Bitcoin snapped a three-year streak of unfavorable summertime typical returns, however it now enters its worst month, called “red September.”

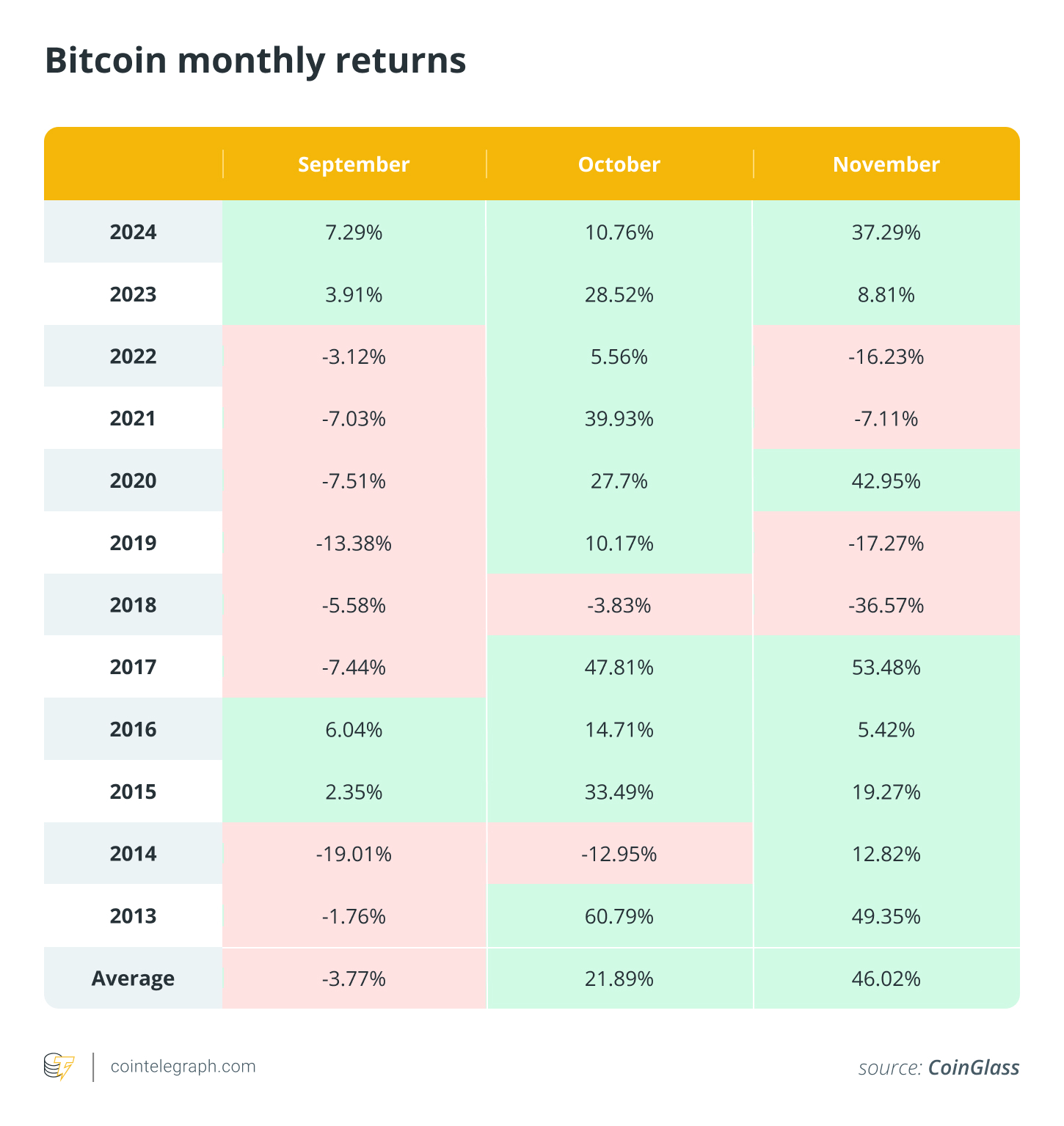

September brings the dreadful label since it has actually provided the most affordable regular monthly returns for Bitcoin (BTC), averaging– 3.77% throughout 12 years from 2013. It is likewise the month China enforced a set of significant crypto restrictions in 2017 and 2021.

That record is weighed down by 6 successive years of losses from 2017 to 2022. The tables kipped down 2023, and Bitcoin has actually now published 2 straight September gains, including its finest September ever in 2024, when it closed the month up 7.29%.

The track record originates from equities, where September is likewise the weakest month for the S&P 500. It’s when financiers return from summertime with a more risk-off posture and funds rebalance heading into the 4th quarter.

The gloom typically does not last. September’s losses have actually traditionally paved the way to October, or “Uptober,” a month that has actually provided gains in 6 successive years and just 2 losses in Bitcoin’s history, according to CoinGlass.

Red September’s regulative drag on Bitcoin

In Bitcoin’s early years, its cost was spread and not commonly tracked. The property initially breached $1,000 in 2013, drawing traditional limelights and triggering much better archival records. That very same year saw the launch of industry-native aggregator CoinMarketCap, followed by CoinGecko in 2014.

