Bitcoin (BTC) begins June with BTC cost action in an unsafe location. Can purchasers maintain essential booming market assistance levels?

-

Bitcoin traders are preparing for fresh volatility as the highest-ever month-to-month close contrasts with increasing bets of a $100,000 retest.

-

Labor market weak point and Fed policy are back under the microscopic lense as inflation diverges from rate of interest.

-

The most recent cost volatility has actually led financiers throughout the hodler spectrum to reconsider their BTC direct exposure.

-

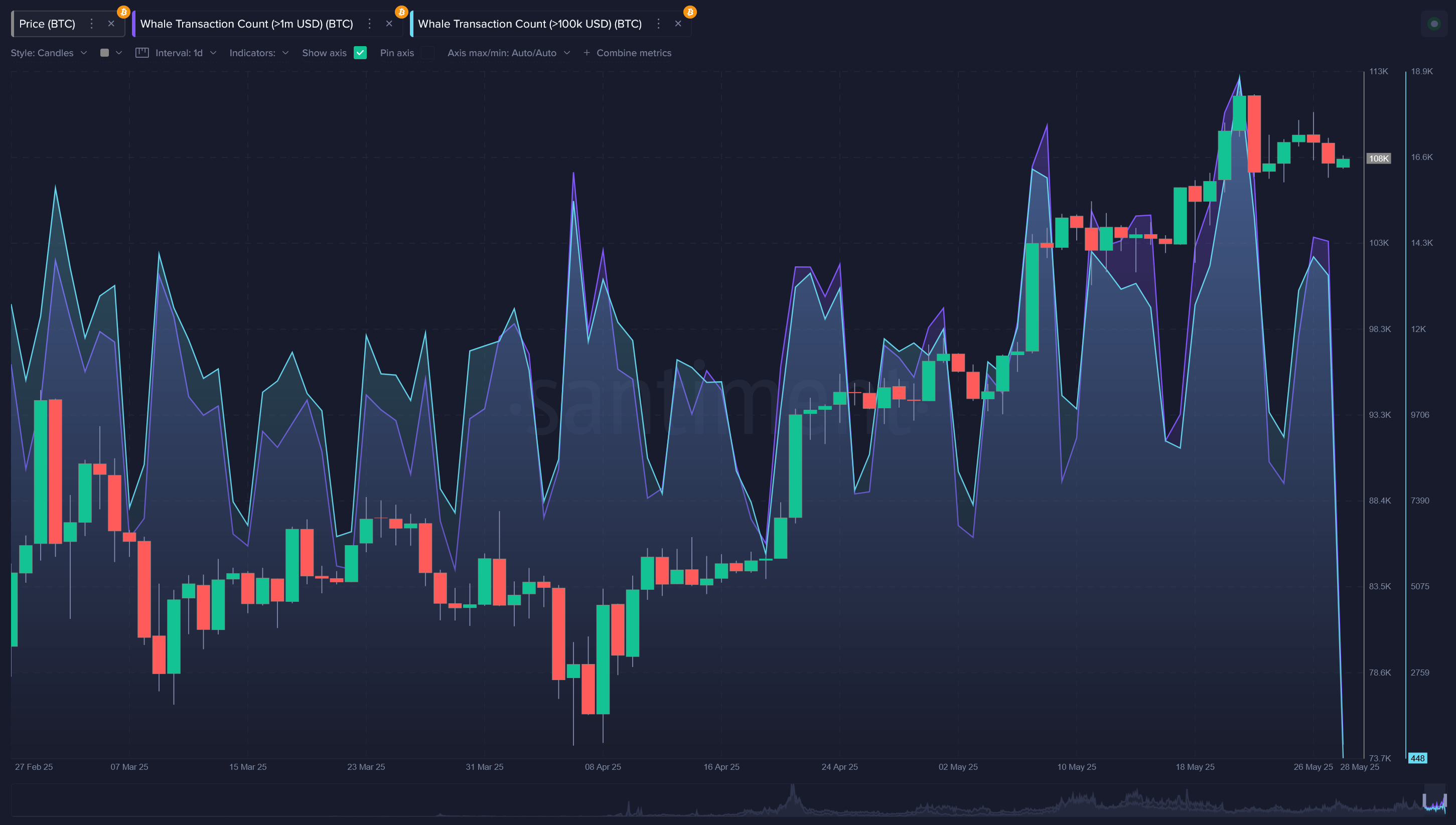

Retail is only simply awakening, however Bitcoin whales are currently displaying traditional pattern turnaround habits.

