Bottom line:

-

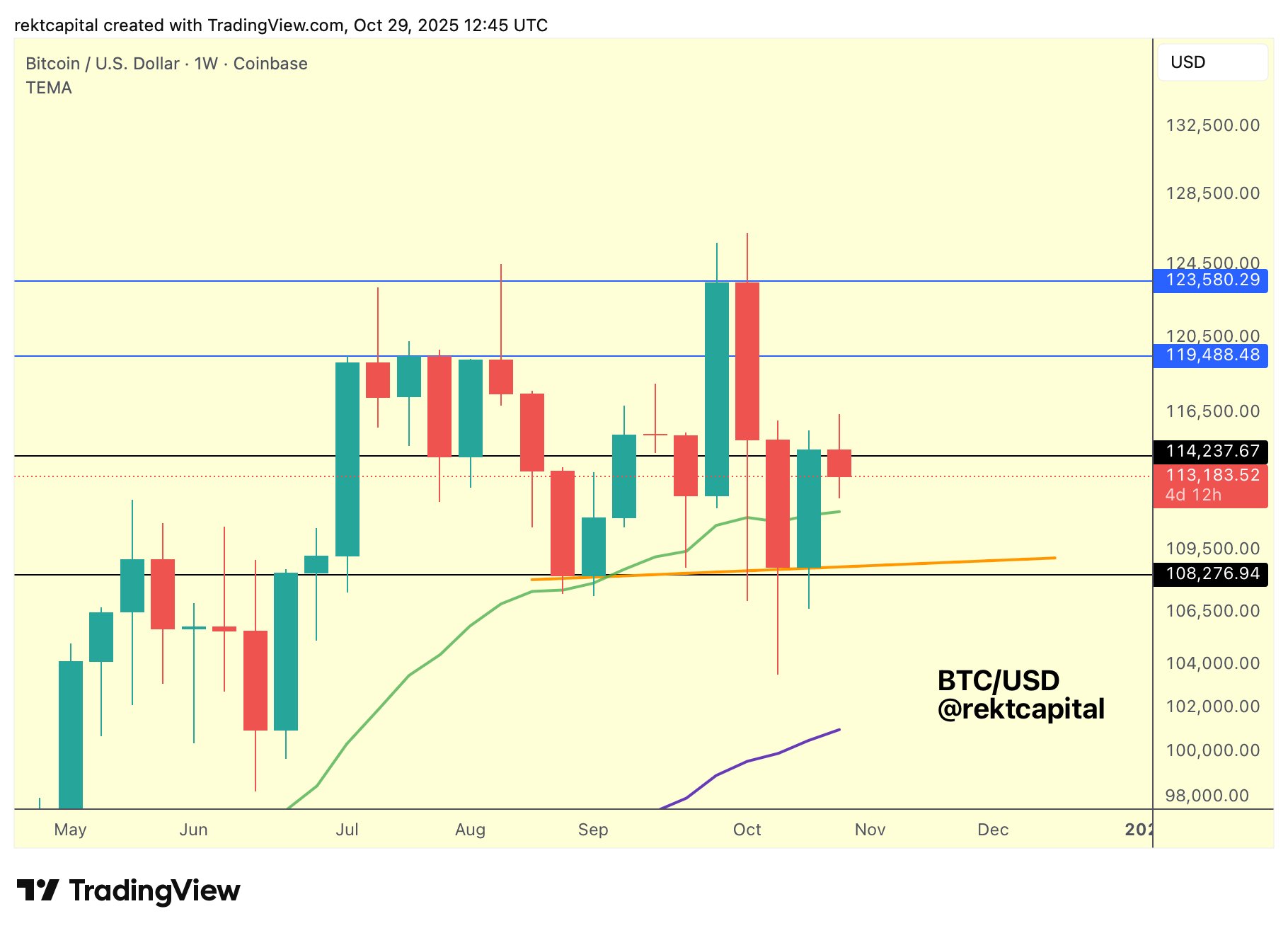

Bitcoin has a hard time to go back to its variety highs after its newest sell-off.

-

BTC rate targets for the brand-new “unstable retest” concentrate on $111,000 and a $114,500 weekly close.