Related: June stays Bitcoin’s risk zone, while S&P 500 eyes summertime rally

In Between 2013 and 2016, Bitcoin’s September efficiency was uniformly divided, with 2 favorable months and 2 unfavorable ones. The pattern broke in 2017 throughout the preliminary coin offering (ICO) boom, when Bitcoin crossed $1,000 for the 2nd time and passed $2,000 for the very first. The speculative craze led China’s reserve bank to prohibit ICOs on Sept. 4, triggering the very first of 6 successive red Septembers. South Korea followed with its own ICO restriction on Sept. 29, while regulators in other places released cautions.

The consequences introduced what ended up being called the very first crypto winter season, as many ICO tokens crashed. By September 2018, Bitcoin had actually dropped from its December 2017 all-time high near $20,000 to listed below $7,000. A Sept. 5 media report declared Goldman Sachs was deserting its crypto desk strategies. The bank later on dismissed the story as “phony news.”

September 2019 included another blow with the long-awaited launch of Bakkt’s Bitcoin futures. In spite of high expectations for institutional inflows, trading volumes were weak, and the launching was branded a flop. 3 days later on, Bitcoin plunged from near $10,000 to listed below $8,000. A Binance Research study report released on Sept. 30, 2019, pointed out Bakkt’s “frustrating start” as a contributing element to Bitcoin’s cost decrease.

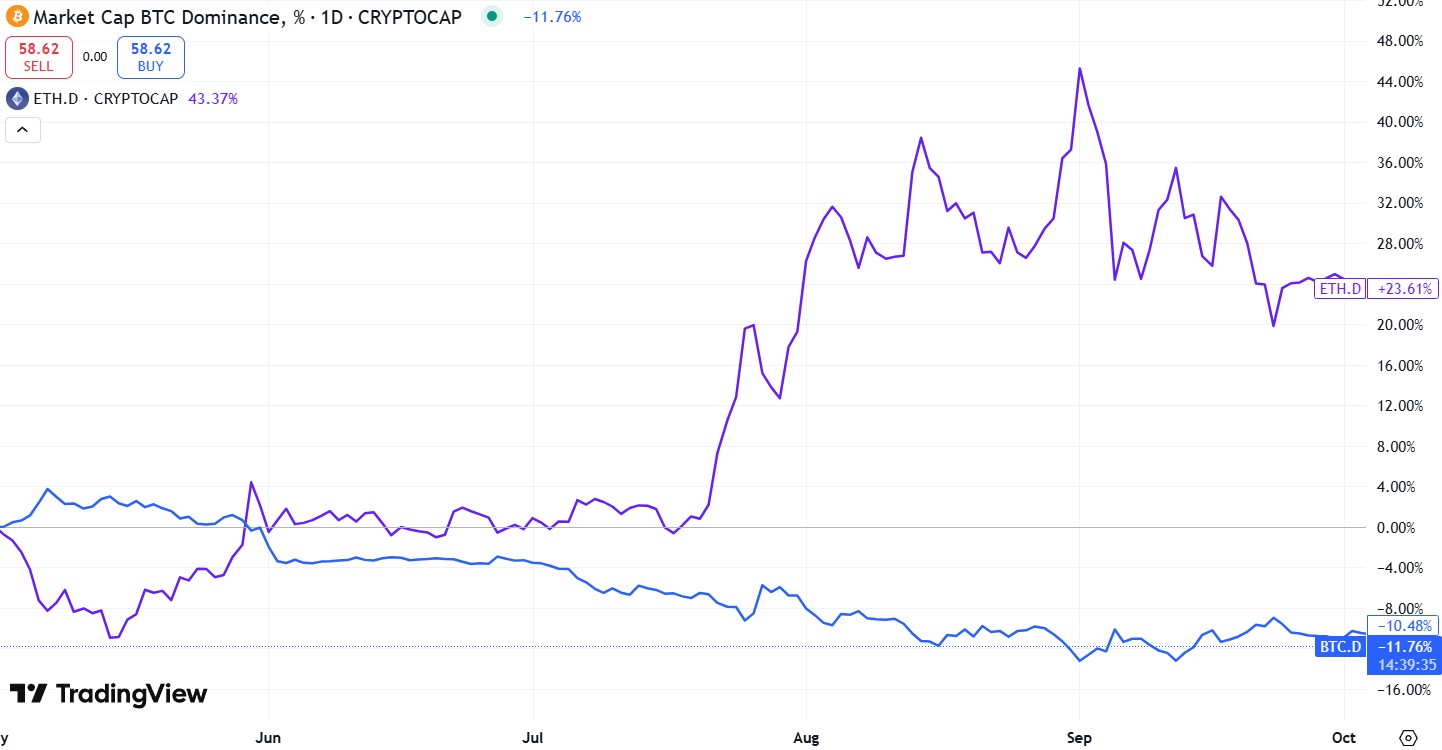

The next 3 Septembers showed the pandemic age and its fallout. While COVID-19 at first enhanced Bitcoin’s story as an inflation hedge, September 2020 saw capital turn into Ether (ETH) throughout the “DeFi Summer season.”