-

Can success fuel another go to as high as $120,000?

Bitcoin RSI information pollutes best-ever month-to-month close

Bitcoin handled to “conserve” the weekly candle light nearby the skin of its teeth, topping a week of retracement, which at one point amounted to 8%.

At around $105,700, information from Cointelegraph Markets Pro and TradingView programs, the weekly close was available in above a crucial level from December 2024– one which analysis stated it required to hold.

We held above $104,500 on the weekly close. Bullish on this. pic.twitter.com/anfq88qeQt

— Crypto Tony (@CryptoTony__) June 2, 2025

The outcomes were bittersweet, with a bearish divergence playing out in the relative strength index (RSI).

A traditional pattern strength sign, RSI has actually printed a lower high as cost hits and withdraws from its highest-ever levels.

” Weekly bearish divergence secured – and a prospective bearish retest forming here too,” trader Jelle cautioned in a post on X.

” Wedding day ahead for Bitcoin, checking some lower levels is possible so long as the black line isn’t recovered.”

Might eventually sealed 11% gains, and marked the greatest month-to-month close ever for BTC/USD regardless of the late comedown.

Now, information from keeping an eye on resource CoinGlass reveals that the majority of order book liquidity lies above, not listed below, the cost.

In his newest X thread, fellow trader CrypNuevo utilized liquidity to anticipate an ultimate rebound to $113,000.

” We’ll ultimately strike that variety. Preferably $100k–> > $113k,” he stated about his favored BTC cost trajectory.

Powell in the spotlight as inflation and Fed diverge

United States joblessness and Federal Reserve policy are the 2 crucial elements on the radar for risk-asset traders today.

The labor market’s strength is under analysis after tips of weak point in current information challenged the Fed’s capability to hold rate of interest “greater for longer.”

The April print of the Personal Usage Expenses (PCE) index, which was available in at or listed below expectations, at the exact same time validated slowing inflationary pressure.

” The moderating level of inflation implies that the short-term fed funds rate of interest is the greatest above PCE because heading into the monetary crisis in 2008,” trading company Mosaic composed in the most recent edition of its routine newsletter, “The marketplace Mosaic.”

” That may discuss why Trump summoned Fed Chair Jerome Powell today to push the reserve bank into cutting rates.”

