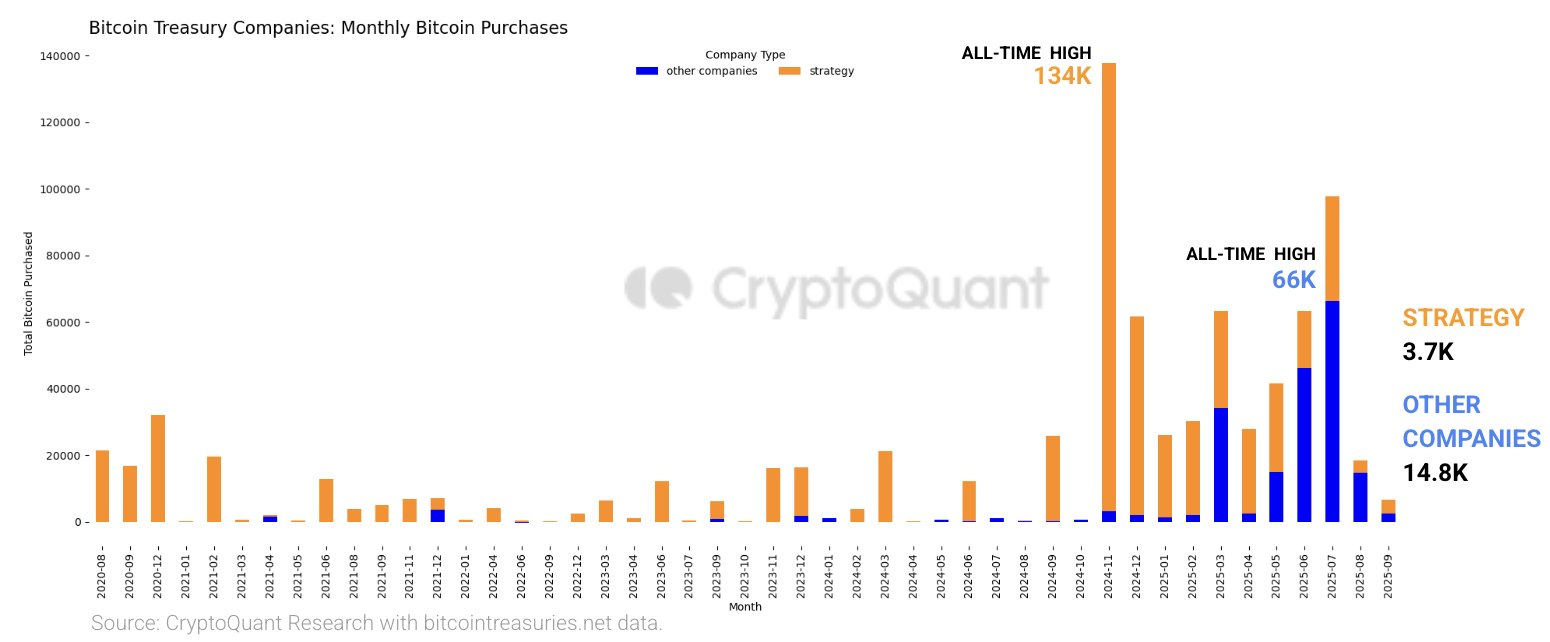

On The Other Hand, regardless of the overall holdings of Bitcoin Treasury Business reaching a record high of 1 million BTC, development has actually slowed dramatically over the previous month.

Technique’s month-to-month buys collapsed from over 134,000 BTC in Nov 2024 to simply 3,700 BTC in Aug 2025, according to information from CryptoQuant.

Other Treasury Business bought 14,800 BTC in August, compared to their record-high purchase of 66,000 Bitcoin June 2025.

” August purchases likewise fell listed below the 2025 month-to-month averages, 26K BTC for Technique and 24K BTC for other companies,” the onchain analytics company stated in its most current Weekly Crypto Report, including:

” Smaller sized, careful deals reveal institutional need is damaging.”

Capriole Investments creator Charles Edwards likewise explains that the rate of business acquiring Bitcoin each day continues to fall, an indication that organizations might be “tired.”

Treasury Business need continues to collapse. The business are still staunchly purchasing, however the rate of business acquiring each day continues to fall. Are organizations tired, or is it simply a dip? pic.twitter.com/3ItN1tVIaU

— Charles Edwards (@caprioleio) September 7, 2025

The minimized purchasing from treasury business even more deteriorates need, intensifying the down pattern.

Bitcoin cost bear flag targets $95,000

Bitcoin dropped 14% from its $124,500 record high reached on Aug. 16 to a seven-week low of $107,500 on Aug. 30, information from Cointelegraph Markets Pro and TradingView programs.

The cost has actually considering that recuperated to the present levels around $111,500.

This cost action has actually printed a bear flag on the everyday chart, as revealed listed below. Bitcoin dropped listed below the flag on Saturday and is now retesting the lower limit of the flag at $112,000 (100-day SMA).

Failure to turn $112,000 into assistance would activate the extension of the drop towards the determined target of the bear flat at $95,500, or a 14.5% drop from the present cost.

Nevertheless, the macro photo looks much healthier, considering that the 13% pullback from all-time is much shallower than previous pullbacks, according to X user Coin Signals.

As Cointelegraph reported, the current forecasts now consist of Bitcoin perhaps dropping listed below $90,000, while still on track for brand-new all-time highs.

Keep In Mind that a 30% drawdown from the present all-time highs puts the BTC cost bottom at $87,000, which lines up with the understood cost of 6-12 months holders.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.