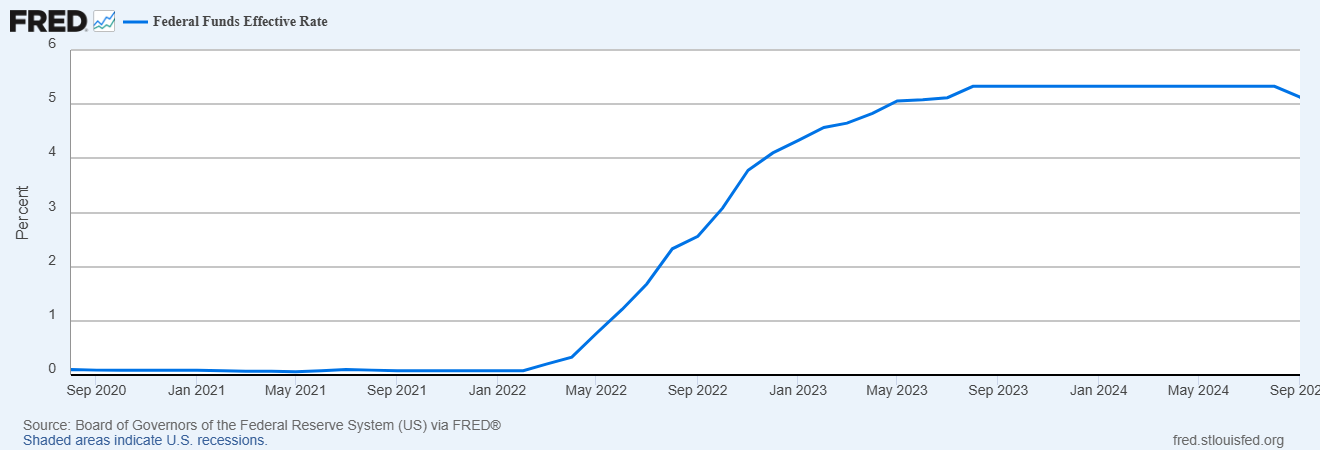

In September 2021, China struck once again with a restriction on crypto mining and trading. The next year, the Terra/LUNA collapse in Might left deep scars, and September’s 0.75 portion point rate trek– its 5th in a year of 7 walkings– included salt to Bitcoin’s injury.

Bitcoin’s “red September” streak breaks

After 6 straight years of September losses, Bitcoin snapped the streak in 2023. A critical driver began Aug. 29 when a federal appeals court ruled that the United States Securities and Exchange Commission’s rejection of Grayscale’s quote to transform its Bitcoin trust into an area exchange-traded fund (ETF) was “approximate and capricious.”

The choice required regulators to review the application and restored self-confidence that a United States area Bitcoin ETF was inescapable. The judgment brought momentum into September, assisting Bitcoin climb up about 4% on the month. The United States Federal Reserve likewise helped belief by holding rates constant after 11 walkings in 12 conferences beginning with March 2022.

Related: Bitcoin treasury flops: These companies fumbled their BTC bets

Area Bitcoin ETFs were authorized and noted in the United States in early 2024. By midyear, the monetary instruments were regularly publishing billions of dollars in everyday trading volume. Macro conditions intensified as the Fed provided a rate cut on Sept. 18, 2024, which was the very first considering that March 2020.

Then came the launch of World Liberty Financial on Sept. 16, 2024, which was rapidly woven into United States election stories. Framed as a Donald Trump-aligned crypto endeavor, it debuted while he remained in the middle of what would end up being an effective governmental project, indicating a political accept of cryptocurrencies at the greatest level.

Another rate cut might assist Bitcoin break the “red September” curse

Bitcoin is heading into September 2025 bring the weight of history. The month has actually long been a stumbling block, marked by regulative shocks and tightening up cycles that scarred financier belief.

This year, the background looks more powerful than in previous downcycles. Area Bitcoin ETFs continue to publish billions in turnover and have actually ended up being an entrance for institutional capital. Throughout 2025, having a hard time business have actually turned to Bitcoin treasury methods in a quote to turn their miseries.

The crypto market likewise brings fresh speculation from August out of China, with reports swirling that authorities might permit stablecoins pegged to the overseas yuan. Up until now, authorities have actually made no verification.

Jerome Powell provides dovish remarks in his last Jackson Hole speech. Source: Associated Press

Financiers’ attention is directly on the United States, where the Fed appears to have actually rotated. In late August, Fed Chair Jerome Powell provided his last Jackson Hole speech before his term ends in Might 2026. The seminar is among the most carefully enjoyed occasions in international economics, as it is typically utilized by Fed chairs to mean policy instructions.

In 2022, Powell alerted of “discomfort” for homes and companies as the Fed continued with aggressive rate walkings. This year, he struck a dovish tone, stating that “moving balance of threats” might call for changing the Fed’s policy position.

Another decrease is commonly anticipated at the Federal Free market Committee conference arranged for Sept. 16-17.

Publication: Bitcoin to see ‘another huge thrust’ to $150K, ETH pressure constructs: Trade Tricks