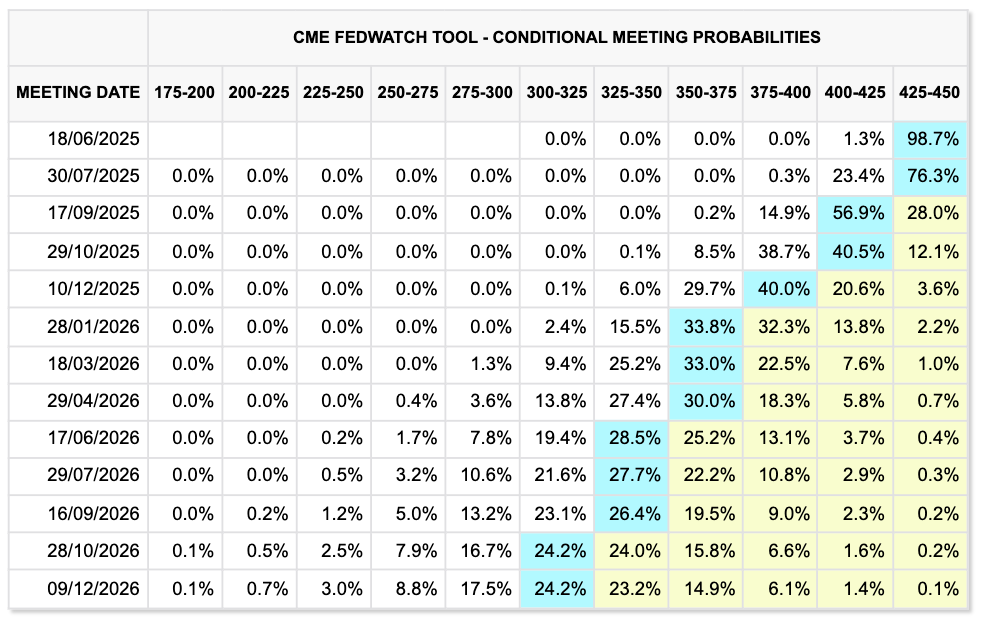

United States President Donald Trump’s very first conference with Powell recently nevertheless did little to enhance bets that the existing hawkish policy might alter in the future. The most recent information from CME Group’s FedWatch Tool reveals markets turning down the possibility of a rate cut before September.

Powell is because of speak at the opening of the Fed Board’s International Financing Department 75th Anniversary Conference in Washington, DC, on June 2.

Continuing, Mosaic Property determines a prospective Bitcoin tailwind in the kind of decreasing United States dollar strength versus the background of trade-tariff unpredictability.

The United States Dollar Index (DXY) has actually hung back listed below 99 after turning the three-figure limit from assistance to resistance last month.

” If drawback in DXY speeds up after losing the 100 level, that might likewise indicate long-lasting issue over the outlook for United States financial development and financial condition,” Mosaic included.

” That might act as another bullish driver for rare-earth elements and Bitcoin.”

Hodler streams recommend “market in shift”

Bitcoin’s 8% comedown from all-time highs has actually currently triggered a shift in financier habits.

While protecting $105,000 at the most recent weekly close, BTC financiers have actually not maintained the levels of direct exposure seen throughout the height of benefit in Might.

In its newest research study, onchain analytics platform CryptoQuant exposed 3 indications that hodlers have actually started to decrease danger.

