Bitcoin (BTC) threats falling under a fresh bearishness as a big collection of BTC cost metrics has actually produced a “bearish divergence.”

In a social networks conversation on March 27, Bitcoin analysts flagged uncomfortable signals from the Capriole Investments’ Bitcoin Macro Index.

Bitcoin Macro Index downturn “not fantastic,” states developer

As BTC/USD has a hard time to go back to the location around all-time highs, onchain metrics are starting to lose their booming market edge.

The Bitcoin Macro Index, developed by Capriole in 2022, utilizes device finding out to examine information from a a great deal of metrics that creator Charles Edwards states “offer a strong sign of Bitcoin’s relative worth throughout historical cycles.”

” The design just takes a look at onchain and macro-market information. Distinctively, cost information and technical analysis is ruled out as an input in this design,” he described in an intro to the tool at the time.

Considering that late 2023, the metric has actually been printing lower highs while cost prints greater highs, producing a “bearish divergence.” While typical to previous booming market, a possible ramification is that BTC/USD has actually currently put in a long-lasting peak.

” Not fantastic,” Edwards responded while reposting a print of the Index submitted to X by another user.

” However … when Bitcoin Macro Index turns favorable, I will not be battling it.”

Capriole Bitcoin Macro Index. Source: @A_Trade_Academy/ X

BTC cost metrics have a hard time to recuperate

Different analytics sources have actually concluded that Bitcoin is struggling with macro turbulence this year.

Related: Bitcoin cost forecast markets wager BTC will not go greater than $138K in 2025

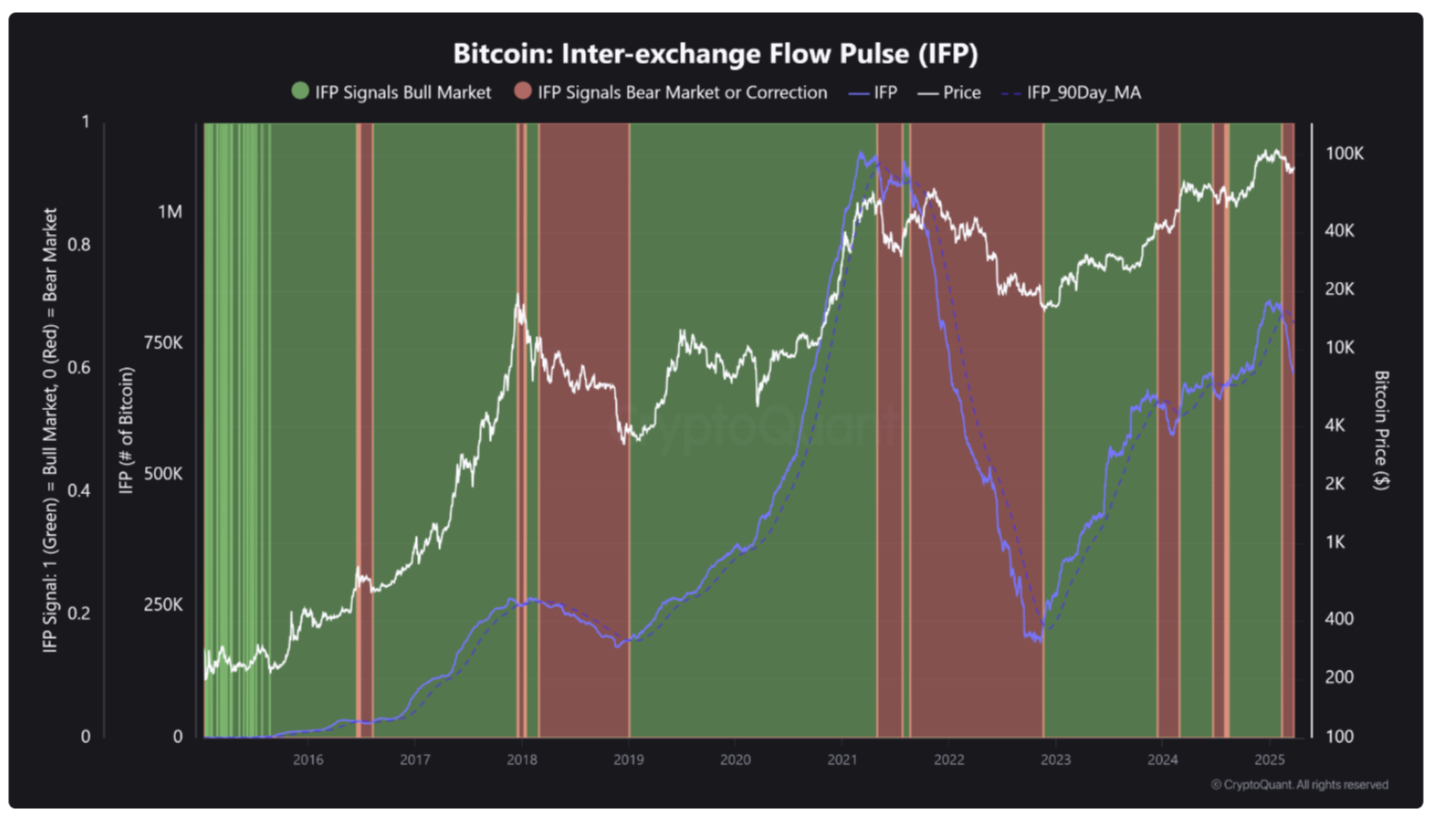

In among its “Quicktake” article today, onchain analytics platform CryptoQuant referenced 4 onchain metrics presently in a state of flux.

” All of these metrics recommend that Bitcoin is experiencing substantial turbulence in the brief to mid-term,” factor Burak Kesmeci stated.

” Nevertheless, none suggest that Bitcoin has actually reached an overheated or cycle-top level.”

Bitcoin IFP chart (screenshot). Source: CryptoQuant

The list consists of the marketplace Worth to Understood Worth (MVRV) and Net Unspent Profit/Loss (NUPL), in addition to the so-called Inter-Exchange Circulation Pulse (IFP) metric, which turned bearish in February.

For this to alter, Kesmeci concluded, IFP ought to return above its 90-day basic moving average (SMA).

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.