-

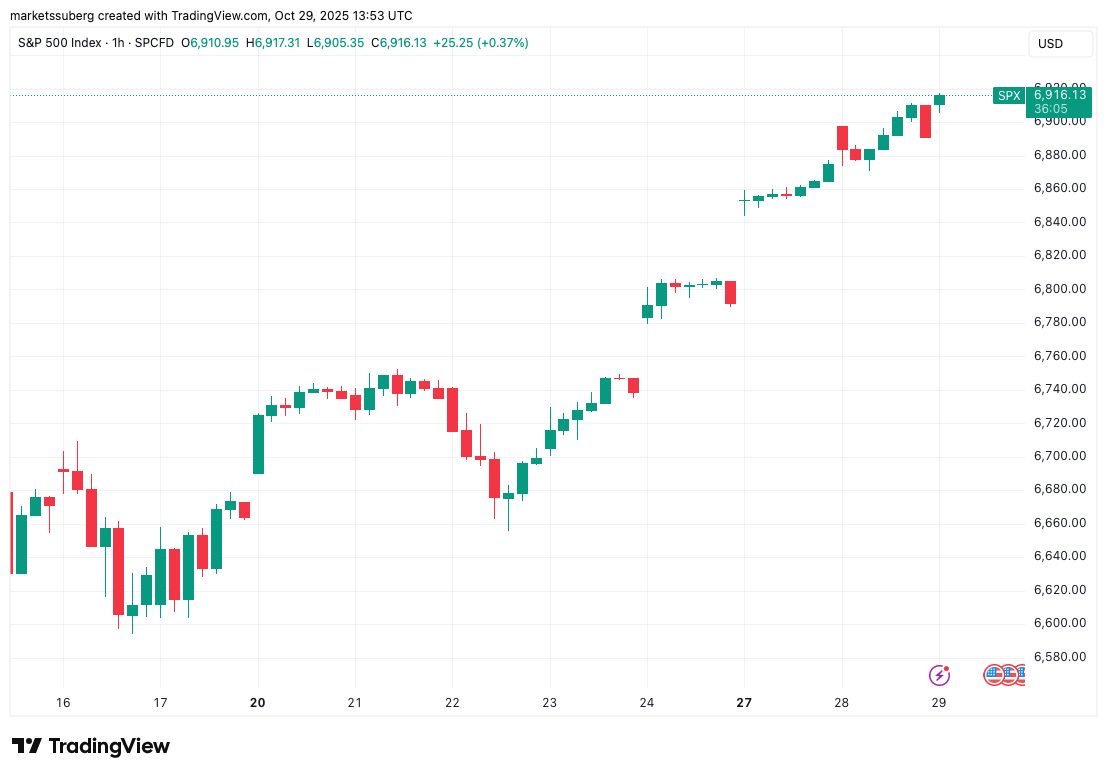

Fed rate-cut anticipation sees brand-new record highs for the S&P 500.

Bitcoin (BTC) remained under pressure at Wednesday’s Wall Street open as United States stocks struck record highs.

Bitcoin phases “unstable retest” into FOMC

Information from Cointelegraph Markets Pro and TradingView revealed BTC rate action holding on to $113,000.

BTC/USD nursed losses from a sell-off that started throughout Tuesday’s United States session, quiting a healing to $116,000.

That level stayed crucial amongst near-term rate targets, while others were $114,500 to the benefit and $111,000 listed below.

” Bitcoin is now in the procedure of an anticipated unstable retest,” trader and expert Rekt Capital composed on X.

Rekt Capital highlighted Bitcoin’s 21-week rapid moving average (EMA) near the $111,000 mark.

” Bitcoin simply requires to Weekly Close above $114.5 k to validate an effective retest,” he included together with the weekly chart.

Trader Daan Crypto Trades contributed the 200-period EMA on four-hour amount of time, which is presently at $113,100.

” BTC is still in the variety. $116K turned down two times now and rate has actually returned down closer to its big volume node around $111K,” he informed X fans.

Daan Crypto Trades likewise accentuated the variety borders at $116,000 and $107,000, respectively.

Rate cut viewed as “non-event” for crypto markets

As crypto markets tracked sideways, the S&P 500 opened with a bang and a brand-new all-time high of 6,914.

Related: BTC rate eyes record monthly close: 5 things to understand in Bitcoin today

The relocation came as risk-asset traders gotten ready for the United States Federal Reserve’s interest-rate choice.

As Cointelegraph reported, markets commonly expected a 0.25% rate cut– a standard tailwind for crypto, stocks and more.

Commenting, trading resource QCP Capital recommended that the statement by Fed Chair Jerome Powell by itself would have little effect.

” Tonight’s FOMC is commonly anticipated to be a non-event. The Fed is set to provide a 25bp cut, constant with its September dot plot, and Powell is not likely to use brand-new forward assistance,” it composed in its newest “Asia Color” market upgrade on the day.

” The lack of main information given that the U.S. federal government shutdown leaves the Fed efficiently flying blind. Without inflation or labour prints, any policy recalibration would be early.”

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.