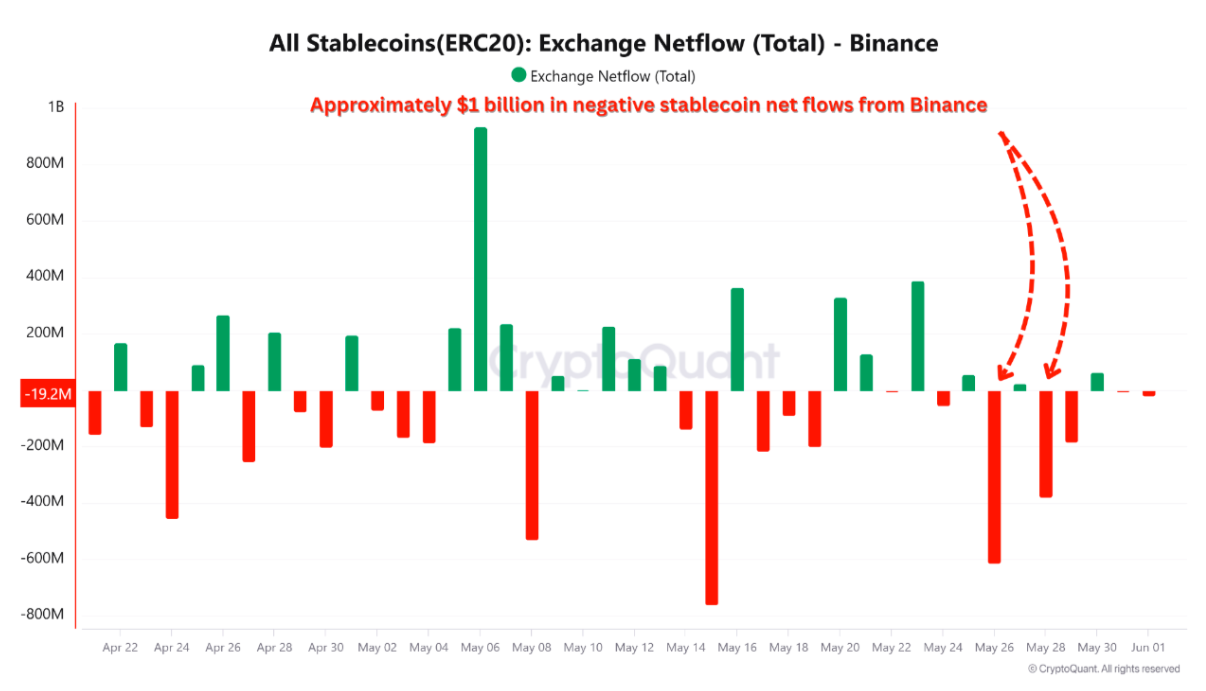

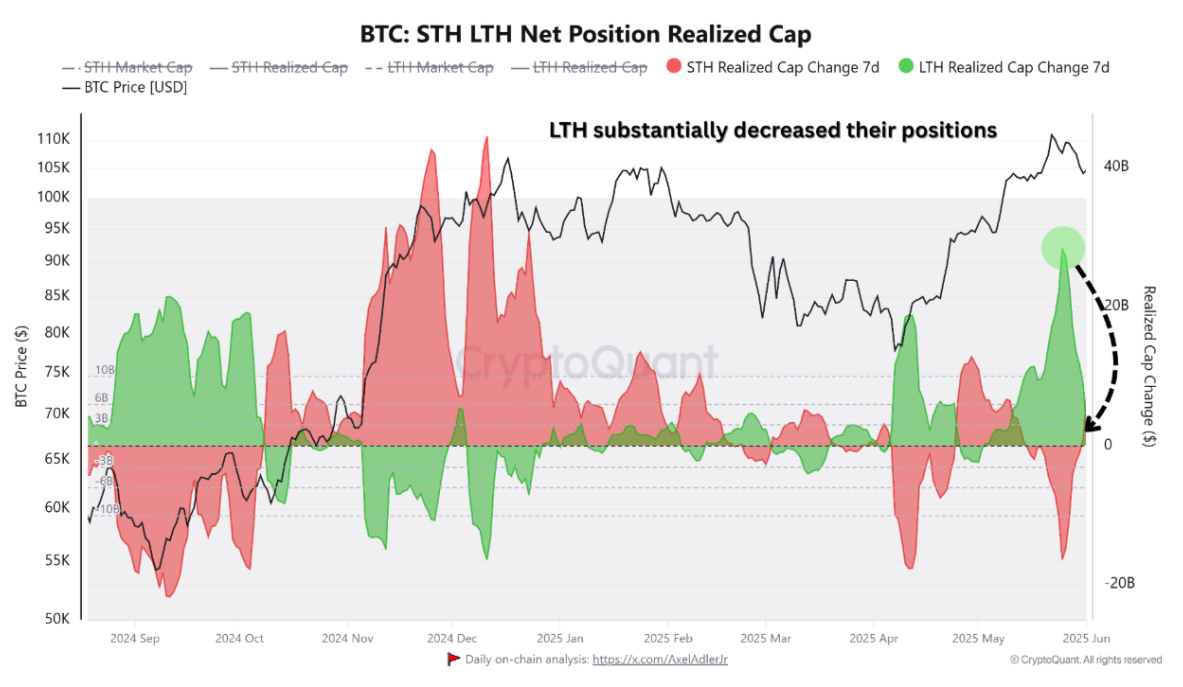

” These consist of substantial stablecoin outflows from Binance, a decrease in long-lasting holder (LTH) interest and contrasting build-up patterns amongst various wallet mates,” factor Amr Taha stated in among its “Quicktake” article.

Binance stablecoin outflows tapped $1 billion at the end of Might — possibly showing traders’ desire to hedge versus danger.

” Stablecoin netflows are an important liquidity sign; unfavorable netflows recommend that traders are moving funds out of exchanges,” Taha stated.

At the exact same time, Bitcoin’s long-lasting holders (LTHs)– entities hodling for 6 months or more– saw their recognized cap decrease through completion of the month. Recognized cap describes the combined worth of all LTH coins determined by the cost at which they last moved.

” The mix of heavy stablecoin withdrawals, decreased LTH build-up, and moving friend habits indicates a market in shift,” CryptoQuant concluded.

” Whether this sets the phase for a cooling-off duration, a healthy debt consolidation, or restored momentum will depend upon how brand-new capital returns to the system and whether retail purchasers can sustain the existing rally without institutional support.”

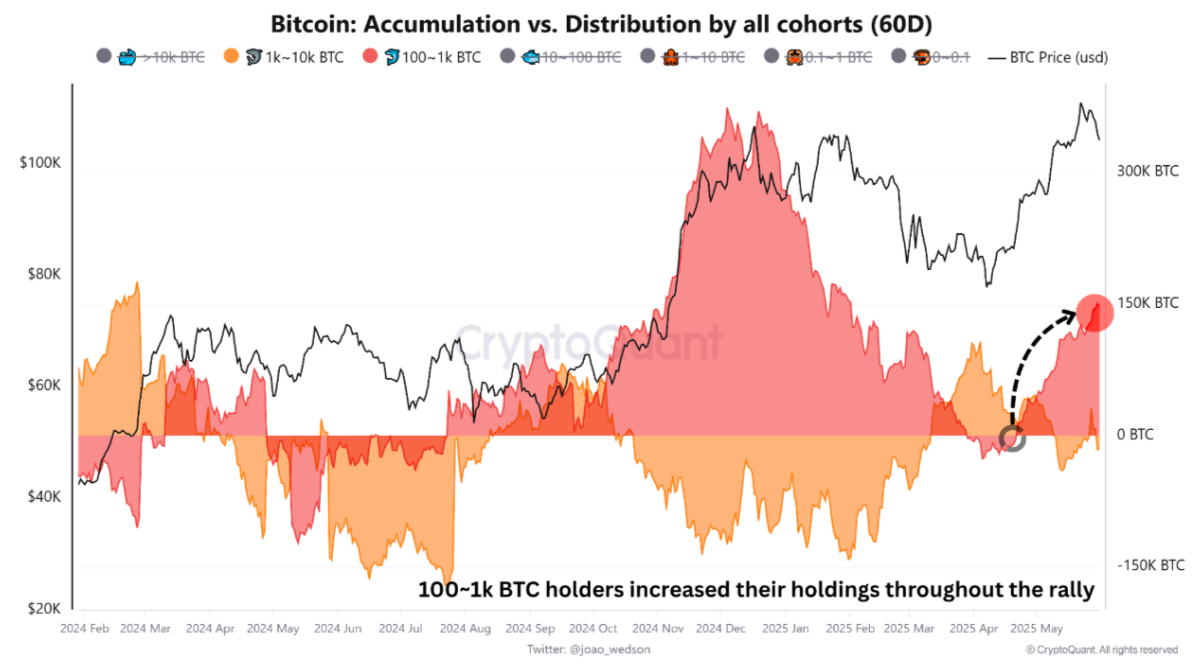

Whales reconsider build-up

A comparable circumstance is playing out amongst Bitcoin whales.

” Entities holding in between (1k ~ 10k) BTC have actually slowly decreased their direct exposure as Bitcoin’s cost climbed up from $81K to $110K, methodically dispersing their holdings in a phased way throughout the rally’s development,” CryptoQuant reported.

Having actually overlooked Bitcoin’s return till brand-new all-time highs struck, retail holders are now diverging from whales by building up “at the top.”

Altering whale patterns have actually not gone undetected in other places. In its newest biweekly report on May 30, research study company Santiment explained “clear indications of profit-taking.”

” High whale activity throughout market tops can often indicate circulation, or wise cash taking earnings. We have actually regularly seen unexpected significant whale deal increases mark cost bottoms (like the one we saw on April 7, 2025) or cost tops (i.e., May 22, 2025),” it composed.

” Think about them as great turnaround indications, with the most recent signal revealing some clear profit-taking.”

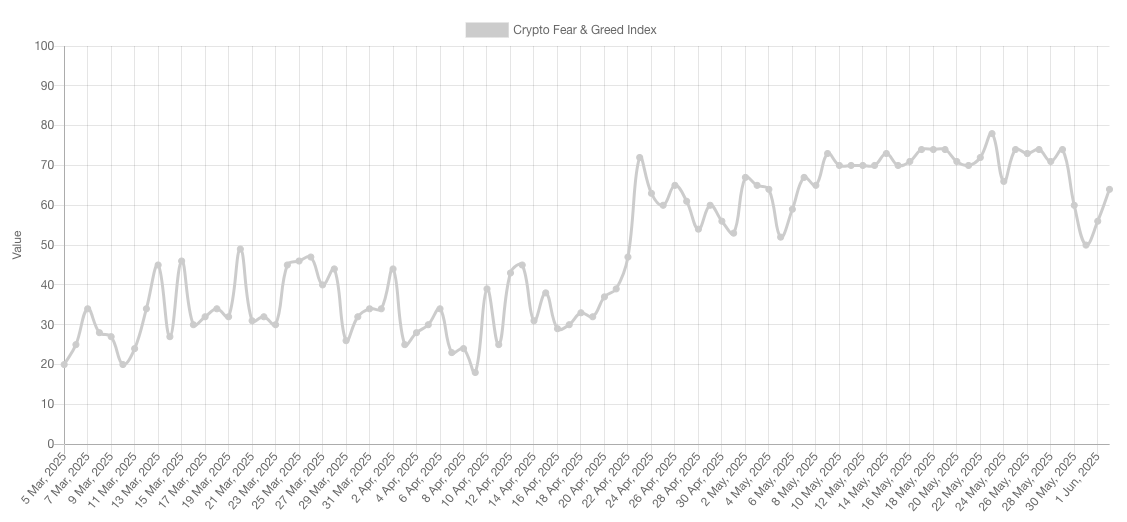

Santiment recommended enjoying crypto market belief hints for tips regarding where the cost may be headed in June.

” We have actually seen belief turn from blissful to afraid in a matter of days, and cost habits has actually followed these feelings with near-perfect timing,” it kept in mind.

After stopping by almost 25% in 2 days recently, the Crypto Worry & & Greed Index now stands at 64/100, marking a go back to “greed” area.

Profit-taking mean $120,000 “regional top”

Ought to the booming market phase a breeze return, bets are currently in over where the next benefit target, and regional top, might be.

Related: How low can the Bitcoin cost go?

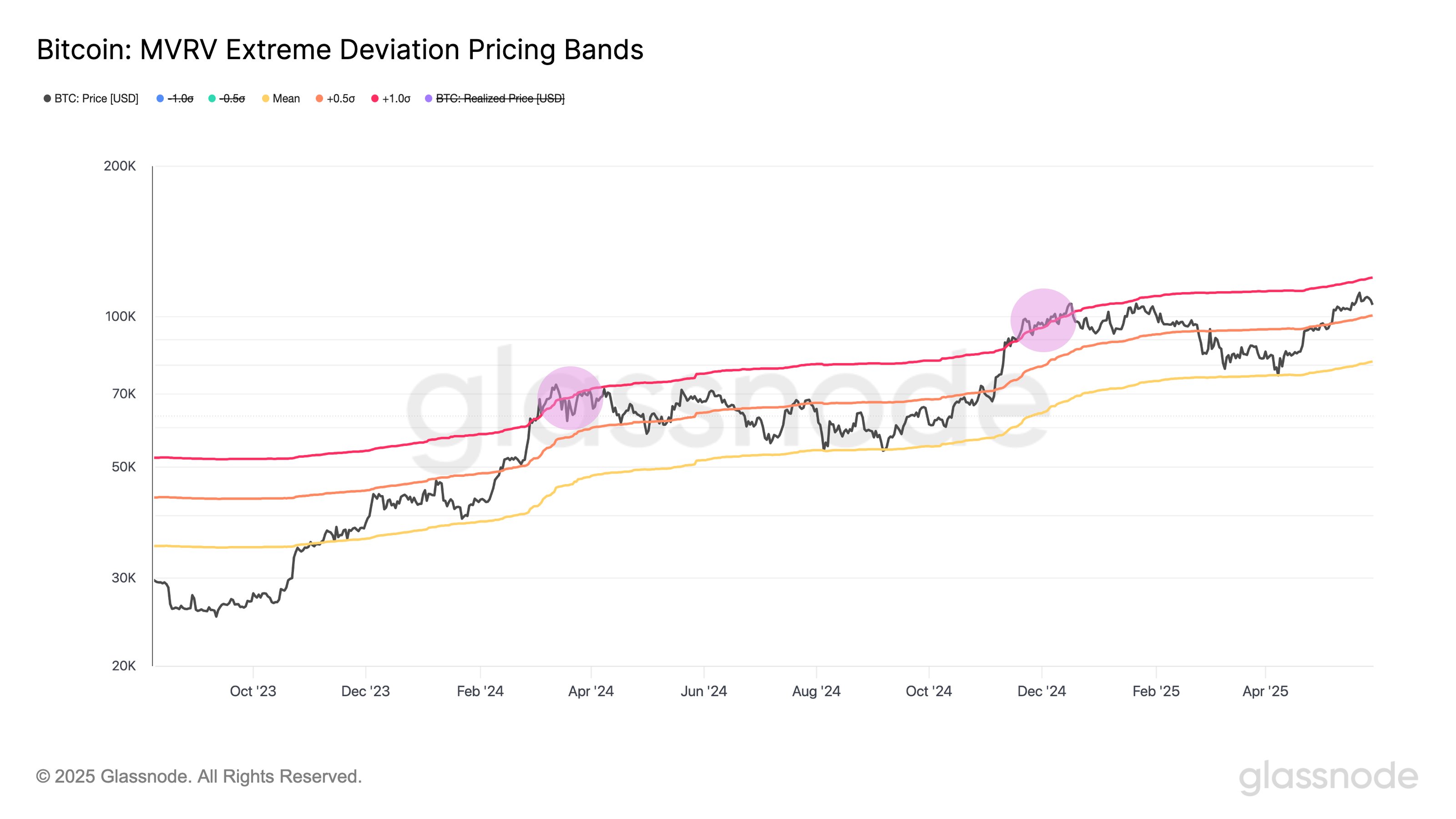

Recently, onchain analytics firm Glassnode leveraged hodler success to mark cost points at which profit-taking ought to once again stop briefly BTC cost benefit. For this, it utilized the basic variance on the marketplace worth to recognized worth (MVRV) ratio.

” MVRV Ratio compares BTC’s market value to the typical financier expense basis – assisting determine when financiers hold outsized latent earnings,” it discussed in an X thread on Might 30.

” We’re now trading in between +0.5 σ ($ 100.2 K) and +1 σ ($ 119.4 K) bands, a zone that has actually typically preceded regional tops.”

BTC cost action might hence maintain $100,000 as assistance, contrasting with other drawback targets, that include a return more detailed to the $90,000 mark.

” While $BTC is near overheated area, it hasn’t yet crossed above the +1 σ MVRV band – a level that traditionally sets off mass profit-taking,” Glassnode included.

” Up until then, the marketplace might still have space to run before financier gains end up being ‘too excellent not to offer.'”

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.